Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following lists correctly ranks countries from most equal to least equal distribution of income?

A) Nigeria, India, Mexico, Germany

B) Brazil, United States, India, Japan

C) United States, Ethiopia, Japan, South Africa

D) Japan, India, United States, Brazil

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

About half of black and Hispanic children in female-headed households live in poverty.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 20-11

Poverty Thresholds in 2011, by Size of Family and Number of Related Children Under 18 Years

[Dollars] ![Table 20-11 Poverty Thresholds in 2011, by Size of Family and Number of Related Children Under 18 Years [Dollars] Source: U. S. Bureau of the Census, Current Population Survey. -Refer to Table 20-11. What is the poverty line for a family with one 68-year-old adult and one child? A) $10,788 B) $15,446 C) $15,504 D) $18,106](https://d2lvgg3v3hfg70.cloudfront.net/TB2269/11eb175c_fc8f_1e9f_931a_bb58b8f16319_TB2269_00.jpg) Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-11. What is the poverty line for a family with one 68-year-old adult and one child?

Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-11. What is the poverty line for a family with one 68-year-old adult and one child?

A) $10,788

B) $15,446

C) $15,504

D) $18,106

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty rate is the percentage of the population that have a family income level below the

A) income maintenance threshold.

B) poverty line.

C) bottom quintile of the income distribution.

D) minimum wage.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Welfare is a broad term that includes a variety of government programs designed to help poor people.

B) Since the early 1970s, welfare benefits adjusted for inflation have increased, as has the percentage of children living with only one parent.

C) Critics of welfare programs argue that they can create incentives for unmarried women to have children.

D) Supporters argue that welfare doesn't cause the decline of two-parent families.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Which of the three political philosophies discussed in the textbook, if any, think the government should not take from some individuals and give to others to achieve any particular distribution of income?

Correct Answer

verified

Correct Answer

verified

True/False

Critics argue that a disadvantage of minimum-wage laws is that they do not effectively target the working poor because many minimum-wage workers are the teenage children of middle-income families.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

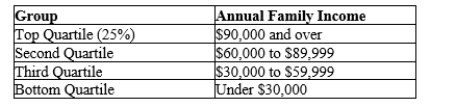

Table 20-1

The following table shows the distribution of income in Marysville.  -Refer to Table 20-1. Fifty percent of all families have incomes below what level?

-Refer to Table 20-1. Fifty percent of all families have incomes below what level?

A) $30,000

B) $60,000

C) $90,000

D) There is insufficient information to answer this question.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The United States has greater income disparity than

A) Japan.

B) India.

C) South Africa.

D) Both a and b are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The economic life cycle describes how young people usually have higher savings rates than middle-aged people.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

If greater equality is the benefit of government intervention into the allocation of society's resources, what is the cost?

Correct Answer

verified

Correct Answer

verified

True/False

A goal of libertarians is to provide citizens with equal opportunities rather than to ensure equal outcomes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The goal of utilitarians is to

A) apply the logic of individual decision making to questions concerning morality and public policy.

B) measure happiness and satisfaction.

C) redistribute income based on the assumption of increasing marginal utility.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

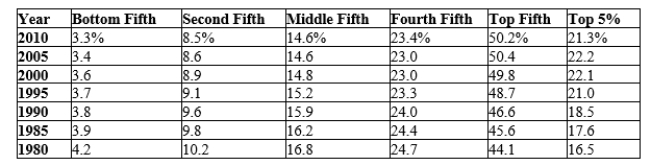

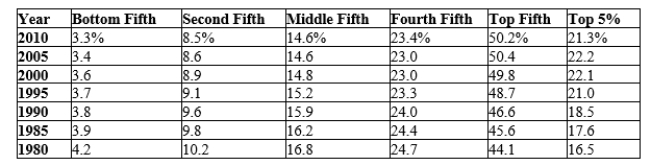

Table 20-14

Income Inequality in the United States

The values in the table reflect the percentages of pre-tax-and transfer income.  Source: US Census Bureau

-Refer to Table 20-14. If the distribution of income were completely equal, what percentage of income would the bottom fifth of the population earn?

Source: US Census Bureau

-Refer to Table 20-14. If the distribution of income were completely equal, what percentage of income would the bottom fifth of the population earn?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty line is adjusted each year to reflect changes in the

A) number of people currently on public assistance.

B) level of prices.

C) nutritional content of an "adequate" diet.

D) size of a family.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A family's ability to buy goods and services depends largely on its

A) permanent income, which is its normal, or average, income.

B) permanent income, which is the lowest annual income the family has received over a 10-year period.

C) transitory income, which is the measure of income used by the government to analyze the distribution of income and the poverty rate.

D) transitory income, which is its money income plus any in-kind transfers it receives.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rule for redistribution proposed by John Rawls in his book A Theory of Justice is called the

A) "optimal ignorance" rule.

B) libertarian justice rule.

C) maximin criterion.

D) egalitarian criterion.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Table 20-14

Income Inequality in the United States

The values in the table reflect the percentages of pre-tax-and transfer income.  Source: US Census Bureau

-Refer to Table 20-14. In 2010, what percentage of total income in the US did the bottom 20% of families have?

Source: US Census Bureau

-Refer to Table 20-14. In 2010, what percentage of total income in the US did the bottom 20% of families have?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-7 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/6 of income) - $24,000 -Refer to Scenario 20-7. A family earning $60,000 before taxes would pay how much in taxes?

A) -$20,000

B) -$14,000

C) $36,000

D) $60,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 401 - 420 of 478

Related Exams