A) Buyers and sellers will share the burden of the tax equally.

B) Buyers will bear more of the burden of the tax than sellers will.

C) Sellers will bear more of the burden of the tax than buyers will.

D) Any of the above is possible.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

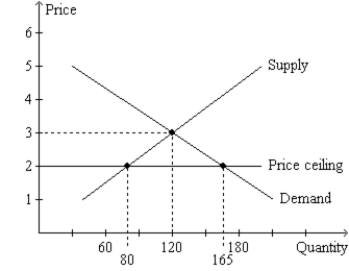

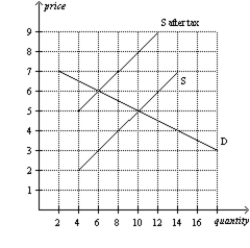

Figure 6-2  -Refer to Figure 6-2. The price ceiling

-Refer to Figure 6-2. The price ceiling

A) causes a shortage of 45 units of the good.

B) makes it necessary for sellers to ration the good.

C) is not binding because it is set below the equilibrium price.

D) causes a shortage of 40 units of the good.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

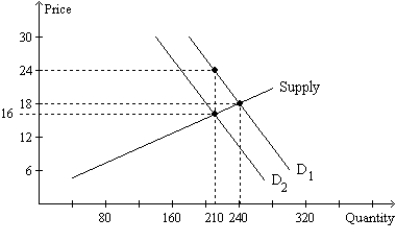

Figure 6-24  -Refer to Figure 6-24. Suppose sellers, rather than buyers, were required to pay this tax (in the same amount per unit as shown in the graph) . Relative to the tax on buyers, the tax on sellers would result in

-Refer to Figure 6-24. Suppose sellers, rather than buyers, were required to pay this tax (in the same amount per unit as shown in the graph) . Relative to the tax on buyers, the tax on sellers would result in

A) buyers bearing the same share of the tax burden.

B) sellers bearing the same share of the tax burden.

C) the same amount of tax revenue for the government.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Who bears the majority of a tax burden depends on the relative elasticity of supply and demand.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a $1 tax on sellers of gasoline and imposes the same $1 tax on buyers of gasoline, then the price paid by buyers will

A) increase, and the price received by sellers will increase.

B) increase, and the price received by sellers will not change.

C) not change, and the price received by sellers will increase.

D) not change, and the price received by sellers will not change.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government has imposed a price ceiling on laptop computers. Which of the following events could transform the price ceiling from one that is not binding into one that is binding?

A) Improvements in production technology reduce the costs of producing laptop computers.

B) The number of firms selling laptop computers decreases.

C) Consumers' income decreases, and laptop computers are a normal good.

D) The number of consumers buying laptop computers decreases.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When OPEC raised the price of crude oil in the 1970s, it caused the United States'

A) nonbinding price floor on gasoline to become binding.

B) binding price floor on gasoline to become nonbinding.

C) nonbinding price ceiling on gasoline to become binding.

D) binding price ceiling on gasoline to become nonbinding.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 6-5  -Refer to Table 6-5. Which of the following price ceilings would be binding in this market?

-Refer to Table 6-5. Which of the following price ceilings would be binding in this market?

A) $3

B) $6

C) $9

D) None of the above price ceilings would be binding.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

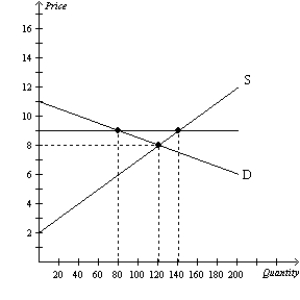

Figure 6-5  -Refer to Figure 6-5. If the solid horizontal line on the graph represents a price floor, then the price floor is

-Refer to Figure 6-5. If the solid horizontal line on the graph represents a price floor, then the price floor is

A) binding and creates a surplus of 60 units of the good.

B) binding and creates a surplus of 20 units of the good.

C) binding and creates a surplus of 40 units of the good.

D) not binding, and there will be no surplus or shortage of the good.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $500 tax per car on sellers of cars, then the price received by sellers of cars would

A) decrease by less than $500.

B) decrease by exactly $500.

C) decrease by more than $500.

D) increase by an indeterminate amount.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a binding price floor is imposed on a market for a good, some people who want to sell the good cannot do so.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price paid by buyers in a market will decrease if the government

A) imposes a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) decreases a binding price floor in that market.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Regardless of whether a tax is levied on sellers or buyers, taxes discourage market activity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

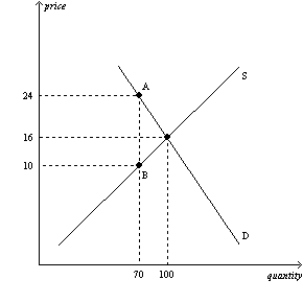

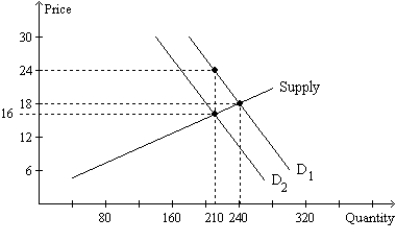

Figure 6-18

The vertical distance between points A and B represents the tax in the market.  -Refer to Figure 6-18. The per-unit burden of the tax on buyers is

-Refer to Figure 6-18. The per-unit burden of the tax on buyers is

A) $6.

B) $8.

C) $14.

D) $24.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

All buyers benefit from a binding price ceiling.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-23  -If a tax is levied on the buyers of dog food, then

-If a tax is levied on the buyers of dog food, then

A) buyers will bear the entire burden of the tax.

B) sellers will bear the entire burden of the tax.

C) buyers and sellers will share the burden of the tax.

D) the government will bear the entire burden of the tax.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-24  -Refer to Figure 6-24. The per-unit burden of the tax on buyers of the good is

-Refer to Figure 6-24. The per-unit burden of the tax on buyers of the good is

A) $2.

B) $4.

C) $6.

D) $8.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When OPEC raised the price of crude oil in the 1970s, it caused the

A) demand for gasoline to increase.

B) demand for gasoline to decrease.

C) supply of gasoline to increase.

D) supply of gasoline to decrease.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum-wage laws dictate the

A) average price employers must pay for labor.

B) highest price employers may pay for labor.

C) lowest price employers may pay for labor.

D) the highest and lowest prices employers may pay for labor.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the US market for chocolate, a market in which the government has imposed a price ceiling. Which of the following events could convert the price ceiling from a nonbinding to a binding price ceiling?

A) a government study that shows that consuming chocolate increases the incidence of cancer.

B) a large increase in the size of the cocoa bean crop; cocoa beans are used to produce chocolate.

C) South American cocoa bean producers refuse to ship to chocolate producers in the US.

D) a sharp drop in consumer income; chocolate is a normal good.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 421 - 440 of 671

Related Exams