A) a marginal tax rate of 20 percent when her income rises from $40,000 to $40,001.

B) a marginal tax rate of 20 percent when her income rises from $30,000 to $30,001.

C) a marginal tax rate of 0 percent when her income rises from $30,000 to $30,001.

D) a marginal tax rate of 10 percent when her income rises from $40,000 to $40,001.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is justified on the basis that the taxpayers who pay the tax receive specific government services from payment of the tax,the tax

A) is considered horizontally equitable.

B) burden is minimized.

C) satisfies the benefits principle.

D) is considered vertically equitable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following countries,which country's government collects the largest amount of tax revenue as a percentage of that country's total income?

A) France

B) United States

C) Canada

D) Sweden

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009,the average American paid approximately how much to the federal government in taxes?

A) $1,900

B) $4,500

C) $6,800

D) $8,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For state and local governments,sales taxes and property taxes make up approximately

A) 19 percent of all receipts.

B) 22 percent of all receipts.

C) 35 percent of all receipts.

D) 48 percent of all receipts.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the 2010 calendar year only,the federal estate tax does not exist.Which of the following is not correct?

A) The one year absence of this tax creates peculiar incentives for people with large estates who are nearing the end of their lives.

B) Some people created provisions in their health-care proxies allowing for life support to continue until 2010 so the estate beneficiaries would receive a larger bequest.

C) The estate tax usually applies to about 5,500 taxpayers per year.

D) Before 2010,the estate tax was approximately 20 percent of the total estate.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to construct a more complete picture of the economic burden of government across income classes,economists usually

A) include tax payments as well as transfer payments received.

B) focus only on the tax payments of wealthy tax payers.

C) limit their analysis to taxes based on the ability-to-pay principle.

D) focus their analysis on issues of tax efficiency.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

The largest category of expenditures for state and local governments is __________.

Correct Answer

verified

Correct Answer

verified

True/False

In practice,the U.S.income tax system is filled with special provisions that alter a family's tax based on its specific circumstances.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For state and local governments,education accounts for approximately what percentage of spending?

A) 25 percent

B) 34 percent

C) 50 percent

D) 75 percent

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income tax requires that taxpayers pay 10% on the first $40,000 of income and 20 percent on all income over $40,000.Karen paid $6,000 in taxes.What were her marginal and average tax rates?

A) 20 percent and 12 percent,respectively

B) 20 percent and 15 percent,respectively

C) 10 percent and 12 percent respectively

D) 10 percent and 15 percent respectively

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

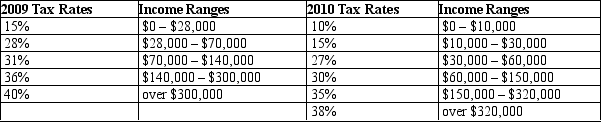

Table 12-12

United States Income Tax Rates for a Single Individual,2009 and 2010.

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What happened to his marginal tax rate between 2009 and 2010?

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What happened to his marginal tax rate between 2009 and 2010?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maurice faces a progressive federal income tax structure that has the following marginal tax rates: 0 percent on the first $10,000,10 percent on the next $10,000,15 percent on the next $10,000,25 percent on the next $10,000,and 50 percent on all additional income.In addition,he must pay 5 percent of his income in state income tax and 15.3 percent of his labor income in federal payroll taxes.Maurice earns $60,000 per year in salary and another $10,000 per year in non-labor income.What is his average tax rate?

A) 17.19 percent

B) 46.69 percent

C) 48.87 percent

D) 56.01 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.income tax

A) discourages saving.

B) encourages saving.

C) has no effect on saving.

D) will reduce the administrative burden of taxation.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If James earns $80,000 in taxable income and pays $20,000 in taxes,his average tax rate is 25 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Today the typical American pays approximately what percent of income in taxes,including all federal,state,and local taxes?

A) 5 percent

B) 18 percent

C) 33 percent

D) 50 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicaid is

A) the government's health plan for the elderly.

B) the government's health plan for the poor.

C) another name for Social Security.

D) Both a and c are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

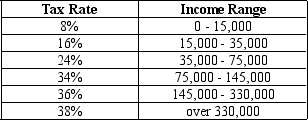

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Mateo has taxable income of $165,000,his tax liability is

-Refer to Table 12-2.If Mateo has taxable income of $165,000,his tax liability is

A) $23,800.

B) $36,000.

C) $45,000.

D) $47,698.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a country imposes a lump-sum income tax of $5,000 on each individual in the country.What is the average income tax rate for an individual who earns $40,000 during the year?

A) 0%

B) 10%

C) More than 10%

D) The average tax rate cannot be determined without knowing the entire tax schedule.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Part of the deadweight loss from taxing labor earnings is that people

A) will work more.

B) will be reluctant to hire accountants to file their tax returns.

C) with low tax liabilities will universally be worse off than under some other tax policy.

D) will work less.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 499

Related Exams