B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) The gain basis for property received by gift is the lesser of the donor's adjusted basis or the fair market value on the date of the gift.

B) The loss basis for property received by gift is the same as the donor's basis.

C) The gain basis for inherited property is the same as the decedent's basis.

D) The loss basis for inherited property is the lesser of the decedent's basis or the fair market value on the date of the decedent's death.

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The holding period of property acquired by gift may begin on:

A) The date the property was acquired by the donor only.

B) The date of gift only.

C) Either the date the property was acquired by the donor or the date of gift.

D) The last day of the tax year in which the property was originally acquired by the donor.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

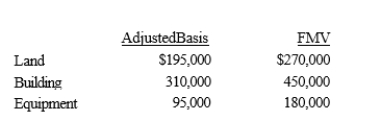

Mona purchased a business from Judah for $1,000,000.Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Abby sells real property for $300,000.The buyer pays $5,000 in property taxes that had accrued during the year while the property was still legally owned by Abby.In addition, Abby pays $15,000 in commissions and $3,000 in legal fees in connection with the sale.How much does Abby realize (the amount realized) from the sale of her property?

A) $277,000

B) $282,000

C) $287,000

D) $300,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A realized gain on the sale or exchange of a personal use asset is recognized, but a realized loss on the sale, exchange, or condemnation of a personal use asset is not recognized.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a taxpayer exchanges like-kind property and assumes a liability associated with the property received, the taxpayer is considered to have received boot in the transaction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Nontaxable stock dividends result in no change to the total basis of the old and new stock, but the basis per share decreases.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the amount of a corporate distribution is less than the amount of the corporate earnings and profits, the return of capital concept does not apply and the shareholders' adjusted basis for the stock remains unchanged.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Milt's building, which houses his retail sporting goods store, is destroyed by a flood.Sandra's warehouse, which she is leasing to Milt to store the inventory of his business, also is destroyed in the same flood.Both Milt and Sandra receive insurance proceeds that result in a realized gain.Sandra will have less flexibility than Milt in the type of building in which she can invest the proceeds and qualify for postponement treatment under § 1033 (nonrecognition of gain from an involuntary conversion).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Kelly, who is single, sells her principal residence, which she has owned and occupied for eight years, for $375,000. The adjusted basis is $64,000 and selling expenses are $22,000.She purchases another principal residence three months later for $200,000.Her recognized gain is $39,000 and her basis for the new principal residence is $200,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If boot is received in a § 1031 like-kind exchange, the recognized gain cannot exceed the realized gain.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Ben sells stock (adjusted basis of $25,000) to his son, Ray, for its fair market value of $15,000.Ray gives the stock to his daughter, Trish, who subsequently sells it for $26,000.Ben's recognized loss is $0 and Trish's recognized gain is $1,000 ($26,000 - $15,000 - $10,000).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The basis of property acquired in a bargain purchase is its cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Janice bought her house in 2010 for $395,000.Since then, she has deducted $70,000 in depreciation associated with her home office and has spent $45,000 replacing all the old pipes and plumbing.She sells the house on July 1, 2019.Her realtor charged $34,700 in commissions.Prior to listing the house with the realtor, she spent $300 advertising in the local newspaper.Don buys the house for $500,000 in cash and assumes her mortgage of $194,000.What is Janice's adjusted basis at the date of the sale and the amount realized?

A) $370,000 adjusted basis; $661,400 amount realized.

B) $370,000 adjusted basis; $659,000 amount realized.

C) $370,000 adjusted basis; $665,200 amount realized.

D) $325,000 adjusted basis; $663,200 amount realized.

E) $325,000 adjusted basis; $694,000 amount realized.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Capital recoveries include:

A) The cost of capital improvements.

B) Ordinary repair and maintenance expenditures.

C) Payments made on the principal of a mortgage on taxpayer's building.

D) Amortization of bond premium.

E) All of these.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If Wal-Mart stock increases in value during the tax year by $6,000, the amount realized is a positive $6,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Dennis, a calendar year taxpayer, owns a warehouse (adjusted basis of $190,000) that is destroyed by a tornado in October 2019.He receives insurance proceeds of $250,000 in January 2020.If before 2022, Dennis replaces the warehouse with another warehouse costing at least $250,000, he can elect to postpone the recognition of any realized gain.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Matt, who is single, sells his principal residence, which he has owned and occupied for five years, for $435,000.The adjusted basis is $140,000 and the selling expenses are $20,000.Three days after the sale, he purchases another residence for $385,000.Matt's recognized gain is $25,000 and his basis for the new residence is $385,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cole exchanges an asset (adjusted basis of $15,000; fair market value of $25,000) for another asset (fair market value of $19,000).In addition, he receives cash of $6,000.If the exchange qualifies as a like-kind exchange, his recognized gain is $6,000, and his adjusted basis for the property received is $21,000 ($15,000 + $6,000 recognized gain).

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 126

Related Exams