A) The taxpayer's itemized deductions.

B) The individual's tax-exempt interest income.

C) The number of quarters the individual worked.

D) The individual's standard deduction.

E) None of these.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Bill paid $2,500 of medical expenses for his daughter, Marie.She is married to John and they file a joint return.Bill can include the $2,500 of expenses when calculating his medical expense deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In December 2019, Emily, a cash basis taxpayer, received a $2,500 cash scholarship for the spring semester of 2020. However, she did not use the funds to pay the tuition until January 2020.Emily can exclude the $2,500 from her gross income in 2019.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The alimony recapture rules are intended to:

A) Assist former spouses in collecting alimony when the other spouse moves to another state.

B) Prevent tax deductions for property divisions.

C) Reduce the net cash outflow for the payor.

D) Distinguish child support payments from alimony.

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Brooke works part-time as a waitress in a restaurant.For groups of seven or more customers, the customer is charged 15% of the bill for Brooke's services.For parties of less than seven, the tips are voluntary.Brooke received $11,000 from the groups of seven or more and $7,000 in voluntary tips from all other customers.Using the customary 15% rate, her voluntary tips would have been only $6,000.Brooke must include $18,000 ($11,000 + $7,000) in gross income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Travis and Andrea were divorced in 2017.Their only marital property consisted of a personal residence (fair market value of $400,000, cost of $200,000) , and publicly traded stocks (fair market value of $800,000, cost basis of $500,000) .Under the terms of the divorce agreement, Andrea received the personal residence and Travis received the stocks.In addition, Andrea was to receive $50,000 for eight years. I.If the $50,000 annual payments are to be made to Andrea or her estate (if she dies before the end of the eight years) , the payments will qualify as alimony. II.Andrea has a taxable gain from an exchange of her one-half interest in the stocks for Travis' one-half interest in the house and cash. III.If Travis sells the stocks for $900,000, he must recognize a $400,000 gain.

A) Only III is true.

B) Only I and III are true.

C) Only I and II are true.

D) I, II, and III are true.

E) None of these are true.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

For purposes of computing the deduction for qualified residence interest, a qualified residence includes the taxpayer's principal residence and two other residences of the taxpayer or spouse.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the current year, Jerry pays $8,000 to become a charter member of Mammoth University's Athletic Council.The membership ensures that Jerry will receive choice seating at all of Mammoth's home basketball games.Also this year, Jerry pays $2,200 (the regular retail price) for season tickets for himself and his wife.For these items, how much qualifies as a charitable contribution?

A) $0

B) $6,400

C) $8,000

D) $10,200

E) None of these

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

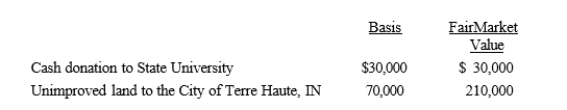

Karen, a calendar year taxpayer, made the following donations to qualified charitable organizations during the year:  The land had been held as an investment and was acquired four years ago.Shortly after receipt, the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction this year is:

The land had been held as an investment and was acquired four years ago.Shortly after receipt, the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction this year is:

A) $100,000.

B) $165,000.

C) $225,000.

D) $240,000.

E) None of these.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olaf was injured in an automobile accident and received $25,000 for his physical injury, $50,000 for his loss of income, and $10,000 for punitive damages.As a result of the award, the amount Olaf must include in gross income is:

A) $10,000.

B) $50,000.

C) $60,000.

D) $85,000.

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer may qualify for the credit for child and dependent care expenses if the taxpayer's dependent is under age 17.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

George and Erin divorced in 2020, and George is required to pay Erin $20,000 of alimony each year.George earns $75,000 a year.Erin is required to include the alimony payments in gross income although George earned the income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Capital assets donated to a public charity that would result in long-term capital gain if sold are subject to the 30%-of- AGI ceiling limitation on charitable contributions for individuals.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Ted earned $150,000 during the current year.He paid Alice, his former wife, $75,000 in alimony.The couple divorced in 2017.Under these facts, the tax is paid by the person who benefits from the income rather than the person who earned the income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Child and dependent care expenses include amounts paid for general household services.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The maximum credit for child and dependent care expenses is $2,100 if only one spouse is employed and the other spouse is a full-time student.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Certain high-income individuals are subject to three additional Medicare taxes on wages, unearned income, and tax credits claimed.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

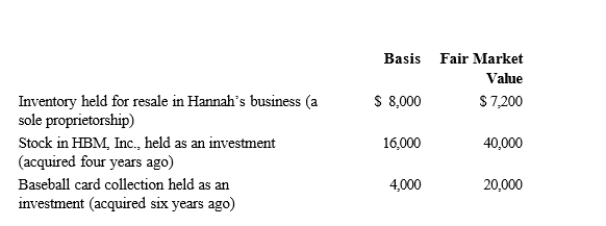

Hannah makes the following charitable donations in the current year:  The HBM stock and the inventory were given to Hannah's church, and the baseball card collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations, Hannah's current charitable contribution deduction is:

The HBM stock and the inventory were given to Hannah's church, and the baseball card collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations, Hannah's current charitable contribution deduction is:

A) $28,000.

B) $51,200.

C) $52,000.

D) $67,200.

E) None of these.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following, if any, correctly describes the earned income credit?

A) Would be available regardless of the amount of the taxpayer's adjusted gross income.

B) Is not available to a surviving spouse.

C) Requires a taxpayer to have a qualifying child to take advantage of the credit.

D) Is a refundable credit.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jack received a court award in a civil libel and slander suit against National Gossip.He received $120,000 for damages to his professional reputation, $100,000 for damages to his personal reputation, and $50,000 in punitive damages.Jack must include in his gross income as a damage award:

A) $0.

B) $100,000.

C) $120,000.

D) $270,000.

E) None of these.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 129

Related Exams