Correct Answer

verified

Correct Answer

verified

Multiple Choice

During 2019, Lisa (age 66) furnished more than 50% of the support of the following persons: ∙ Her current husband who has no income and is not claimed by anyone else as a dependent. ∙ Her stepson (age 19) who lives with her and earns $6,000 as a dance instructor.He dropped out of school a year ago. ∙ Her ex-husband who does not live with her.The divorce occurred two years ago. ∙ Her former brother-in-law who does not live with her. Presuming that all other dependency tests are met, on a separate return how many dependents may Lisa claim?

A) Two

B) Three

C) Four

D) Five

E) None of these

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If an individual does not spend funds that have been received from another source (e.g., interest on municipal bonds), the unexpended amounts are not considered for purposes of the support test.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following, if any, is a deduction for AGI?

A) Contributions to a traditional Individual Retirement Account.

B) Child support payments.

C) Funeral expenses.

D) Loss on the sale of a personal residence.

E) Medical expenses.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The additional standard deduction for age and blindness is greater for married taxpayers than for single taxpayers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Lucas, age 17 and single, earns $6,000 during 2019.His parents cannot claim him as a dependent if he does not live with them.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Match the statements that relate to each other.Note: Choice k.may be used more than once. a.Available to a 70-year-old father claimed as a dependent by his son. b.Equal to tax liability divided by taxable income. c.The highest income tax rate applicable to a taxpayer. d.Not eligible for the standard deduction. e.No one qualified taxpayer meets the support test. f.Taxpayer's ex-husband does not qualify. g.A dependent child (age 18) who has only unearned income. h.Highest applicable rate is 37%. i.Applicable rate could be as low as 0%. j.Maximum rate is 28%. k.No correct match provided. -Additional standard deduction

Correct Answer

verified

Correct Answer

verified

Multiple Choice

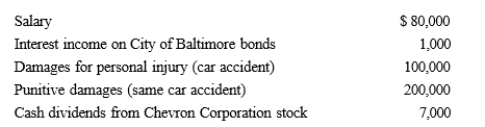

During 2019, Sandeep had the following transactions:  Sandeep's AGI is:

Sandeep's AGI is:

A) $185,000.

B) $187,000.

C) $285,000.

D) $287,000.

E) $387,000.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Matching Regarding classification as a dependent, classify each statement in one of the four categories: a. Could be a qualifying child. b. Could be a qualifying relative. c. Could be either a qualifying child or a qualifying relative. d. Could be neither a qualifying child nor a qualifying relative. -A cousin who does not live with taxpayer.

Correct Answer

verified

Correct Answer

verified

Essay

Match the statements that relate to each other.Note: Some choices may be used more than once. a.Not available to 65-year old taxpayer who itemizes. b.Exception for U.S.citizenship or residency test (for dependency exemption purposes). c.Largest basic standard deduction available to a dependent who has no earned income in 2019. d.Considered for dependency purposes. e.Qualifies for head of household filing status. f.A child (age 15) who is a dependent and has only earned income. g.Considered in applying gross income test (for dependency exemption purposes). h.Not considered in applying the gross income test (for dependency exemption purposes). i.Unmarried taxpayer who can use the same tax rates as married persons filing jointly. j.Exception to the support test (for dependency exemption purposes). k.A child (age 16) who is a dependent and has only unearned income of $4,500.l.No correct match provided. -Resident of Canada or Mexico

Correct Answer

verified

Correct Answer

verified

True/False

The kiddie tax does not apply to a child whose earned income is more than one-half of his or her support.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Roy and Linda divorced in 2018.The divorce decree awards custody of their children (all under age 17) to Linda but is silent as to who is entitled to treat them as dependents for purposes of claiming the child tax credit.If Roy furnished more than half of their support, he can claim the child tax credit for them in 2019.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

After Ellie moves out of the apartment she had rented as her personal residence, she recovers her damage deposit of $1,000.The $1,000 is not income to Ellie.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The additional Medicare taxes assessed on high-income individuals carry differing tax rates depending on the tax base.

B) False

Correct Answer

verified

Correct Answer

verified

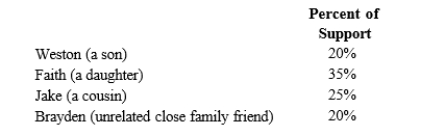

Multiple Choice

Millie, age 80, is supported during the current year as follows:  During the year, Millie lives in an assisted living facility.Under a multiple support agreement, indicate which parties can qualify to claim Millie as a dependent.

During the year, Millie lives in an assisted living facility.Under a multiple support agreement, indicate which parties can qualify to claim Millie as a dependent.

A) Weston and Faith.

B) Faith.

C) Weston, Faith, Jake, and Brayden.

D) Faith, Jake, and Brayden.

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Surviving spouse filing status begins in the year in which the deceased spouse died.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following situations, if any, may the individual not be claimed as a dependent of the taxpayer?

A) A former spouse who lives with the taxpayer (divorce took place last year) .

B) A stepmother who does not live with the taxpayer.

C) A married daughter who lives with the taxpayer.

D) A half-brother who does not live with the taxpayer and is a citizen and resident of Honduras.

E) A cousin who lives with the taxpayer.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

For the year a spouse dies, the surviving spouse is considered married for the entire year for income tax purposes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An above-the-line deduction refers to a deduction for AGI.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Dan and Donna are husband and wife and file separate returns for the year.If Dan itemizes his deductions from AGI, Donna cannot claim the standard deduction.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 132

Related Exams