A) Dexter's level of satisfaction increases by more when his wealth increases from $1,001 to $1,002 than it does when his wealth increases from $1,000 to $1,001.

B) Dexter's level of satisfaction increases by less when his wealth increases from $1,001 to $1,002 than it does when his wealth increases from $1,000 to $1,001.

C) Dexter's level of satisfaction increases by the same amount when his wealth increases from $1,001 to $1,002 as it does when his wealth increases from $1,000 to $1,001.

D) None of the above answers can be inferred from the appearance of the utility function.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Available evidence indicates that stock prices, even if not exactly a random walk, are very close to a random walk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the present value of a payment of $100 to be made one year from today if the interest rate is 5 percent?

A) $105.26

B) $105.00

C) $95.24

D) $95.00

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ben decided to increase the number of stocks in his portfolio. In doing so, Ben reduced

A) both the firm-specific risk and the market risk of his portfolio.

B) the firm-specific risk, but not the market risk of his portfolio.

C) the market risk, but not the firm-specific risk of his portfolio.

D) neither the market risk nor the firm-specific risk of his portfolio.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

James offers you $1,000 today or $X in 7 years. If the interest rate is 4.5 percent, then you would prefer to take the $1,000 today if and only if

A) X < 1,045.00.

B) X < 1,188.89.

C) X < 1,266.67.

D) X < 1,360.86.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your accountant tells you that if you can continue to earn the current interest rate on your balance of $500 for ten years, you will have about $983.58. If your accountant is correct, what is the current rate of interest?

A) 5 percent

B) 6 percent

C) 7 percent

D) 8 percent

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The rule of 70 applies to a growing savings account but not to a growing economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To diversify, a homeowner with a variable-rate mortgage should choose investments that

A) pay higher returns when interest rates rise and lower returns when interest rates fall.

B) pay lower returns when interest rates rise and higher returns when interest rates fall.

C) provide a higher return than the market average.

D) provide a lower return than the market average.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the efficient market hypothesis is correct, then

A) index funds should typically beat managed funds, and usually do.

B) index fund should typically beat managed funds, but usually do not.

C) mutual funds should typically beat index funds, and usually do.

D) mutual funds should typically beat index funds, but usually do not.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Thom experiences a greater loss in utility if he loses $50 than he would gain in utility if he wins $50. This implies that Thom's

A) marginal utility diminishes as wealth rises, so he must be risk averse.

B) marginal utility diminishes as wealth rises, but we can't tell from this if he is risk averse.

C) marginal utility increases as wealth rises, so he must be risk averse.

D) marginal utility increases as wealth rises, but we can't tell from this if he is risk averse.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Imagine that someone offers you $X today or $1,500 in 5 years. If the interest rate is 6 percent, then you would prefer to take the $X today if and only if

A) X > 1,055.56.

B) X > 1,120.89.

C) X > 1,213.33.

D) X > 1,338.26.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

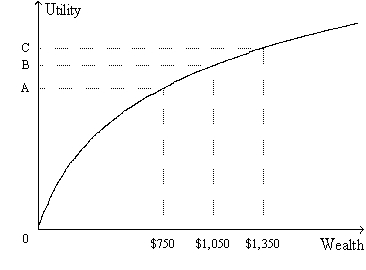

Figure 14-2. The figure shows a utility function for Mary Ann.  -Refer to Figure 14-2. From the appearance of the utility function, we know that

-Refer to Figure 14-2. From the appearance of the utility function, we know that

A) Mary Ann is risk averse.

B) Mary Ann gains more satisfaction when her wealth increases by X dollars than she loses in satisfaction when her wealth decreases by X dollars.

C) the property of increasing marginal utility applies to Mary Ann.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you put $300 into an account paying 2 percent interest, what will be the value of this account in 4 years?

A) $320.69

B) $324.00

C) $324.73

D) $327.81

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of a bond is equal to the sum of the present values of its future payments. Suppose a certain bond pays $50 one year from today and $1,050 two years from today. What is the price of the bond if the interest rate is 5 percent?

A) $1,050.00

B) $1,045.35

C) $1,000.00

D) $945.35

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Managed mutual funds usually outperform mutual funds that are supposed to follow some stock index.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the rule of 70, if a person's saving doubles in 10 years, what interest rate were they earning?

A) 3.5

B) 7

C) 14

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $79.50 one year from today equal to $75 today?

A) 4 percent

B) 5 percent

C) 6 percent

D) 7 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If stock prices follow a random walk, it means

A) long periods of declining prices are followed by long periods of rising prices.

B) the greater the number of consecutive days of price declines, the greater the probability prices will increase the following day.

C) stock prices are unrelated to random events that shock the economy.

D) stock prices are just as likely to rise as to fall at any given time.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a stock or bond is risky

A) risk averse people may be willing to hold it as part of a diversified portfolio.

B) risk averse people may be willing to hold it if the expected return is high enough.

C) both A and B are correct.

D) risk averse people will not hold it.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The efficient markets hypothesis says that

A) only individual investors can make money in the stock market.

B) it should be easy to find stocks whose price differs from their fundamental value.

C) stock prices follow a random walk.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 419

Related Exams