A) in-kind transfer.

B) negative income tax payment.

C) property income.

D) welfare payment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

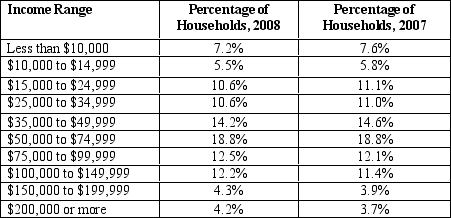

Table 20-6

-Refer to Table 20-6.In both 2007 and 2008,approximately 25% of the population earned less than

-Refer to Table 20-6.In both 2007 and 2008,approximately 25% of the population earned less than

A) $15,000.

B) $25,000.

C) $50,000.

D) $100,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists study poverty and income inequality in order to answer which of the following questions?

A) What are people's wages?

B) How does labor-force experience affect wages?

C) How much inequality is there in society?

D) How do people adjust their behavior due to taxation?

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Since 1970 the United States' income distribution has become more equal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rule for redistribution proposed by John Rawls in his book A Theory of Justice is called the

A) "optimal ignorance" rule.

B) libertarian justice rule.

C) maximin criterion.

D) egalitarian criterion.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A disadvantage associated with in-kind transfers to reduce poverty is that they

A) are more expensive than a negative income tax.

B) are inefficient because they do not allow poor families to make purchases based on their preferences.

C) focus on children and the disabled while neglecting the working poor.

D) may benefit the teenage children of families who are not poor.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the government proposes a negative income tax that calculates the taxes owed as follows: Taxes Owed = (1/3

Income) - 10,000.A family that earns an income of $30,000 will

Income) - 10,000.A family that earns an income of $30,000 will

A) neither pay taxes nor receive an income subsidy.

B) receive an income subsidy of $500.

C) pay $1,000 in taxes.

D) pay $600 in taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Relative to direct cash payments,in-kind transfers have the advantage of being

A) more politically popular.

B) more efficient.

C) more respectful of the poor.

D) of a higher dollar value than cash payments.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

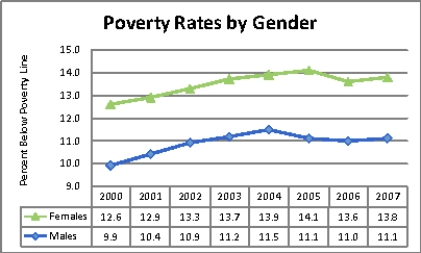

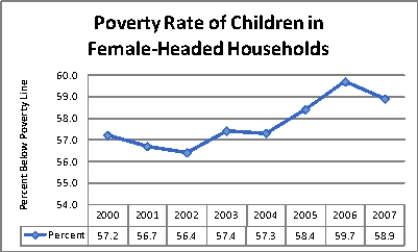

Figure 20-3

Panel A  Source: U.S.Bureau of the Census

Panel B

Source: U.S.Bureau of the Census

Panel B  Source: U.S.Bureau of the Census

-Refer to Figure 20-3.Panel B focuses on children who live in female-headed households.It illustrates the percentage of those children who live in poverty.For example,in 2000,slightly over 57 percent of all children who lived in a female-headed household lived below the poverty line.How is this information related to the graph illustrated in Panel A?

Source: U.S.Bureau of the Census

-Refer to Figure 20-3.Panel B focuses on children who live in female-headed households.It illustrates the percentage of those children who live in poverty.For example,in 2000,slightly over 57 percent of all children who lived in a female-headed household lived below the poverty line.How is this information related to the graph illustrated in Panel A?

A) The high prevalence of poverty in households headed by women is inversely related to male poverty rates.

B) The poverty rates shown in Panel B are found by multiplying the female poverty rates shown in Panel A by 450%.

C) The high prevalence of poverty in households headed by women likely explains why female poverty rates are higher than male poverty rates.

D) Both b and c are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Less than three percent of families are categorized as poor for eight years or more.

B) In the United States,the grandson of a millionaire is much more likely to be rich than the grandson of an average-income person.

C) The majority of millionaires in the United States inherited their wealth.

D) Most workers have about the same income (adjusted for inflation) when they are young as when they are middle-aged.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty line is

A) established by the federal government.

B) approximately equivalent to three times the cost of providing an adequate diet.

C) an absolute level of income below which a family is deemed to be in poverty.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Smith family owns an apple orchard in Illinois.The Jones family owns an apple orchard in Wisconsin.A late frost destroys half of the Smith family's harvest for one year.For the Jones family,their

A) transitory income for the year of the frost likely exceeds their permanent income.

B) permanent income likely exceeds their transitory income for the year of the frost.

C) permanent income will be more affected by the frost than their transitory income.

D) Both a and c are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Data for the United States suggests that about how many millionaires inherited their fortunes?

A) one in seven

B) one in five

C) one in three

D) one in two

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

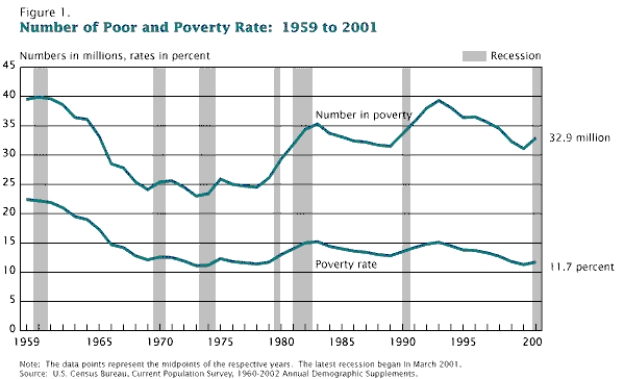

Figure 20-2

Number of Poor  -Refer to Figure 20-2.Between 1959 and 2001 the poverty rate has

-Refer to Figure 20-2.Between 1959 and 2001 the poverty rate has

A) increased overall.

B) decreased overall.

C) stayed the same overall.

D) moved in the opposite direction of the number of people in poverty.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Governments enact policies to

A) make the distribution of income more efficient.

B) make the distribution of income more equal.

C) maximize the use of the welfare system.

D) minimize the use of in-kind transfers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of utility is fundamental to utilitarianism and describes the

A) optimal distribution of wealth in society.

B) level of satisfaction derived from a person's circumstances.

C) method by which society chooses to allocate resources.

D) method whereby wealth is stored.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The regular pattern of income variation over a person's life is called

A) the earned income cycle.

B) the substitution effect.

C) the life cycle.

D) the pattern of change.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic mobility in the United States is

A) uncommon.Over 50 percent of poor families remain poor for 8 or more years.

B) uncommon.Over 75 percent of poor families remain poor for 8 or more years.

C) common.Fewer than 3 percent of poor families remain poor for 8 or more years.

D) common.Fewer than 1 percent of poor families remain poor for 8 or more years.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government used the following formula to compute a family's tax liability: Taxes owed = 28% of income - $8,000.How much would a family that earned $150,000 owe?

A) $34,000

B) $42,000

C) $50,000

D) $68,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 381 - 399 of 399

Related Exams