A) has gradually become more equal over the entire time period.

B) has gradually become less equal over the entire time period.

C) gradually became less equal until about 1970, then became more equal from 1970 to 2008.

D) gradually became more equal until about 1970, then became less equal from 1970 to 2008.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liberalism is the political philosophy espoused by

A) Robert Nozick.

B) John Stuart Mill.

C) John Rawls.

D) Jeremy Bentham.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 20-9

Poverty Thresholds in 2002, by Size of Family and Number of Related Children Under 18 Years

[Dollars]

![Table 20-9 Poverty Thresholds in 2002, by Size of Family and Number of Related Children Under 18 Years [Dollars] Source: U. S. Bureau of the Census, Current Population Survey. -Refer to Table 20-9.What is the poverty line for a family of eight with two children? A) $14,494 B) $32,812 C) $33,121 D) $34,780](https://d2lvgg3v3hfg70.cloudfront.net/TB2185/11ea33e9_388d_e064_ac7d_d3b8556c5ada_TB2185_00_TB2185_00_TB2185_00_TB2185_00_TB2185_00_TB2185_00.jpg) Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-9.What is the poverty line for a family of eight with two children?

Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-9.What is the poverty line for a family of eight with two children?

A) $14,494

B) $32,812

C) $33,121

D) $34,780

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A negative income tax system would

A) make taxes more regressive.

B) sever the link between tax policy and income distribution.

C) collect from high-income households and give transfers to low-income households.

D) eliminate progressive tax rates.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a question that economists try to answer when measuring the distribution of income?

A) How many people live in poverty?

B) How often do people receive a raise at work?

C) How often do people move among income classes?

D) What problems arise in measuring the amount of inequality?

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Only individual members of society earn income,not society itself." This statement is most closely associated with the political philosophy of a

A) utilitarian.

B) liberal.

C) libertarian.

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic mobility in the United States is so great that fewer than

A) 3 percent of families are poor for 8 or more years.

B) 5 percent of families are poor for 8 or more years.

C) 8 percent of families are poor for 8 or more years.

D) 10 percent of families are poor for 8 or more years.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In comparison to the average poverty rate,

A) children and the elderly are more likely to be poor.

B) children and the elderly are less likely to be poor.

C) children are more likely to be poor, but the elderly are less likely to be poor.

D) children are less likely to be poor, but the elderly are more likely to be poor.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Critics argue that a disadvantage of the Earned Income Tax Credit is that it does not effectively target the working poor because many recipients are the teenage children of middle-income families.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S.government determines that the cost of feeding an urban family of six is $6,000 per year,then the official poverty line for a family of that type is

A) $6,000.

B) $12,000.

C) $18,000.

D) $36,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The study by economists Cox and Alm found

A) inequality in consumption is much smaller than inequality in annual income.

B) inequality in consumption is slightly smaller than inequality in annual income.

C) inequality in consumption is slightly larger than inequality in annual income.

D) inequality in consumption is much larger than inequality in annual income.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The goal of utilitarians is to

A) apply the logic of individual decision making to questions concerning morality and public policy.

B) measure happiness and satisfaction.

C) redistribute income based on the assumption of increasing marginal utility.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The philosopher John Rawls argued that

A) people would choose a more equal distribution of income if they had to determine an economic distribution system before knowing their place in it.

B) people would choose income inequality to allow the maximum use of their individual talents.

C) government has a role to ensure income equality to prevent social unrest.

D) people would choose equal opportunity because it is morally right.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum wage laws

A) benefit all unskilled workers.

B) create unemployment, but if demand is relatively elastic, the unemployment effects will be minor.

C) may help the nonpoor, such as teenagers from wealthy families.

D) reduce poverty by reducing unemployment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the maximin criterion,income should be transferred from the rich to the poor as long as it

A) raises the well-being of the least fortunate.

B) does not alter incentives to work and save.

C) promotes an equal distribution of income.

D) does not lower the welfare of the elderly.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of the Earned Income Tax Credit (EITC) ?

A) It does not discourage recipients from working.

B) It is less distortionary than other anti-poverty programs.

C) It helps the disabled who cannot work.

D) It applies only to the working poor.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) Libertarians are opposed to redistributing income.

B) Critics of the welfare system argue that it breaks up families.

C) One of the problems with measuring income inequality is valuing in-kind transfers.

D) Utilitarians believe that the government should punish crimes but should not redistribute income.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

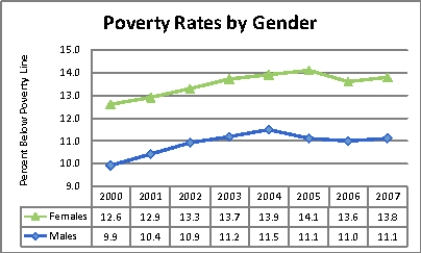

Figure 20-3

Panel A

Source: U.S. Bureau of the Census

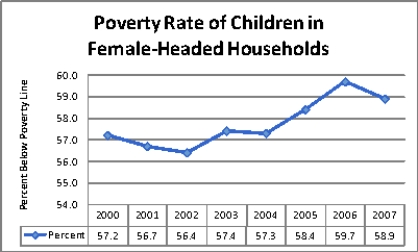

Panel B

Source: U.S. Bureau of the Census

Panel B

Source: U.S. Bureau of the Census

-Refer to Figure 20-3.Panel B focuses on children who live in female-headed households.It illustrates the percentage of those children who live in poverty.For example,in 2000,slightly over 57 percent of all children who lived in a female-headed household lived below the poverty line.How is this information related to the graph illustrated in Panel A?

Source: U.S. Bureau of the Census

-Refer to Figure 20-3.Panel B focuses on children who live in female-headed households.It illustrates the percentage of those children who live in poverty.For example,in 2000,slightly over 57 percent of all children who lived in a female-headed household lived below the poverty line.How is this information related to the graph illustrated in Panel A?

A) The high prevalence of poverty in households headed by women is inversely related to male poverty rates.

B) The poverty rates shown in Panel B are found by multiplying the female poverty rates shown in Panel A by 450%.

C) The high prevalence of poverty in households headed by women likely explains why female poverty rates are higher than male poverty rates.

D) Both b and c are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) An advantage of the Earned Income Tax Credit (EITC) is that it targets the working poor better than the minimum wage because it does not benefit teenagers from middle-class families who work summer jobs at the minimum wage.

B) A disadvantage of in-kind transfer programs such as food stamps is that they force recipients to purchase from a restricted set of items which may not include things that the poor need the most such as diapers or cleaning supplies.

C) A disadvantage of minimum wage laws is that they are expensive for state and local governments to fund.

D) Effective minimum wage laws create a surplus of labor.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A disadvantage of a minimum-wage law is that it may benefit unskilled workers who are not low-income workers.

B) A disadvantage of a negative income tax program is that a poor person who chooses not to work many hours would receive a cash benefit.

C) A disadvantage of an Earned Income Tax Credit (EITC) is that a person who is unable to work due to a disability does not benefit from the program.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 374

Related Exams