Filters

Question type

A) Senator Filch only

B) Senator Moody only

C) Senators Fudge and Malfoy only

D) Senators Malfoy and Moody only

E) A) and B)

F) A) and C)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Question 342

Multiple Choice

Which of the following tax structures is potentially consistent with the concept of vertical equity?

A) A proportional tax

B) A progressive tax

C) A regressive tax

D) Any of these tax structures are potentially consistent with vertical equity

E) A) and C)

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

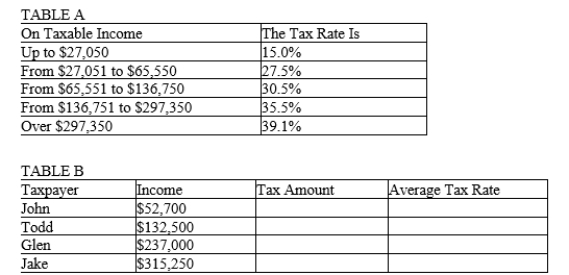

Question 343

Essay

Use Table A to complete Table B.

Correct Answer

verified

Correct Answer

verified

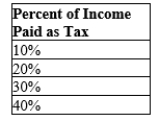

Question 344

Multiple Choice

Table 12-16  -Refer to Table 12-16. In this tax system which of the following is possible?

-Refer to Table 12-16. In this tax system which of the following is possible?

A) vertical and horizontal equity

B) vertical but not horizontal equity

C) horizontal but not vertical equity

D) neither horizontal nor vertical equity

E) A) and D)

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 661 - 664 of 664

Related Exams