A) price no longer serves as a rationing device.

B) the quantity supplied at the price floor exceeds the quantity that would have been supplied without the price floor.

C) only some sellers benefit.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

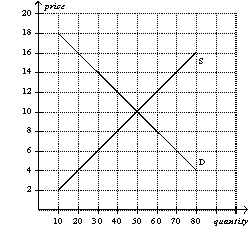

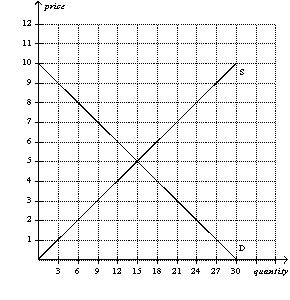

Figure 6-6

-Refer to Figure 6-6.If the government imposes a price ceiling of $8 on this market,then there will be

-Refer to Figure 6-6.If the government imposes a price ceiling of $8 on this market,then there will be

A) no shortage.

B) a shortage of 10 units.

C) a shortage of 20 units.

D) a shortage of 40 units.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

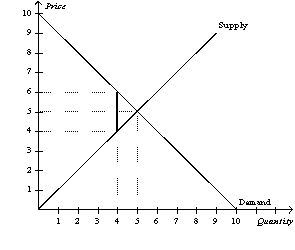

Figure 6-27

-Refer to Figure 6-27.If the government places a $2 tax in the market,the buyer bears $2 of the tax burden.

-Refer to Figure 6-27.If the government places a $2 tax in the market,the buyer bears $2 of the tax burden.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rent control

A) is an example of a price ceiling.

B) leads to a larger shortage of apartments in the long run than in the short run.

C) leads to lower rents and, in the long run, to lower-quality housing.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity sold in a market will decrease if the government decreases a

A) binding price floor in that market.

B) binding price ceiling in that market.

C) tax on the good sold in that market.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

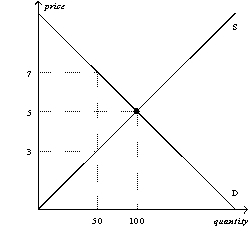

Figure 6-15

-Refer to Figure 6-15.Suppose a tax of $2 per unit is imposed on this market.How much will sellers receive per unit after the tax is imposed?

-Refer to Figure 6-15.Suppose a tax of $2 per unit is imposed on this market.How much will sellers receive per unit after the tax is imposed?

A) $3

B) between $3 and $5

C) between $5 and $7

D) $7

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

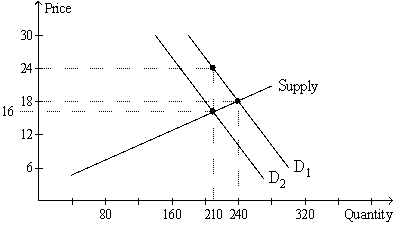

Figure 6-20

-Refer to Figure 6-20.The price paid by buyers after the tax is imposed is

-Refer to Figure 6-20.The price paid by buyers after the tax is imposed is

A) $24.

B) $21.

C) $18.

D) $16.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in a particular market,the supply curve is highly elastic and the demand curve is highly inelastic.If a tax is imposed in this market,then the

A) buyers will bear a greater burden of the tax than the sellers.

B) sellers will bear a greater burden of the tax than the buyers.

C) buyers and sellers are likely to share the burden of the tax equally.

D) buyers and sellers will not share the burden equally, but it is impossible to determine who will bear the greater burden of the tax without more information.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rent control

A) serves as an example of how a social problem can be alleviated or even solved by government policies.

B) serves as an example of a price ceiling.

C) is regarded by most economists as an efficient way of helping the poor.

D) is the most efficient way to allocate scarce housing resources.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a $2 tax on buyers of cigars and imposes the same $2 tax on sellers of cigars,then the price paid by buyers will

A) not change, and the price received by sellers will not change.

B) not change, and the price received by sellers will decrease.

C) decrease, and the price received by sellers will not change.

D) decrease, and the price received by sellers will decrease.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The imposition of a binding price floor on a market causes quantity demanded to be

A) greater than quantity supplied.

B) less than quantity supplied.

C) equal to quantity supplied.

D) Both a) and b) are possible.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-9

-Refer to Figure 6-9.At which price would a price ceiling be nonbinding?

-Refer to Figure 6-9.At which price would a price ceiling be nonbinding?

A) $2

B) $3

C) $4

D) $6

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

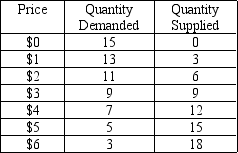

Table 6-3

The following table contains the demand schedule and supply schedule for a market for a particular good. Suppose sellers of the good successfully lobby Congress to impose a price floor $2 above the equilibrium price in this market.

-Refer to Table 6-3.Following the imposition of a price floor $2 above the equilibrium price,irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor.The resulting shortage is

-Refer to Table 6-3.Following the imposition of a price floor $2 above the equilibrium price,irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor.The resulting shortage is

A) 0 units.

B) 2 units.

C) 5 units.

D) 7 units.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

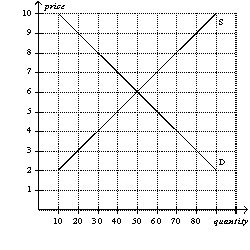

Figure 6-7

-Refer to Figure 6-7.Which of the following price controls would cause a surplus of 20 units of the good?

-Refer to Figure 6-7.Which of the following price controls would cause a surplus of 20 units of the good?

A) a price ceiling set at $4

B) a price ceiling set at $5

C) a price floor set at $7

D) a price floor set at $8

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the housing market,supply and demand are

A) more elastic in the short run than in the long run, and so rent control leads to a larger shortage of apartments in the short run than in the long run.

B) more elastic in the short run than in the long run, and so rent control leads to a larger shortage of apartments in the long run than in the short run.

C) more elastic in the long run than in the short run, and so rent control leads to a larger shortage of apartments in the short run than in the long run.

D) more elastic in the long run than in the short run, and so rent control leads to a larger shortage of apartments in the long run than in the short run.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a price ceiling of $2 per gallon is imposed on gasoline,and the market equilibrium price is $1.50,then the price ceiling is a binding constraint on the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

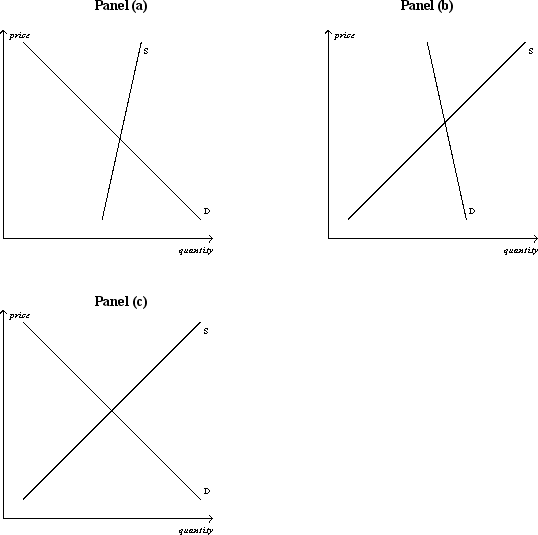

Figure 6-25

-Refer to Figure 6-25.In which market will the majority of the tax burden fall on sellers?

-Refer to Figure 6-25.In which market will the majority of the tax burden fall on sellers?

A) market (a)

B) market (b)

C) market (c)

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price received by sellers in a market will decrease if the government

A) increases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) decreases a tax on the good sold in that market.

D) None of the above is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the sellers of a product,buyers pay

A) more, and sellers receive more than they did before the tax.

B) more, and sellers receive less than they did before the tax.

C) less, and sellers receive more than they did before the tax.

D) less, and sellers receive less than they did before the tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of dog food,then

A) buyers will bear the entire burden of the tax.

B) sellers will bear the entire burden of the tax.

C) buyers and sellers will share the burden of the tax.

D) the government will bear the entire burden of the tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 501 - 520 of 557

Related Exams