A) His average tax rate is 17.19 percent, and the marginal tax rate on his salary is 55 percent.

B) His average tax rate is 50.23 percent, and the marginal tax rate on his salary is 70.3 percent.

C) His average tax rate is 53.63 percent, and the marginal tax rate on his salary is 70.3 percent.

D) His average tax rate is 55.79 percent, and the marginal tax rate on his salary is 70.3 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the 1980s, President Ronald Reagan argued that high tax rates distorted economic incentives to work and save. In the 1990s, President Bill Clinton argued that the rich were not paying their fair share of taxes. Which of the following statements best summarizes the economic theories behind the differing philosophies?

A) President Reagan was concerned about vertical equity, whereas President Clinton was concerned about horizontal equity.

B) President Reagan was concerned about average tax rates, whereas President Clinton was concerned about horizontal equity.

C) President Reagan was concerned about marginal tax rates, whereas President Clinton was concerned about vertical equity.

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some colleges charge all students the same fee for a weekly dining services meal plan. Suppose that students differ by how much food they consume each week. For example, members of the women's swimming team consume, on average, twice as much food as the average female college student, and the average male college student consumes 20 percent more food than the average female college student. The dining services fee is most like a(n)

A) excise tax that conforms to the benefits principle.

B) excise tax that violates the benefits principle.

C) lump-sum tax that conforms to the benefits principle.

D) lump-sum tax that violates the benefits principle.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A budget deficit occurs when government receipts fall short of government spending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

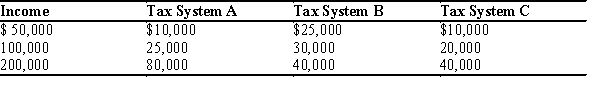

Table 12-21

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.  -Refer to Table 12-21. Which of the three tax systems is proportional?

-Refer to Table 12-21. Which of the three tax systems is proportional?

A) Tax System A

B) Tax System B

C) Tax System C

D) None of the systems are proportional.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a state has the following individual income tax structure.The first $20,000 that an individual earns is taxed at 5%. The next $30,000 is taxed at 10%. Any income exceeding $50,000 is taxed at 20%.Based on this tax structure, if a person's income is equal to $60,000, his average tax rate is equal to:

A) 15%

B) 10%

C) 11.67%

D) 20%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tax systems is the most fair?

A) proportional taxes

B) regressive taxes

C) progressive taxes

D) There is no objective way to assess fairness among the three systems.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most efficient tax possible is a

A) marginal income tax.

B) lump-sum tax.

C) consumption tax.

D) corporate profit tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The administrative burden of any tax system is part of the inefficiency it creates.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

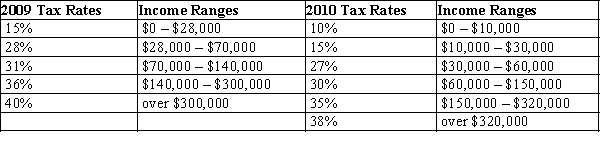

Table 12-18

United States Income Tax Rates for a Single Individual, 2009 and 2010.  -Refer to Table 12-18. What type of tax structure does the United States have in 2010 for single individuals?

-Refer to Table 12-18. What type of tax structure does the United States have in 2010 for single individuals?

A) a proportional tax structure

B) a regressive tax structure

C) a progressive tax structure

D) a lump-sum tax structure

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A budget surplus occurs when government receipts fall short of government spending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the marginal tax rate equals the average tax rate, the tax is

A) proportional.

B) progressive.

C) regressive.

D) egalitarian.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

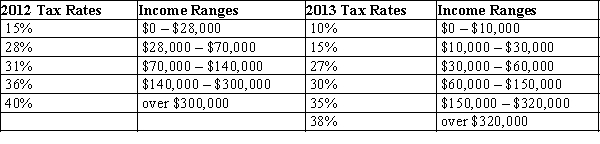

Table 12-9

United States Income Tax Rates for a Single Individual, 2012 and 2013.  -Refer to Table 12-9. Harry is a single person whose taxable income is $35,000 a year. What happened to his marginal tax rate between 2012 and 2013?

-Refer to Table 12-9. Harry is a single person whose taxable income is $35,000 a year. What happened to his marginal tax rate between 2012 and 2013?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Leonard, Sheldon, Raj, and Penny each like science fiction moves. The price of a special boxed set of Star Trek DVDs is $50. Leonard values the set of movies at $70, Sheldon at $65, Raj at $60, and Penny at $55. Suppose that if the government taxes DVDs at $10 each, the price rises to $60. A consequence of the tax is that consumer surplus shrinks by

A) $50 and tax revenues increase by $30, so there is a deadweight loss of $20.

B) $35 and tax revenues increase by $30, so there is a deadweight loss of $5.

C) $20 and tax revenues increase by $20, so there is no deadweight loss.

D) $15 and tax revenues increase by $20, so there is no deadweight loss.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

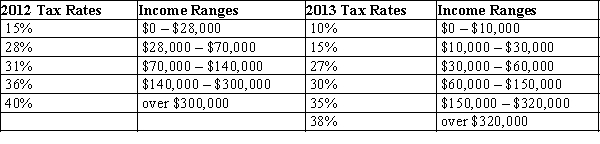

Table 12-9

United States Income Tax Rates for a Single Individual, 2012 and 2013.  -Refer to Table 12-9. Ruby Sue is a single person whose taxable income is $100,000 a year. What happened to her marginal tax rate between 2012 and 2013?

-Refer to Table 12-9. Ruby Sue is a single person whose taxable income is $100,000 a year. What happened to her marginal tax rate between 2012 and 2013?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax that is higher for men than for women violates the criterion of

A) horizontal equity.

B) vertical equity.

C) the ability-to-pay principle.

D) the marriage tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

By law, all states must have a state income tax.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

According to the benefits principle, it is fair for people to pay taxes based on their ability to shoulder the tax burden.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal equity can be difficult to assess because it is difficult to compare the similarity of tax payers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal and vertical equity are the two primary measures of efficiency of a tax system.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 441 - 460 of 563

Related Exams