A) $11,581.

B) $16,181.

C) $20,000.

D) $24,881.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009, the lowest quintile of income earners paid about

A) 1 percent of income as taxes and paid less than 1 percent of all taxes.

B) 5 percent of income as taxes and paid less than 1 percent of all taxes.

C) 1 percent of income as taxes and paid about 5 percent of all taxes.

D) 5 percent of income as taxes and paid about 5 percent of all taxes.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes a situation where tax laws give preferential treatment to specific types of behavior?

A) tax evasion

B) a political payoff

C) a tax loophole

D) compensation for the benefit of society

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Ken places a $20 value on a cigar, and Mark places a $17 value on it. The equilibrium price for this brand of cigar is $15. -Refer to Scenario 12-1. Suppose the government levies a tax of $1 on each cigar, and the equilibrium price of a cigar increases to $16. Because total consumer surplus has

A) fallen by more than the tax revenue, the tax has a deadweight loss.

B) fallen by less than the tax revenue, the tax has no deadweight loss.

C) fallen by exactly the amount of the tax revenue, the tax has no deadweight loss.

D) increased by less than the tax revenue, the tax has a deadweight loss.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Ken places a $20 value on a cigar, and Mark places a $17 value on it. The equilibrium price for this brand of cigar is $15. -Refer to Scenario 12-1. Suppose the government levies a tax of $3 on each cigar, and the equilibrium price of a cigar increases to $18. Because total consumer surplus has

A) fallen by more than the tax revenue, the tax has a deadweight loss

B) fallen by less than the tax revenue, the tax has no dead weight loss.

C) fallen by exactly the amount of the tax revenue, the tax has no deadweight loss.

D) increased by less than the tax revenue, the tax has a deadweight loss.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

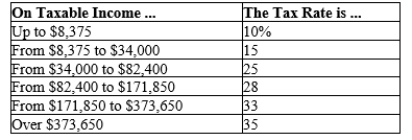

Table 12-10  -Refer to Table 12-10. If Si has $100,000 in taxable income, his tax liability will be

-Refer to Table 12-10. If Si has $100,000 in taxable income, his tax liability will be

A) $838.

B) $3,844.

C) $12,100.

D) $21,709.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Individual Retirement Accounts and 401(k) plans make the current U.S. tax system

A) more like a consumption tax and so more like the tax system of many European countries.

B) more like a consumption tax and so less like the tax system of many European countries.

C) less like a consumption tax and so more like the tax system of many European countries.

D) less like a consumption tax and so less like the tax system of many European countries.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Ken places a $20 value on a cigar, and Mark places a $17 value on it. The equilibrium price for this brand of cigar is $15. -Refer to Scenario 12-1. Suppose the government levies a tax of $1 on each cigar, and the equilibrium price of a cigar increases to $16. What is total consumer surplus after the tax is levied?

A) $2

B) $3

C) $4

D) $5

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Incentives to work and save are reduced when

A) income taxes are higher.

B) consumption taxes replace income taxes.

C) corrective taxes are implemented.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a poor family has three children in public school and a rich family has two children in private school, the ability-to-pay principle would suggest that

A) the poor family should pay more in taxes to pay for public education than the rich family.

B) the rich family should pay more in taxes to pay for public education than the poor family.

C) the benefits of private school exceed those of public school.

D) public schools should be financed by property taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

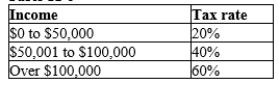

Table 12-5  -Refer to Table 12-5. What is the average tax rate for a person who makes $120,000?

-Refer to Table 12-5. What is the average tax rate for a person who makes $120,000?

A) 25%

B) 35%

C) 45%

D) 60%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Darby values a certain smart phone at $400. Jake values the same smart phone at $300. The pre-tax price of this smart phone is $250. The government imposes a tax of $75 on each smart phone, and the price rises to $325. The deadweight loss from the tax is

A) $150.

B) $100.

C) $50.

D) $0.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

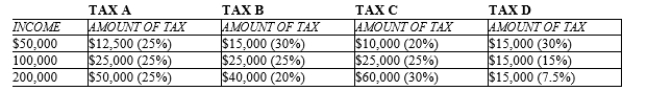

Table 12-22  -Refer to Table 12-22. A lump-sum tax is illustrated by tax

-Refer to Table 12-22. A lump-sum tax is illustrated by tax

A) A.

B) B.

C) C.

D) D.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the rich pay more in taxes than the poor, the tax system must be progressive.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The single largest expenditure by state and local governments is on

A) highways.

B) police.

C) public welfare.

D) education.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

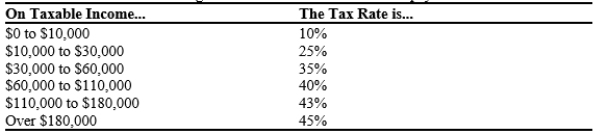

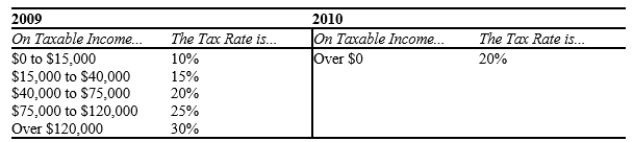

Table 12-6

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.  -Refer to Table 12-6. For this tax schedule, what is the total income tax due for an individual with $49,000 in taxable income?

-Refer to Table 12-6. For this tax schedule, what is the total income tax due for an individual with $49,000 in taxable income?

A) $12,650

B) $14,370

C) $15,960

D) $16,220

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-17

The following table shows the marginal tax rates for unmarried individuals for two years.  -Refer to Table 12-17. Suppose one goal of the tax system was to achieve vertical equity. While people may disagree about what is "equitable," based on the marginal tax rates given for the two years, which of the following statements is true?

-Refer to Table 12-17. Suppose one goal of the tax system was to achieve vertical equity. While people may disagree about what is "equitable," based on the marginal tax rates given for the two years, which of the following statements is true?

A) Vertical equity is possible in both years.

B) Vertical equity is possible in 2009 but not in 2010.

C) Vertical equity is not possible in 2009 but is possible in 2010.

D) Vertical equity is not possible in either year.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tax evasion is

A) facilitated by legal deductions to taxable income.

B) the same as tax avoidance.

C) recommended by the American Accounting Association.

D) illegal.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are taxed?

A) both corporate profits and dividends shareholders receive

B) corporate profits but not dividends shareholders receive

C) dividends shareholders receive but not corporate profits

D) neither corporate profits nor dividends shareholders receive

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

The largest category of expenditures for state and local governments is __________.

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 664

Related Exams