A) punish crimes and enforce voluntary agreements but not to redistribute income.

B) redistribute income until each person has equal earnings.

C) redistribute income until the marginal utility of the wealthiest person equals the total utility of the poorest person.

D) redistribute income based on the assumption of diminishing marginal utility.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following groups has the highest poverty rate?

A) blacks

B) Asians

C) children (under age 18)

D) female households, no spouse present

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Since 1970 the United States' income distribution has become more equal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government enacts policies to redistribute income,

A) the objective is to enhance efficiency and a side effect is that the allocation of resources becomes more equal.

B) the objective is to enhance efficiency and a side effect is that the allocation of resources becomes less equal.

C) the objective is to enhance equality and a side effect is that the allocation of resources becomes more efficient.

D) the objective is to enhance equality and a side effect is that the allocation of resources becomes less efficient.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Less than three percent of families are categorized as poor for eight years or more.

B) In the United States, the grandson of a millionaire is much more likely to be rich than the grandson of an average-income person.

C) The majority of millionaires in the United States inherited their wealth.

D) Most workers have about the same income (adjusted for inflation) when they are young as when they are middle-aged.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The maximin criterion suggests that social policy should

A) expropriate the factors of production from the capitalist class.

B) ensure an equal distribution of income.

C) elevate the well-being of those at the bottom of the income distribution.

D) elevate the well-being of all workers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past 50 years,the U.S.poverty rate was at its lowest level in

A) 1973.

B) 1980.

C) 1990.

D) 2008.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

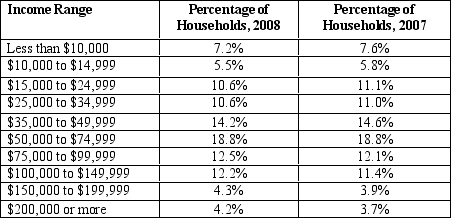

Table 20-6

-Refer to Table 20-6.In both 2007 and 2008,approximately 25% of the population earned less than

-Refer to Table 20-6.In both 2007 and 2008,approximately 25% of the population earned less than

A) $15,000.

B) $25,000.

C) $50,000.

D) $100,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-3 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/3 of income) - $15,000 -Refer to Scenario 20-3.Below what level of income would families start to receive a subsidy from this negative income tax?

A) $15,000

B) $30,000

C) $45,000

D) $60,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on U.S.income data from 2008,the bottom fifth of all families received approximately what percent of all income?

A) 48 percent

B) 21 percent

C) 10 percent

D) 4 percent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

One existing government program that works much like a negative income tax is the Earned Income Tax Credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Government vouchers to purchase food,also known as food stamps,are an example of

A) an in-kind transfer.

B) life-cycle income.

C) a negative income tax.

D) permanent income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The life cycle effect characterizes a lifetime income profile in which income

A) tends to follow a seasonal pattern.

B) rises as a worker gains maturity and experience.

C) rises and falls in conjunction with the business cycle.

D) falls during the early years of market activity and peaks at retirement.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Libertarians believe that the government should enforce individual rights to ensure that all people have the same opportunities to use their talents to achieve success.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-3 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/3 of income) - $15,000 -Refer to Scenario 20-3.A family earning $60,000 before taxes would have how much after-tax income?

A) $5,000

B) $15,000

C) $55,000

D) $65,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In the United States in 2008,the bottom fifth of the income distribution had incomes below $19,250.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because people can borrow when they are young,the life cycle theory would suggest that one's standard of living depends on

A) lifetime income rather than annual income.

B) aggregate income rather than annual personal income.

C) annual extended-family income rather than annual personal income.

D) income averaged across seasons rather than across years.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A government's policy of redistributing income makes the income distribution

A) more equal, distorts incentives, alters behavior, and makes the allocation of resources more efficient.

B) more equal, distorts incentives, alters behavior, and makes the allocation of resources less efficient.

C) less equal, distorts incentives, alters behavior, and makes the allocation of resources more efficient.

D) less equal, distorts incentives, alters behavior, and makes the allocation of resources less efficient.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Binding minimum-wage laws

A) are most effective at alleviating poverty when labor demand is highly elastic.

B) force a market imbalance between the supply and demand for labor.

C) increase the efficiency of labor markets.

D) are typically associated with a rise in employment among the poor.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Since the early 1970s,welfare benefits have declined,

A) which is largely due to the success of the negative income tax program.

B) which is largely due to the success of private charities.

C) yet the percentage of children living with only one parent has increased.

D) and the percentage of children living with only one parent has decreased.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 374

Related Exams