A) $1,920.

B) $4,400.

C) $6,320.

D) $8,175.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Resources devoted to complying with the tax laws are a type of deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Max values a concert ticket at $45. Charles values the same concert ticket at $40. The pre-tax price of a concert ticket is $30. The government imposes a tax of $5 on each concert ticket, and the price rises to $35. The deadweight loss from the tax is

A) $15.

B) $10.

C) $5.

D) $0.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

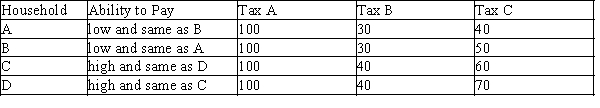

Table 12-13

The table below provides information on the 4 households that make up a small economy and how much they would pay in taxes under 3 types of taxes.  -Refer to Table 12-13. In this economy Tax B exhibits

-Refer to Table 12-13. In this economy Tax B exhibits

A) horizontal and vertical equity.

B) horizontal equity but not vertical equity.

C) vertical equity but not horizontal equity.

D) neither horizontal nor vertical equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss associated with a tax on a commodity is generated by

A) the consumers who still choose to consume the commodity but pay a higher price that reflects the tax.

B) the consumers who choose to not consume the commodity that is taxed.

C) all citizens who are able to use services provided by government.

D) the consumers who are unable to avoid paying the tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some colleges charge all students the same fee for access to campus computing services. Suppose that students differ by how many hours of campus computing services they use. For example, some students print all their papers and assignment in the campus computer labs, while others use their own printers in their apartments. The computing services fee is most like a(n)

A) excise tax that conforms to the benefits principle.

B) excise tax that violates the benefits principle.

C) lump-sum tax that conforms to the benefits principle.

D) lump-sum tax that violates the benefits principle.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tim earns income of $60,000 per year and pays $21,000 per year in taxes. Tim paid 20 percent in taxes on the first $30,000 he earned. What was the marginal tax rate on the second $30,000 he earned?

A) 20 percent

B) 30 percent

C) 50 percent

D) 70 percent

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Equity is more important than efficiency as a goal of the tax system.

B) Efficiency is more important than equity as a goal of the tax system.

C) Both equity and efficiency are important goals of the tax system.

D) Neither equity nor efficiency is an important goal of the tax system.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With a lump-sum tax,the average tax rate for high income taxpayers will be

A) the same as the average tax rate for low income taxpayers.

B) lower than the average tax rate for low income taxpayers.

C) higher than the average tax rate for high income taxpayers.

D) Any of the above could be true under a regressive tax system.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S. income tax

A) discourages saving.

B) encourages saving.

C) has no effect on saving.

D) will reduce the administrative burden of taxation.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-13

The table below provides information on the 4 households that make up a small economy and how much they would pay in taxes under 3 types of taxes.  -Refer to Table 12-13. In this economy Tax C exhibits

-Refer to Table 12-13. In this economy Tax C exhibits

A) horizontal and vertical equity.

B) horizontal equity but not vertical equity.

C) vertical equity but not horizontal equity.

D) neither horizontal nor vertical equity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pat calculates that for every extra dollar she earns, she owes the government 33 cents. Her total income now is $35,000, on which she pays taxes of $7,000. Determine her average tax rate and her marginal tax rate.

A) Her average tax rate is 33 percent and her marginal tax rate is 20 percent.

B) Her average tax rate is 20 percent and her marginal tax rate is 33 percent.

C) Her average tax rate is 20 percent and her marginal tax rate is 20 percent.

D) Her average tax rate is 33 percent and her marginal tax rate is 33 percent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country is using a proportional tax when

A) its marginal tax rate equals its average tax rate.

B) its marginal tax rate is less than its average tax rate.

C) its marginal tax rate is greater than its average tax rate.

D) it uses a lump-sum tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If transfer payments are included when evaluating tax burdens, then the average tax rate of the poorest quintile of taxpayers would be approximately

A) negative 30 percent.

B) negative 10 percent.

C) positive 1 percent.

D) positive 8 percent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

The largest category of expenditures for state and local governments is __________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

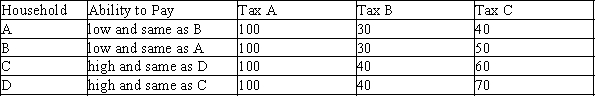

Table 12-9

United States Income Tax Rates for a Single Individual, 2012 and 2013.  -Refer to Table 12-9. Samantha is a single person whose taxable income is $100,000 a year. What happened to her average tax rate between 2012 and 2013?

-Refer to Table 12-9. Samantha is a single person whose taxable income is $100,000 a year. What happened to her average tax rate between 2012 and 2013?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

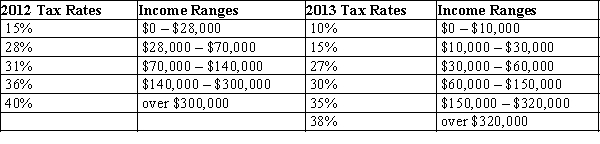

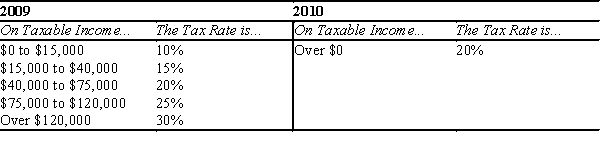

Table 12-7

The following table shows the marginal tax rates for unmarried individuals for two years.  -Refer to Table 12-7. For an individual who earned $80,000 in both years, which of the following statements is true regarding the individual's marginal tax rate?

-Refer to Table 12-7. For an individual who earned $80,000 in both years, which of the following statements is true regarding the individual's marginal tax rate?

A) The marginal tax rate is higher in 2010 than in 2009.

B) The marginal tax rate is the same in 2010 as it was in 2009.

C) The marginal tax rate is lower in 2010 than in 2009.

D) With a proportional tax, as in 2010, it is not possible to determine the individual's marginal tax rate so it is not possible to compare the marginal tax rates in the two years.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefits principle is used to justify

A) sales taxes.

B) gasoline taxes.

C) "sin" taxes on cigarettes and alcoholic beverages.

D) personal income taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With a lump-sum tax, the

A) marginal tax rate is always less than the average tax rate.

B) average tax rate is always less than the marginal tax rate.

C) marginal tax rate falls as income rises.

D) marginal tax rate rises as income rises.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When taxes are imposed on a commodity,

A) there is never a deadweight loss.

B) some consumers alter their consumption by not purchasing the taxed commodity.

C) tax revenue will rise by the amount of the tax multiplied by the before-tax level of consumption.

D) the taxes do not distort incentives.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 321 - 340 of 563

Related Exams