B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In January, Lance sold stock with a cost basis of $26,000 to his brother, James, for $24,000, the fair market value of the stock on the date of sale.Five months later, James sold the same stock through his broker for $27,000.What is the tax effect of these transactions?

A) Disallowed loss to James of $2,000; gain to Lance of $1,000.

B) Disallowed loss to Lance of $2,000; gain to James of $3,000.

C) Deductible loss to Lance of $2,000; gain to James of $3,000.

D) Disallowed loss to Lance of $2,000; gain to James of $1,000.

E) None of these.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following may be deductible in 2019?

A) Bribes that relate to a U.S.business.

B) Fines paid for violations of the law.

C) Interest on a loan used in a hobby.

D) All of these.

E) None of these.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The basis of cost recovery property must be reduced by at least the cost recovery allowable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The only asset Bill purchased during 2019 was a new seven-year class asset.The asset, which was listed property, was acquired on June 17 at a cost of $50,000.The asset was used 40% for business, 30% for the production of income, and the rest of the time for personal use.Bill always elects to expense the maximum amount under § 179 whenever it is applicable.The net income from the business before the § 179 deduction is $100,000.Determine Bill's maximum deduction with respect to the property for 2019.

A) $1,428

B) $2,499

C) $26,749

D) $33,375

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under MACRS, which one of the following is not considered in determining depreciation for tax purposes?

A) Cost of asset.

B) Property recovery class.

C) Half-year convention.

D) Salvage (or residual) value.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

None of the prepaid rent paid on September 1 by a calendar year cash basis taxpayer for the next 18 months is deductible in the current period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

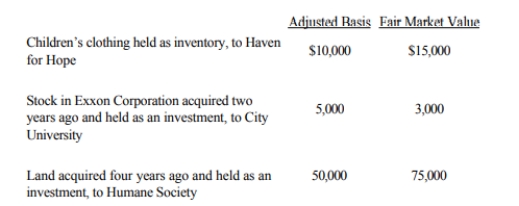

Owl Corporation (a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations this year.  How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of these.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonnie purchased a new business asset (five-year property) on March 10, 2019, at a cost of $30,000.She also purchased a new business asset (seven-year property) on November 20, 2019, at a cost of $13,000.Bonnie did not elect to expense either of the assets under § 179, nor did she elect straight-line cost recovery.Bonnie takes additional first-year depreciation.Determine the cost recovery deduction for 2019 for these assets.

A) $7,858

B) $9,586

C) $21,915

D) $43,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grape Corporation purchased a machine in December of the current year.This was the only asset purchased during the current year.The machine was placed in service in January of the following year.No assets were purchased in the following year.Grape's cost recovery would begin:

A) In the current year using a mid-quarter convention.

B) In the current year using a half-year convention.

C) In the following year using a mid-quarter convention.

D) In the following year using a half-year convention.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The maximum cost recovery method for all personal property under MACRS is 150% declining balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a related party for constructive ownership purposes under § 267?

A) The taxpayer's aunt.

B) The taxpayer's brother.

C) The taxpayer's grandmother.

D) A corporation owned more than 50% by the taxpayer.

E) None of these.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

For a taxpayer who is engaged in a trade or business, the cost of investigating a business in the same field is deductible only if the taxpayer acquires the business.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The $1 million limitation on the deduction of executive compensation applies to compensation paid to a publicly traded corporation's principal executive officer, principal financial officer, and board of directors.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the current year, Crow Corporation, a C corporation, donated scientific property (basis of $30,000, fair market value of $50,000) to State University, a qualified charitable organization, to be used in research.Crow had held the property for four months as inventory.Crow Corporation may deduct $50,000 for the charitable contribution (ignoring the taxable income limitation).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Ordinary and necessary business expenses, other than cost of goods sold, of an illegal drug-trafficking business do not reduce taxable income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If an automobile is placed in service in 2019, the limitation for cost recovery in 2021 will be based on the cost recovery limits for the year 2019.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For real property, the ADS convention is the mid-month convention.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a taxpayer has a business with a net operating loss carryover reducing current year income, the taxpayer may want to elect to use straight-line depreciation to slow down the cost recovery.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the 12-month rule for the current-period deduction of prepaid expenses of cash basis taxpayers, the asset must expire or be consumed by the end of the tax year following the year of payment.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 143

Related Exams