A) a sales tax.

B) an excise tax.

C) a retail tax.

D) an income tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true about government spending on national defense?

A) It is the second-largest spending category for the U.S.federal government.

B) It includes salaries of military personnel.

C) It fluctuates over time as the political climate changes.

D) It is not financed with tax revenue.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If transfer payments are included when evaluating tax burdens,then the average tax rate of the poorest quintile of taxpayers would be approximately

A) negative 30 percent.

B) negative 10 percent.

C) positive 1 percent.

D) positive 8 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following in not a reason that a lump-sum tax imposes a minimal administrative burden on taxpayers?

A) Everyone can easily compute the amount of tax owed.

B) There is no benefit to hiring an accountant to do your taxes.

C) Everyone owes the same amount of tax,regardless of earnings.

D) The government can easily forecast tax revenues.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martavius faces a progressive federal income tax structure that has the following marginal tax rates: 0 percent on the first $10,000,10 percent on the next $10,000,15 percent on the next $10,000,25 percent on the next $10,000,and 50 percent on all additional income.In addition,he must pay 5 percent of his income in state income tax and 15.3 percent of his labor income in federal payroll taxes.Marcus earns $70,000 per year in salary and another $20,000 per year in non-labor income.What is his average tax rate,and what is his marginal tax rate on his salary?

A) His average tax rate is 17.19 percent,and the marginal tax rate on his salary is 55 percent.

B) His average tax rate is 50.23 percent,and the marginal tax rate on his salary is 70.3 percent.

C) His average tax rate is 53.63 percent,and the marginal tax rate on his salary is 70.3 percent.

D) His average tax rate is 55.79 percent,and the marginal tax rate on his salary is 70.3 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes on specific goods such as cigarettes,gasoline,and alcoholic beverages are called

A) sales taxes.

B) excise taxes.

C) social insurance taxes.

D) consumption taxes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Most economists believe that a corporate income tax affects the stockholders of a corporation but not its employees or customers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

According to the ability-to-pay principle,it is fair for people to pay taxes based on the amount of government services that they receive.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most common explanation for Social Security payments accounting for a larger share of federal government expenditures is

A) increases in life expectancy.

B) people becoming eligible for Social Security benefits at an earlier age.

C) increases in birth rates among teenagers and the poor.

D) falling payroll tax receipts.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the marginal tax rate equals the average tax rate,the tax is

A) proportional.

B) progressive.

C) regressive.

D) egalitarian.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1789,the average American paid approximately what percent of income in taxes?

A) 5%

B) 15%

C) 33%

D) 50%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-3.A taxpayer faces the following tax rates on her income: 20 percent of the first $40,000 of her income; 30 percent of all her income above $40,000. -Refer to Scenario 12-3.The taxpayer faces

A) a marginal tax rate of 20 percent when her income rises from $40,000 to $40,001.

B) a marginal tax rate of 20 percent when her income rises from $30,000 to $30,001.

C) a marginal tax rate of 0 percent when her income rises from $30,000 to $30,001.

D) a marginal tax rate of 10 percent when her income rises from $40,000 to $40,001.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

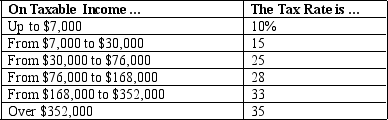

Table 12-1

-Refer to Table 12-1.If Andrea has $85,000 in taxable income,her tax liability is

-Refer to Table 12-1.If Andrea has $85,000 in taxable income,her tax liability is

A) $12,750.

B) $18,170.

C) $21,250.

D) $23,800.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the government taxes income in the following fashion: 30 percent of the first $20,000,50 percent of the next $30,000,and 60 percent of all income over $50,000.George earns $40,000,and Elaine earns $60,000.Which of the following statements is correct?

A) George's marginal tax rate is 60 percent,and his average tax rate is 50 percent.

B) George's marginal tax rate is 50 percent,and his average tax rate is 40 percent.

C) Elaine's marginal tax rate is 50 percent,and her average tax rate is 45 percent.

D) Elaine's marginal tax rate is 60 percent,and her average tax rate is 40 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Who pays a corporate income tax?

A) Owners of the corporation

B) Customers of the corporation

C) Workers of the corporation

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a tax of 10 percent on the first $40,000 of income and 20 percent on all income above $40,000.What are the tax liability and the marginal tax rate for a person whose income is $50,000?

A) 12 percent and 20 percent,respectively

B) 12 percent and $50,000,respectively

C) $6,000 and 12 percent,respectively

D) $6,000 and 20 percent,respectively

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

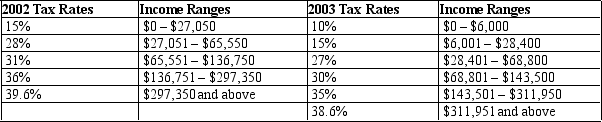

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Samantha is a single person whose taxable income is $100,000 a year.What happened to her average tax rate between 2002 and 2003?

-Refer to Table 12-12.Samantha is a single person whose taxable income is $100,000 a year.What happened to her average tax rate between 2002 and 2003?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If all taxpayers pay the same percentage of income in taxes,the tax system is progressive.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Resources devoted to complying with the tax laws are a type of deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The flypaper theory of tax incidence

A) ignores the indirect effects of taxes.

B) assumes that most taxes should be "stuck on " the rich.

C) says that once a tax has been imposed,there is little chance of it changing,so in essence people are stuck with it.

D) suggests that taxes are like flies because they are everywhere and will never go away.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 341 - 360 of 397

Related Exams