A) increase,and the quantity sold in the market will increase.

B) increase,and the quantity sold in the market will decrease.

C) decrease,and the quantity sold in the market will increase.

D) decrease,and the quantity sold in the market will decrease.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers shifts the demand curve to the right.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A price floor is a legal minimum on the price at which a good or service can be sold.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage may not help all workers,but it does not hurt any workers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price paid by buyers in a market will increase if the government

A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) decreases a tax on the good sold in that market.

D) imposes a binding price ceiling in that market.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Congress intended that

A) the entire FICA tax be paid by workers.

B) the entire FICA tax be paid by firms.

C) one-quarter of the FICA tax be paid by workers,and three-quarters be paid by firms.

D) half the FICA tax be paid by workers,and half be paid by firms.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government has imposed a price floor on the market for soybeans.Which of the following events could transform the price floor from one that is not binding into one that is binding?

A) Farmers use improved,draught-resistant seeds,which lowers the cost of growing soybeans.

B) The number of farmers selling soybeans decreases.

C) Consumers' income increases,and soybeans are a normal good.

D) The number of consumers buying soybeans increases.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When government imposes a price ceiling or a price floor on a market,

A) price no longer serves as a rationing device.

B) efficiency in the market is enhanced.

C) shortages and surpluses are eliminated.

D) both buyers and sellers become better off.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

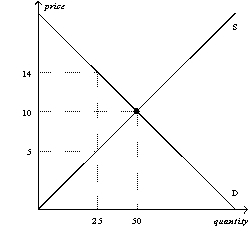

Figure 6-16  -Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.What will be the new equilibrium quantity in this market?

-Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.What will be the new equilibrium quantity in this market?

A) less than 25 units

B) 25 units

C) between 25 units and 50 units

D) greater than 50 units

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In an unregulated labor market,the wage adjusts to balance labor supply and labor demand.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax imposed on the buyers of a good will

A) raise both the price buyers pay and the effective price sellers receive.

B) raise the price buyers pay and lower the effective price sellers receive.

C) lower the price buyers pay and raise the effective price sellers receive.

D) lower both the price buyers pay and the effective price sellers receive.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price paid by buyers in a market will decrease if the government

A) increases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) decreases a tax on the good sold in that market.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

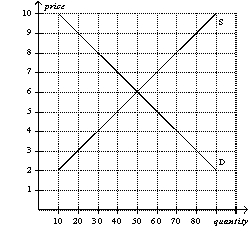

Figure 6-7  -Refer to Figure 6-7.For a price floor to be binding in this market,it would have to be set at

-Refer to Figure 6-7.For a price floor to be binding in this market,it would have to be set at

A) any price below $6.

B) a price between $3 and $6.

C) a price between $6 and $9.

D) any price above $6.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You receive a paycheck from your employer,and your pay stub indicates that $400 was deducted to pay the FICA (Social Security/Medicare) tax.Which of the following statements is correct?

A) This type of tax is an example of a payback tax.

B) Your employer is required by law to pay $400 to match the $400 deducted from your check.

C) The $400 that you paid is the true burden of the tax that falls on you,the employee.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

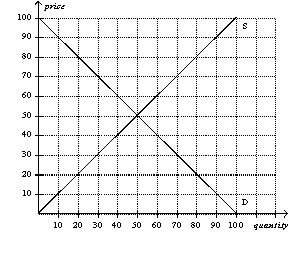

True/False

Figure 6-26  -Refer to Figure 6-26.A price floor set at $60 would create a surplus of 20 units.

-Refer to Figure 6-26.A price floor set at $60 would create a surplus of 20 units.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a 25-cent tax on the buyers of incandescent light bulbs.Which of the following is not correct? The tax would

A) shift the demand curve downward by 25 cents.

B) lower the equilibrium price by 25 cents.

C) reduce the equilibrium quantity.

D) discourage market activity.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

To be binding,a price floor must be set above the equilibrium price.

B) False

Correct Answer

verified

Correct Answer

verified

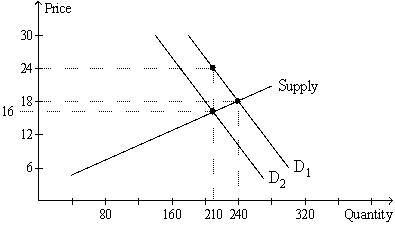

Multiple Choice

Figure 6-20  -Refer to Figure 6-20.The price paid by buyers after the tax is imposed is

-Refer to Figure 6-20.The price paid by buyers after the tax is imposed is

A) $24.

B) $21.

C) $18.

D) $16.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Rent control and the minimum wage are both examples of price ceilings.

B) Rent control is an example of a price ceiling,and the minimum wage is an example of a price floor.

C) Rent control is an example of a price floor,and the minimum wage is an example of a price ceiling.

D) Rent control and the minimum wage are both examples of price floors.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the demand curve is very elastic and the supply curve is very inelastic in a market,then the sellers will bear a greater burden of a tax imposed on the market,even if the tax is imposed on the buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 553

Related Exams