B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

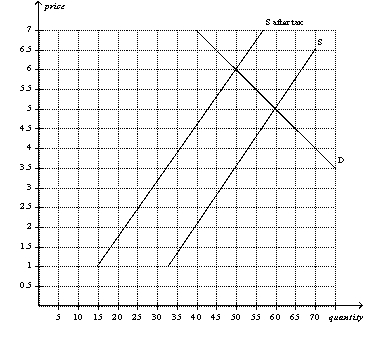

Figure 6-18  -Refer to Figure 6-18.Suppose the same supply and demand curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the buyers of the good,rather than the sellers,are required to pay the tax to the government.After the buyers pay the tax,relative to the case depicted in the figure,the burden on buyers will be

-Refer to Figure 6-18.Suppose the same supply and demand curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the buyers of the good,rather than the sellers,are required to pay the tax to the government.After the buyers pay the tax,relative to the case depicted in the figure,the burden on buyers will be

A) larger,and the burden on sellers will be smaller.

B) smaller,and the burden on sellers will be larger.

C) the same,and the burden on sellers will be the same.

D) The relative burdens in the two cases cannot be determined without further information.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The goal of rent control is to

A) facilitate controlled economic experiments in urban areas.

B) help landlords by assuring them a low vacancy rate for their apartments.

C) help the poor by assuring them an adequate supply of apartments.

D) help the poor by making housing more affordable.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on golf clubs will cause buyers of golf clubs to pay a higher price,sellers of golf clubs to receive a lower price,and fewer golf clubs to be sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax burden falls more heavily on the side of the market that

A) has a fewer number of participants.

B) is more inelastic.

C) is closer to unit elastic.

D) is less inelastic.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

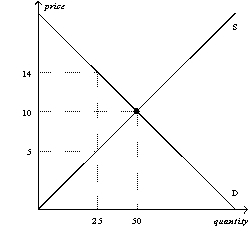

Figure 6-16  -Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.How much will buyers pay per unit after the tax is imposed?

-Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.How much will buyers pay per unit after the tax is imposed?

A) $5

B) between $5 and $10

C) between $10 and $14

D) $14

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The burden of a luxury tax falls

A) more on the rich than on the middle class.

B) more on the poor than on the rich.

C) more on the middle class than on the rich.

D) equally on the rich,the middle class,and the poor.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a nonbinding price ceiling is imposed on a market,then the

A) quantity sold in the market will decrease.

B) quantity sold in the market will stay the same.

C) price in the market will increase.

D) price in the market will decrease.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

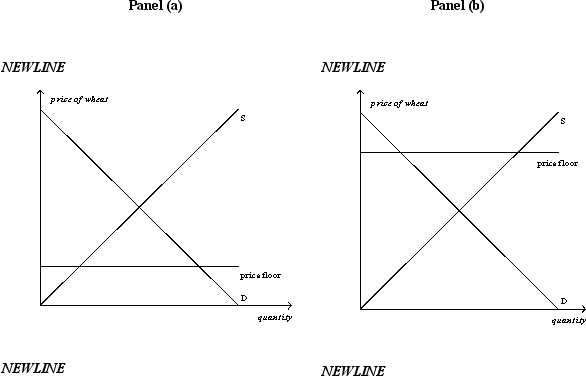

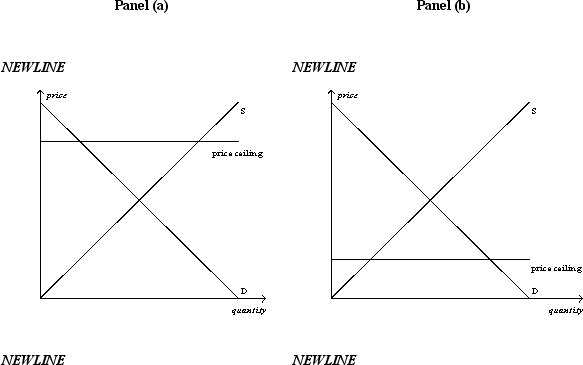

Figure 6-3

-Refer to Figure 6-3.A binding price floor is shown in

-Refer to Figure 6-3.A binding price floor is shown in

A) both panel (a) and panel (b) .

B) panel (a) only.

C) panel (b) only.

D) neither panel (a) nor panel (b) .

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling set below the equilibrium price is nonbinding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One economist has argued that rent control is "the best way to destroy a city,other than bombing." Why would an economist say this?

A) He fears that low rents will cause low-income people to move into the city,reducing the quality of life for other people.

B) He fears that rent control will benefit landlords at the expense of tenants,increasing inequality in the city.

C) He fears that rent controls will cause a construction boom,which will make the city crowded and more polluted.

D) He fears that rent control will eliminate the incentive to maintain buildings,leading to a deterioration of the city.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

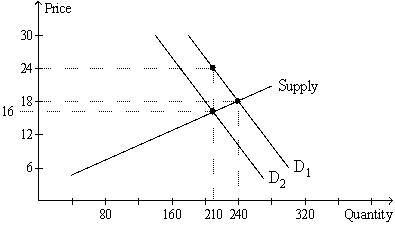

Figure 6-20  -Refer to Figure 6-20.The per-unit burden of the tax on buyers of the good is

-Refer to Figure 6-20.The per-unit burden of the tax on buyers of the good is

A) $2.

B) $4.

C) $6.

D) $8.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a payroll tax is enacted,the wage received by workers

A) falls,and the wage paid by firms rises.

B) falls,and the wage paid by firms falls.

C) rises,and the wage paid by firms falls.

D) rises,and the wage paid by firms rises.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-1

-Refer to Figure 6-1.The price ceiling shown in panel (b)

-Refer to Figure 6-1.The price ceiling shown in panel (b)

A) is not binding.

B) creates a surplus.

C) creates a shortage.

D) Both a) and b) are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $1,000 tax per boat on sellers of boats,then the price paid by buyers of boats would

A) increase by more than $1,000.

B) increase by exactly $1,000.

C) increase by less than $1,000.

D) decrease by an indeterminate amount.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Regardless of whether a tax is levied on sellers or buyers,taxes discourage market activity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buyers of a good bear the larger share of the tax burden when the (i) supply is more elastic than the demand for the product. (ii) demand in more elastic than the supply for the product. (iii) tax is placed on the sellers of the product. (iv) Tax is placed on the buyers of the product.

A) (i) only

B) (ii) only

C) (i) and (iii) only

D) (i) and (iv) only

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Policymakers use taxes

A) to raise revenue for public purposes but not to influence market outcomes.

B) both to raise revenue for public purposes and to influence market outcomes.

C) when they realize that price controls alone are insufficient to correct market inequities.

D) only in those markets in which the burden of the tax falls clearly on the sellers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Taxes levied on sellers and taxes levied on buyers are equivalent.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the equilibrium price of an airline ticket is $400 and the government imposes a price floor of $500 on airline tickets,then fewer airline tickets will be sold than at the market equilibrium.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 553

Related Exams