Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 132

Multiple Choice

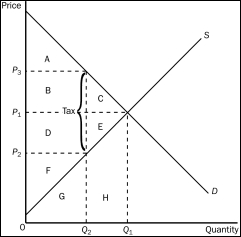

Figure 8-4

-Refer to Figure 8-4.After the tax is levied,consumer surplus is represented by area

-Refer to Figure 8-4.After the tax is levied,consumer surplus is represented by area

A) a.

B) A + B + C.

C) D + E + F.

D) F.

E) A) and B)

F) None of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Question 133

Multiple Choice

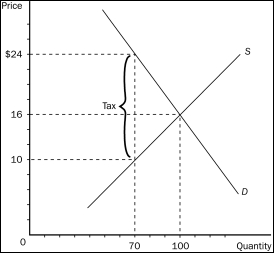

Figure 8-3

-Refer to Figure 8-3.The amount of deadweight loss as a result of the tax is

-Refer to Figure 8-3.The amount of deadweight loss as a result of the tax is

A) $210.

B) $420.

C) $560.

D) $980.

E) A) and C)

F) C) and D)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Question 134

Multiple Choice

Which U.S.president lost his bid for re-election,in part because he had broken an earlier campaign promise to refrain from imposing any new taxes?

A) Lyndon B.Johnson

B) Jimmy Carter

C) George H.W.Bush

D) Bill Clinton

E) A) and B)

F) B) and D)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Question 135

True/False

If the size of a tax doubles,the deadweight loss rises by a factor of six.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Showing 241 - 245 of 245

Related Exams