B) False

Correct Answer

verified

Correct Answer

verified

True/False

All domestic bribes (i.e., to a U.S.official) are disallowed as deductions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

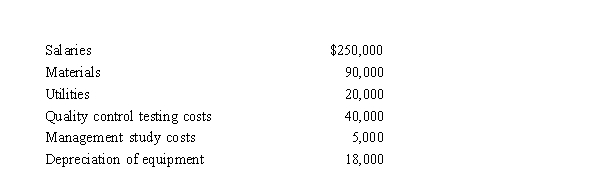

Last year, Green Corporation incurred the following expenditures in the development of a new plant process:  During the current year, benefits from the project began being realized in May.If Green Corporation elects a 60 month deferral and amortization period, determine the amount of the deduction for the current year.

During the current year, benefits from the project began being realized in May.If Green Corporation elects a 60 month deferral and amortization period, determine the amount of the deduction for the current year.

A) $48,000

B) $50,400

C) $54,667

D) $57,067

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A major objective of MACRS is to:

A) Reduce the amount of the cost recovery deduction on businesses tax returns.

B) Ensure that the amount of cost recovery for tax purposes will be the same as book depreciation.

C) Help companies achieve a faster write-off of their capital assets.

D) Require companies to use the actual economic lives of assets in calculating cost recovery for tax purposes.

E) All of these are major objectives.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Fines and penalties paid for violations of the law (e.g., illegal dumping of hazardous waste) are deductible only if they relate to a trade or business.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The amount of startup expenditures that can be deducted in the year incurred is the greater of the actual amount of such expenses or $5,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An election to use straight-line under ADS is made on an asset-by-asset basis for property other than eligible real estate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Any § 179 expense amount that is carried forward is subject to the business income limitation in the carryforward year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alice purchased office furniture on September 20, 2018, for $100,000.On October 10, 2018, she purchased business computers for $80,000.Alice placed all of the assets in service on January 15, 2019.She did not elect to expense any of the assets under § 179, did not elect straight-line cost recovery, and did not take additional first-year depreciation.Determine the cost recovery deduction for the business assets for 2019.

A) $6,426

B) $14,710

C) $25,722

D) $30,290

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

LD Partnership, a cash basis taxpayer, purchases land and a building for $200,000 with $150,000 of the cost being allocated to the building.The gross receipts of the partnership are less than $100,000.LD must capitalize the $50,000 paid for the land but can deduct the $150,000 paid for the building in the current tax year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of MACRS for property other than real estate?

A) MACRS uses shorter asset lives.

B) MACRS increases taxable income in the early years of the asset's life.

C) MACRS accelerates cost recovery.

D) MACRS decreases taxable income in the early years of the asset's life.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Land costs generally are amortized rather than being cost recovered under MACRS.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 1 of the current year, Tab converted a machine from personal use to rental property.At the time of the conversion, the machine was worth $90,000.Five years ago, Tab purchased the machine for $120,000.The machine is still encumbered by a $50,000 mortgage.What is the basis of the machine for cost recovery?

A) $70,000

B) $90,000

C) $120,000

D) $140,000

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hazel purchased a new business asset (five-year asset) on September 30, 2019, at a cost of $100,000.On October 4, 2019, she placed the asset in service.This was the only asset she placed in service in 2019.Hazel did not elect § 179 or additional first-year depreciation.On August 20, 2020, Hazel sold the asset.Determine the cost recovery for 2020 for the asset.

A) $14,250

B) $19,000

C) $23,750

D) $38,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 15, 2019, Vern purchased the rights to a mineral interest for $3,500,000.At that time, it was estimated that the recoverable units would be 500,000.During the year, 40,000 units were mined and 25,000 units were sold for $800,000.Vern incurred expenses during 2019 of $500,000.The percentage depletion rate is 22%.Determine Vern's depletion deduction for 2019.

A) $150,000

B) $175,000

C) $176,000

D) $200,000

E) $250,000

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The basis of an asset on which $20,000 has been expensed under § 179 will be reduced by $20,000 even if $20,000 cannot be expensed in the current year because of the taxable income limitation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Isabella owns two business entities.She may be able to use the cash method for one and the accrual method for the other.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The factor for determining the cost recovery for eligible real estate under MACRS in the year of disposition is taken from the month of the disposition.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 2, 2019, Fran acquires a business from Chuck.Among the assets purchased are the following intangibles: patent with a 7-year remaining life, a covenant not to compete for 10 years, and goodwill. Of the purchase price, $140,000 was paid for the patent and $60,000 for the covenant.The amount of the excess of the purchase price over the identifiable assets was $100,000.What is the amount of the amortization deduction for 2019?

A) $10,667.

B) $16,000.

C) $20,000.

D) $32,667.

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Motel buildings have a cost recovery period of 27.5 years.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 143

Related Exams