A) $75

B) $105

C) $185

D) $215

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Corporate income taxes are based on the amount of revenue a corporation earns.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

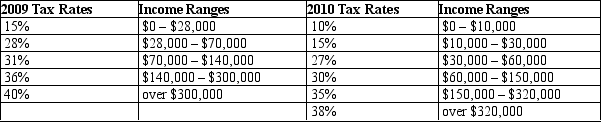

Table 12-12

United States Income Tax Rates for a Single Individual,2009 and 2010.

-Refer to Table 12-12.Mia is a single person whose taxable income is $100,000 a year.What happened to her marginal tax rate between 2009 and 2010?

-Refer to Table 12-12.Mia is a single person whose taxable income is $100,000 a year.What happened to her marginal tax rate between 2009 and 2010?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009,what percentage of federal government receipts came from corporate income taxes?

A) 7%

B) 15%

C) 25%

D) 42%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to long-run projections,under current law,

A) federal government spending as a percentage of GDP will rise gradually but substantially in the next several decades.

B) federal taxes as a percentage of GDP will rise gradually but substantially in the next several decades.

C) the federal government's budget deficit will gradually be eliminated in the next several decades.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the 1980s,President Ronald Reagan argued that high tax rates distorted economic incentives to work and save.In the 1990s,President Bill Clinton argued that the rich were not paying their fair share of taxes.Which of the following statements best summarizes the economic theories behind the differing philosophies?

A) President Reagan was concerned about vertical equity,whereas President Clinton was concerned about horizontal equity.

B) President Reagan was concerned about average tax rates,whereas President Clinton was concerned about horizontal equity.

C) President Reagan was concerned about marginal tax rates,whereas President Clinton was concerned about vertical equity.

D) None of the above is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a tax generates a reduction in surplus that is exactly offset by the tax revenue collected by the government,the tax does not have a deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A lump-sum tax minimizes deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Approximately what percentage of the U.S.federal government's receipts come from individual income taxes?

A) 8%

B) 15%

C) 43%

D) 67%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009,the federal government spent 5 percent of the budget on net interest.Which of the following statements regarding net interest is correct?

A) If the government pays down its debt,the amount of the budget needed for net interest decreases.

B) If the government accrues more debt,the amount of the budget needed for net interest increases.

C) In 2009,the federal government spent 187 billion dollars to cover interest payments on its loans.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) All states have state income taxes,but the percentages vary widely.

B) Sales taxes and property taxes are important revenue sources for state and local governments.

C) Medicare spending has increased because the percentage of the population that is elderly and the cost of health care have both increased.

D) A budget deficit occurs when government spending exceeds government receipts.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many economists believe that

A) the corporate income tax satisfies the goal of horizontal equity.

B) the corporate income tax does not distort the incentives of customers.

C) the corporate income tax is more efficient than the personal income tax.

D) workers and customers bear much of the burden of the corporate income tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following tax systems do taxes increase as income increases?

A) both proportional and progressive

B) proportional but not progressive

C) progressive but not proportional

D) neither proportional nor progressive

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight losses are associated with

A) taxes that distort the incentives that people face.

B) taxes that target expenditures on survivor's benefits for Social Security.

C) taxes that have no efficiency losses.

D) lump-sum taxes.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

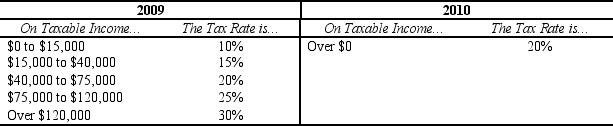

Table 12-10

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-10.Which of the following best describes the tax schedule in 2009?

-Refer to Table 12-10.Which of the following best describes the tax schedule in 2009?

A) proportional tax

B) progressive tax

C) regressive tax

D) vertical tax

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tax incidence refers to

A) what product or service the tax is levied on.

B) who bears the tax burden.

C) what sector of the economy is most affected by the tax.

D) the dollar value of the tax revenues.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Social Security is an income support program,designed primarily to maintain the living standards of the poor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

High marginal income tax rates

A) distort incentives to work.

B) are used to encourage saving behavior.

C) will invariably lead to lower average tax rates.

D) are not associated with deadweight losses.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The administrative burden of any tax system is part of the inefficiency it creates.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

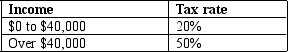

Table 12-5

-Refer to Table 12-5.What is the marginal tax rate for a person who makes $60,000?

-Refer to Table 12-5.What is the marginal tax rate for a person who makes $60,000?

A) 20%

B) 30%

C) 40%

D) 50%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 499

Related Exams