A) utilitarian.

B) liberal.

C) libertarian.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

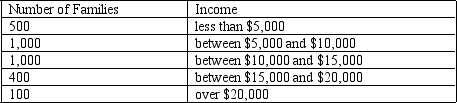

The distribution of income for Grim is as follows:

Where would the government in Grim set the poverty line to establish a poverty rate of 50 percent?

Where would the government in Grim set the poverty line to establish a poverty rate of 50 percent?

A) $5,000.

B) $10,000.

C) $15,000.

D) $20,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The philosopher John Rawls argued that

A) people would choose a more equal distribution of income if they had to determine an economic distribution system before knowing their place in it.

B) people would choose income inequality to allow the maximum use of their individual talents.

C) government has a role to ensure income equality to prevent social unrest.

D) people would choose income equality because it is morally right.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

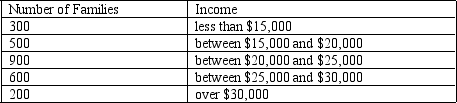

The poverty line in the country of Abbyville is $15,000.The distribution of income for Abbyville is as follows:

The poverty rate in Abbyville is

The poverty rate in Abbyville is

A) 12 percent.

B) 32 percent.

C) 50 percent.

D) 68 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Libertarians believe that the government should enforce individual rights to ensure that all people have the same opportunities to use their talents to achieve success.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many Democrats who campaigned in the 2006 elections supported raising the U.S.minimum wage.Supporters of raising the minimum wage argue that minimum-wage laws are

A) a tax-free way to help the working poor;after all,business bear the burden of paying higher wages,not the government.

B) better that the Earned Income Tax Credit (EITC) in targeting the working poor;after all,the EITC may benefit teenagers from middle-class families who work summer jobs at the minimum wage.

C) better than in-kind transfers such as food stamps in providing food rather than unhealthy items such as drugs or alcohol.

D) a way to increase employment of those likely to make the minimum wage.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic mobility in the United States is

A) uncommon.Over 50 percent of poor families remain poor for 8 or more years.

B) uncommon.Over 75 percent of poor families remain poor for 8 or more years.

C) common.Fewer than 3 percent of poor families remain poor for 8 or more years.

D) common.Fewer than 1 percent of poor families remain poor for 8 or more years.

F) None of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Data for the United States suggests that about how many millionaires inherited their fortunes?

A) One in seven.

B) One in five.

C) One in three.

D) One in two.

F) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Scenario 20-1 Suppose that a society is made up of five families whose incomes are as follows: $120,000;$90,000;$30,000;$30,000;and $18,000. The federal government is considering two potential income tax plans: Plan A is a negative income tax plan where the taxes owed equal 1/3 of income minus $20,000. Plan B is a two-tiered plan where the poverty line is $35,000;families earning over $35,000 pay 10% of their income in taxes,and families earning less than $35,000 pay no income tax. -Refer to Scenario 20-1.Assuming that utility is directly proportional to the cash value of after-tax income,which government policy would an advocate of liberalism prefer?

A) Plan A

B) Plan B

C) either Plan A or Plan B

D) neither Plan A nor Plan B because any plan that forcibly redistributes income is against the philosophy

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty line is adjusted each year to reflect changes in the

A) number of people currently on public assistance.

B) level of prices.

C) nutritional content of an "adequate" diet.

D) size of a family.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because people can borrow when they are young,the life cycle theory would suggest that one's standard of living depends on

A) lifetime income rather than annual income.

B) aggregate income rather than annual personal income.

C) annual extended family income rather than annual personal income.

D) income averaged across seasons rather than across years.

F) B) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Suppose that income is subject to increasing marginal utility.From a utilitarian perspective,

A) some income redistribution from rich to poor would increase social welfare.

B) some income redistribution from poor to rich would increase social welfare.

C) any income redistribution would probably reduce social welfare.

D) any income redistribution would probably increase social welfare.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The distribution of annual income accurately reflects the distribution of living standards.

B) Permanent incomes are more equally distributed than annual incomes.

C) Transitory changes in income generally have a significant impact on a family's standard of living.

D) Annual income is more equally distributed than permanent income.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Although globalization has reduced income inequality,the number of people living in extreme poverty has remained unchanged.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

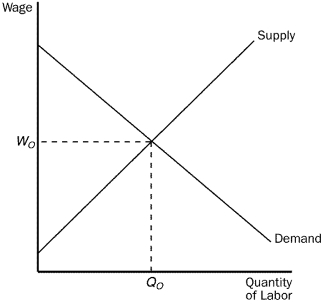

Figure 20-3  -Refer to Figure 20-3.If the government imposes a minimum wage above Wo,it is likely to

-Refer to Figure 20-3.If the government imposes a minimum wage above Wo,it is likely to

A) increase employment to a level above Qo.

B) reduce employment to a level below Qo.

C) provide more income to the working poor than they collectively received before the minimum wage was set.

D) have no effect on employment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The invisible hand of the marketplace acts to allocate resources efficiently,but it does not necessarily ensure that resources are allocated fairly.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following formulas is most representative of a negative income tax proposal?

A) Taxes Owed = (1/4 of Income) *$2

B) Taxes Owed = (1/2 of Income) *3/4

C) Taxes Owed = (1/2 of Income) + $10,000

D) Taxes Owed = (1/3 of Income) - $10,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A society consists of three individuals: Arthur,Billie,and Chris.In terms of income and utility,Arthur is currently best-off,Billie ranks in the middle,and Chris is worst-off.Which of the following statements is correct?

A) Utilitarianism suggests that government policies should strive to maximize Billie's utility.

B) Liberalism suggests that government policies should strive to maximize Chris's utility.

C) Libertarianism suggests that government policies should strive to maximize Arthur's utility.

D) Mobilism suggests that government policies should strive to make Chris better off than Billie.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poor families are eligible for financial assistance,without having to demonstrate any additional "need,"

A) under the current welfare system and under a negative income tax.

B) under the current welfare system but not under a negative income tax.

C) under a negative income tax but not under the current welfare system.

D) under neither the current welfare system nor under a negative income tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For which of the following programs can a person qualify solely by having a low income?

A) both Temporary Assistance for Needy Families (TANF) and Supplemental Security Income (SSI)

B) Temporary Assistance for Needy Families (TANF) but not Supplemental Security Income (SSI)

C) Supplemental Security Income (SSI) but not Temporary Assistance for Needy Families (TANF)

D) neither Temporary Assistance for Needy Families (TANF) nor Supplemental Security Income (SSI)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 312

Related Exams