A) the demand for treadmills will increase.

B) the supply of treadmills will decrease.

C) a shortage of treadmills will develop.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a tax is placed on books.If the buyers pay the majority of the tax,then we know that the

A) demand is more inelastic than the supply.

B) supply is more inelastic than the demand.

C) government has required that buyers remit the tax payments.

D) government has required that sellers remit the tax payments.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Advocates of the minimum wage admit that it has some adverse effects,but they believe that these effects are small and that a higher minimum wage makes the poor better off.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government wants to reduce smoking,it should impose a tax on

A) buyers of cigarettes.

B) sellers of cigarettes.

C) either buyers or sellers of cigarettes.

D) whichever side of the market is less elastic.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

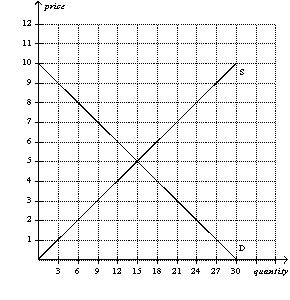

Figure 6-9

-Refer to Figure 6-9.A price floor set at

-Refer to Figure 6-9.A price floor set at

A) $4 will be binding and will result in a shortage of 3 units.

B) $4 will be binding and will result in a shortage of 6 units.

C) $7 will be binding and will result in a surplus of 6 units.

D) $7 will be binding and will result in a surplus of 12 units.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A legal maximum on the price at which a good can be sold is called a price

A) floor.

B) subsidy.

C) support.

D) ceiling.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Regardless of whether a tax is levied on sellers or buyers,taxes discourage market activity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists generally believe that rent control is

A) an efficient and fair way to help the poor.

B) inefficient but the best available means of solving a serious social problem.

C) a highly inefficient way to help the poor raise their standard of living.

D) an efficient way to allocate housing, but not a good way to help the poor.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

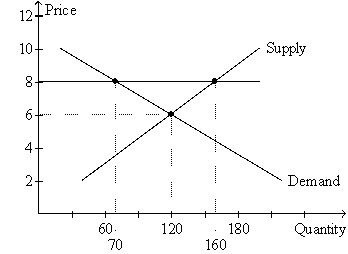

Figure 6-5

-Refer to Figure 6-5.If the horizontal line on the graph represents a price floor,then the price floor is

-Refer to Figure 6-5.If the horizontal line on the graph represents a price floor,then the price floor is

A) binding and creates a shortage of 40 units of the good.

B) binding and creates a surplus of 50 units of the good.

C) binding and creates a surplus of 90 units of the good.

D) not binding but creates a surplus of 40 units of the good.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

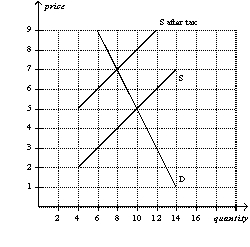

Figure 6-19

-Refer to Figure 6-19.The price paid by buyers after the tax is imposed is

-Refer to Figure 6-19.The price paid by buyers after the tax is imposed is

A) $3.

B) $4.

C) $5.

D) $7.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $0.50 tax levied on the buyers of pomegranate juice will shift the demand curve

A) upward by exactly $0.50.

B) upward by less than $0.50.

C) downward by exactly $0.50.

D) downward by less than $0.50.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the sellers of cell phones,the size of the cell phone market

A) and the price paid by buyers both increase.

B) increases, but the price paid by buyers decreases.

C) decreases, but the price paid by buyers increases.

D) and the price paid by buyers both decrease.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a nonbinding price floor is imposed on a market,then the

A) quantity sold in the market will decrease.

B) quantity sold in the market will stay the same.

C) price in the market will increase.

D) price in the market will decrease.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

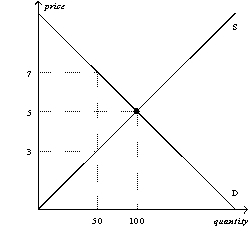

Figure 6-15

-Refer to Figure 6-15.Suppose a tax of $2 per unit is imposed on this market.Which of the following is correct?

-Refer to Figure 6-15.Suppose a tax of $2 per unit is imposed on this market.Which of the following is correct?

A) One-fourth of the burden of the tax will fall on buyers, and three-fourths of the burden of the tax will fall on sellers.

B) One-third of the burden of the tax will fall on buyers, and two-thirds of the burden of the tax will fall on sellers.

C) One-half of the burden of the tax will fall on buyers ,and one-half of the burden of the tax will fall on sellers.

D) Two-thirds of the burden of the tax will fall on buyers, and one-third of the burden of the tax will fall on sellers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Long lines and discrimination are examples of rationing methods that may naturally develop in response to a binding price ceiling.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $2.00 tax levied on the sellers of birdhouses will shift the supply curve

A) upward by exactly $2.00.

B) upward by less than $2.00.

C) downward by exactly $2.00.

D) downward by less than $2.00.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct concerning the burden of a tax imposed on take-out food?

A) Buyers bear the entire burden of the tax.

B) Sellers bear the entire burden of the tax.

C) Buyers and sellers share the burden of the tax.

D) We have to know whether it is the buyers or the sellers that are required to pay the tax to the government in order to make this determination.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The rationing mechanisms that develop under binding price ceilings are usually inefficient.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

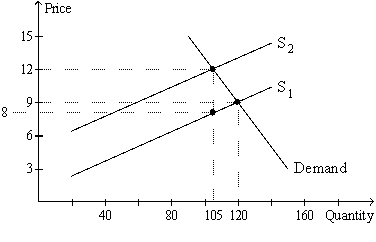

Figure 6-17

-Refer to Figure 6-17.Acme,Inc.is a seller of the good.Acme sells a unit of the good to a buyer and then pays the tax on that unit to the government.Acme is left with how much money?

-Refer to Figure 6-17.Acme,Inc.is a seller of the good.Acme sells a unit of the good to a buyer and then pays the tax on that unit to the government.Acme is left with how much money?

A) $8.00

B) $9.00

C) $10.50

D) $12.00

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the demand curve is very inelastic and the supply curve is very elastic in a market,then the sellers will bear a greater burden of a tax imposed on the market,even if the tax is imposed on the buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 557

Related Exams