B) False

Correct Answer

verified

Correct Answer

verified

True/False

An assembly worker earns a $50,000 salary and receives a fringe benefit package worth $15,000. The payroll factor assigns $65,000 for this employee.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Property taxes generally are collected by local taxing jurisdictions, not the state or Federal governments.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An LLC apportions and allocates its annual taxable income in the same manner used by any other business operating in the state.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

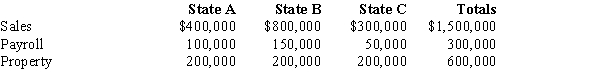

Simpkin Corporation owns manufacturing facilities in States A, B, and C. A uses a three-factor apportionment formula under which the sales, property and payroll factors are equally weighted. B uses a three-factor apportionment formula under which sales are double-weighted. C employs a single-factor apportionment factor, based solely on sales.

Simpkin's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows.

Simpkin's apportionable income assigned to B is:

Simpkin's apportionable income assigned to B is:

A) $1,000,000.

B) $533,333.

C) $475,000.

D) $0.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hendricks Corporation sells widgets in two states. State A levies a 9% effective tax rate, and State B levies a 3% rate. A and B have adopted sales-factor-only apportionment formulas. To reduce overall multistate income tax liabilities, Hendricks should:

A) Move its home office from B to A.

B) Remove all stored inventory from A.

C) Establish a personal training center in A.

D) Convert to employee status the independent contractors that it uses to sell widgets in A.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The property factor includes business assets that the taxpayer owns, but also those merely used under a lease agreement.

B) False

Correct Answer

verified

Correct Answer

verified

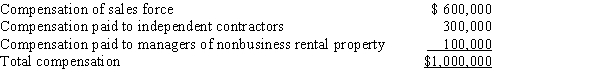

Multiple Choice

Given the following transactions for the year, determine Comp Corporation's D payroll factor denominator. State D has adopted the principles of UDITPA.

A) $1,000,000

B) $900,000

C) $700,000

D) $600,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Typically exempt from the sales/use tax base is the purchase of lumber by a do-it-yourself homeowner, when she builds a deck onto her patio. This exemption is known as the "homestead rule."

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected a.Taxable b.Not taxable -A garment purchased by a self-employed actress.

A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

By making a water's edge election, the multinational taxpayer can limit the reach of unitary principles to the apportionment factors and income of its U.S. and E.U. affiliates.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following events, considered independently, to its likely effect on WillCo's various apportionment factors. WillCo is based in Q and has customers in Q, R, and S. To this point, WillCo has not established nexus with S. More than one choice may be correct -R adopts an increase in its statutory corporate income tax rates.

A) No change in apportionment factors

B) Q apportionment factor increases

C) Q apportionment factor decreases

D) R apportionment factor increases

E) R apportionment factor decreases

F) S apportionment factor increases

G) S apportionment factor decreases

I) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Most states begin the computation of corporate taxable income with an amount from the Federal income tax return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The property factor includes land and buildings used for business purposes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

State and local politicians tend to apply new and increased taxes to taxpayers who are visitors to the jurisdiction, such as a tax on auto rentals, because the taxpayer cannot vote to reelect the lawmaker.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected a.Taxable b.Not taxable -A new auto purchased in Europe and shipped by the driver to her home state in the U.S.

A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

Typically, corporate income taxes constitute about 20 percent of a state's annual tax collections.

B) False

Correct Answer

verified

Correct Answer

verified

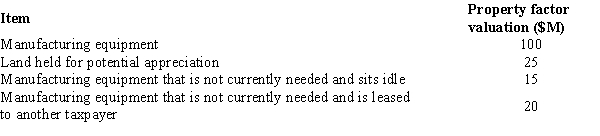

Multiple Choice

Hopper Corporation's property holdings in State E are as follows.  Compute the numerator of Hopper's E property factor.

Compute the numerator of Hopper's E property factor.

A) $100 million.

B) $135 million.

C) $140 million.

D) $160 million.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

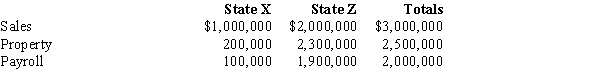

Multiple Choice

Chipper Corporation realized $1,000,000 taxable income from the sales of its products in States X and Z. Chipper's activities establish nexus for income tax purposes only in Z, the state of its incorporation. Chipper's sales, payroll, and property among the states include the following.

X utilizes a sales-only factor in its three-factor apportionment formula. How much of Chipper's taxable income is apportioned to X?

X utilizes a sales-only factor in its three-factor apportionment formula. How much of Chipper's taxable income is apportioned to X?

A) $0

B) $333,333

C) $500,000

D) $1,000,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in applying the P.L. 86-272 definition of solicitation -Operating a warehouse for inventory that is held in the state.

A) More than solicitation, creates nexus

B) Solicitation only, no nexus created

D) undefined

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 123

Related Exams