A) triangle.

B) rectangle.

C) trapezoid.

D) None of the above is correct; government's tax revenue is the area between the supply and demand curves, above the horizontal axis, and below the effective price to buyers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct regarding a tax on a good and the resulting deadweight loss?

A) The greater are the price elasticities of supply and demand, the greater is the deadweight loss.

B) The greater is the price elasticity of supply and the smaller is the price elasticity of demand, the greater is the deadweight loss.

C) The smaller are the decreases in quantity demanded and quantity supplied, the greater the deadweight loss.

D) The smaller is the wedge between the effective price to sellers and the effective price to buyers, the greater is the deadweight loss.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10

![Figure 8-10 -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The deadweight loss of the tax is A) [ x (P0-P5) x Q5] + [ x (P5-0) x Q5]. B) [ x (P0-P2) x Q2] +[(P2-P8) x Q2] + [ x (P8-0) x Q2]. C) (P2-P8) x Q2. D) x (P2-P8) x (Q5-Q2) .](https://d2lvgg3v3hfg70.cloudfront.net/TB2185/11ea33e9_381d_ba09_ac7d_970eb44cd4df_TB2185_00_TB2185_00_TB2185_00_TB2185_00_TB2185_00_TB2185_00_TB2185_00_TB2185_00_TB2185_00_TB2185_00_TB2185_00.jpg) -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The deadweight loss of the tax is

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The deadweight loss of the tax is

A) [ ![]() x (P0-P5) x Q5] + [

x (P0-P5) x Q5] + [ ![]() x (P5-0) x Q5].

x (P5-0) x Q5].

B) [ ![]() x (P0-P2) x Q2] +[(P2-P8) x Q2] + [

x (P0-P2) x Q2] +[(P2-P8) x Q2] + [ ![]() x (P8-0) x Q2].

x (P8-0) x Q2].

C) (P2-P8) x Q2.

D) ![]() x (P2-P8) x (Q5-Q2) .

x (P2-P8) x (Q5-Q2) .

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefit that government receives from a tax is measured by

A) the change in the equilibrium quantity of the good.

B) the change in the equilibrium price of the good.

C) tax revenue.

D) total surplus.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the government imposes a $3 tax in a market,the buyers and sellers will share an equal burden of the tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

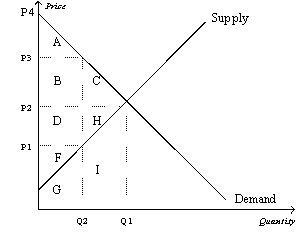

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.

-Refer to Figure 8-5.The tax causes a reduction in consumer surplus that is represented by area

-Refer to Figure 8-5.The tax causes a reduction in consumer surplus that is represented by area

A) A.

B) B+C.

C) C+H.

D) F.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on a good

A) gives buyers an incentive to buy more of the good than they otherwise would buy.

B) gives sellers an incentive to produce less of the good than they otherwise would produce.

C) creates a benefit to the government, the size of which exceeds the loss in surplus to buyers and sellers.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would likely have the smallest deadweight loss relative to the tax revenue?

A) a head tax (that is, a tax everyone must pay regardless of what one does or buys)

B) an income tax

C) a tax on compact discs

D) a tax on caviar

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Normally,both buyers and sellers of a good become worse off when the good is taxed.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

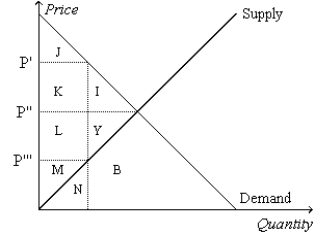

Figure 8-1

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The area measured by M represents

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The area measured by M represents

A) consumer surplus after the tax.

B) consumer surplus before the tax.

C) producer surplus after the tax.

D) producer surplus before the tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

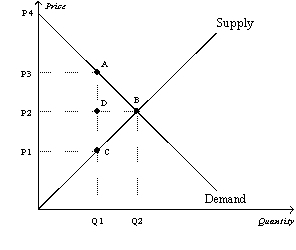

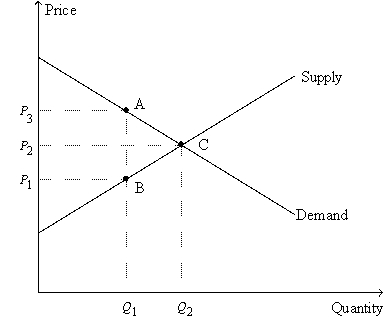

Figure 8-3

The vertical distance between points A and C represents a tax in the market.

-Refer to Figure 8-3.Which of the following equations is valid for the tax revenue that the tax provides to the government?

-Refer to Figure 8-3.Which of the following equations is valid for the tax revenue that the tax provides to the government?

A) Tax revenue = (P2 - P1) xQ1

B) Tax revenue = (P3 - P1) xQ1

C) Tax revenue = (P3 - P2) xQ1

D) Tax revenue = (P3 - P1) x(Q2 - Q1)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

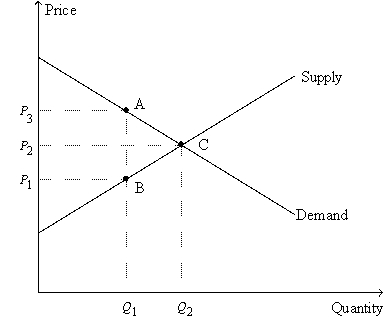

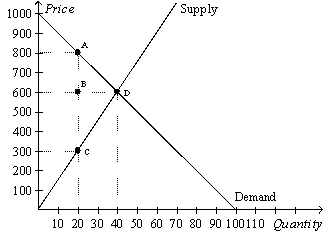

Figure 8-11

-Refer to Figure 8-11.Suppose Q₁ = 4; Q₂ = 7; P₁ = $6; P₂ = $8; and P₃ = $10.Then the deadweight loss of the tax is

-Refer to Figure 8-11.Suppose Q₁ = 4; Q₂ = 7; P₁ = $6; P₂ = $8; and P₃ = $10.Then the deadweight loss of the tax is

A) $6.

B) $8.

C) $9.

D) $12.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-11

-Refer to Figure 8-11.The price labeled as P₁ on the vertical axis represents the price

-Refer to Figure 8-11.The price labeled as P₁ on the vertical axis represents the price

A) received by sellers before the tax is imposed.

B) received by sellers after the tax is imposed.

C) paid by buyers before the tax is imposed.

D) paid by buyers after the tax is imposed.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $3.50 tax per gallon of paint placed on the sellers of paint will shift the supply curve

A) downward by exactly $3.50.

B) downward by less than $3.50.

C) upward by exactly $3.50.

D) upward by less than $3.50.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax shifts the demand curve downward (or to the left) ,we can infer that the tax was levied on

A) buyers of the good.

B) sellers of the good.

C) both buyers and sellers of the good.

D) We cannot infer anything because the shift described is not consistent with a tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As the price elasticities of supply and demand increase,the deadweight loss from a tax increases.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Social Security tax,and to a large extent,the federal income tax,are labor taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things equal,the deadweight loss of a tax

A) decreases as the size of the tax increases.

B) increases as the size of the tax increases, but the increase in the deadweight loss is less rapid than the increase in the size of the tax.

C) increases as the size of the tax increases, and the increase in the deadweight loss is more rapid than the increase in the size of the tax.

D) increases as the price elasticities of demand and/or supply increase, but the deadweight loss does not change as the size of the tax increases.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed on a good for which both demand and supply are very elastic,

A) sellers effectively pay the majority of the tax.

B) buyers effectively pay the majority of the tax.

C) the tax burden is equally divided between buyers and sellers.

D) None of the above is correct; further information would be required to determine how the burden of the tax is distributed between buyers and sellers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-9

The vertical distance between points A and C represent a tax in the market.

-Refer to Figure 8-9.The imposition of the tax causes the price received by sellers to decrease by

-Refer to Figure 8-9.The imposition of the tax causes the price received by sellers to decrease by

A) $20.

B) $200.

C) $300.

D) $500.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 424

Related Exams