A) $0

B) $4

C) $6

D) $10

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on a good

A) raises the price that buyers effectively pay and raises the price that sellers effectively receive.

B) raises the price that buyers effectively pay and lowers the price that sellers effectively receive.

C) lowers the price that buyers effectively pay and raises the price that sellers effectively receive.

D) lowers the price that buyers effectively pay and lowers the price that sellers effectively receive.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax levied on the sellers of a good shifts the

A) supply curve upward (or to the left) .

B) supply curve downward (or to the right) .

C) demand curve upward (or to the right) .

D) demand curve downward (or to the left) .

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

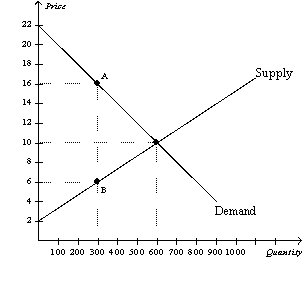

Figure 8-6

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-6.Without a tax,the equilibrium price and quantity are

-Refer to Figure 8-6.Without a tax,the equilibrium price and quantity are

A) $16 and 300.

B) $10 and 600.

C) $10 and 300.

D) $6 and 300.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

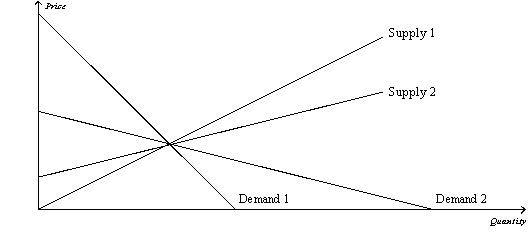

Figure 8-12  -Refer to Figure 8-12.Which of the following combinations will minimize the deadweight loss from a tax?

-Refer to Figure 8-12.Which of the following combinations will minimize the deadweight loss from a tax?

A) supply 1 and demand 1

B) supply 2 and demand 2

C) supply 1 and demand 2

D) supply 2 and demand 1

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss from a tax of $5 per unit will be smallest in a market with

A) inelastic supply and elastic demand.

B) inelastic supply and inelastic demand.

C) elastic supply and elastic demand.

D) elastic supply and inelastic demand.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

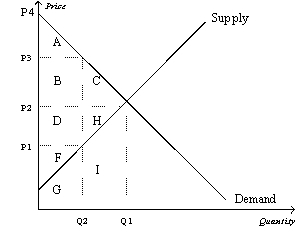

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5.After the tax is levied,producer surplus is represented by area

-Refer to Figure 8-5.After the tax is levied,producer surplus is represented by area

A) A.

B) A+B+C.

C) D+H+F.

D) F.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the tax on gasoline is raised from $0.50 per gallon to $2.50 per gallon.As a result,

A) tax revenue necessarily increases.

B) the deadweight loss of the tax necessarily increases.

C) the demand curve for gasoline necessarily becomes steeper.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The less freedom people are given to choose the date of their retirement,the

A) more elastic is the supply of labor.

B) less elastic is the supply of labor.

C) flatter is the labor supply curve.

D) smaller is the decrease in employment that will result from a tax on labor.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government increases the size of a tax by 40 percent.The deadweight loss from that tax

A) increases by 40 percent.

B) increases by more than 40 percent.

C) increases but by less than 40 percent.

D) decreases by 40 percent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The result of the large tax cuts in the first Reagan Administration demonstrated very convincingly that Arthur Laffer was correct when he asserted that cuts in tax rates would increase tax revenue.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax of $1 per unit is imposed on a good.The more elastic the demand for the good,other things equal,

A) the larger is the decrease in quantity demanded as a result of the tax.

B) the smaller is the tax burden on buyers relative to the tax burden on sellers.

C) the larger is the deadweight loss of the tax.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total surplus with a tax is equal to

A) consumer surplus plus producer surplus.

B) consumer surplus minus producer surplus.

C) consumer surplus plus producer surplus minus tax revenue.

D) consumer surplus plus producer surplus plus tax revenue.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Tax revenues increase in direct proportion to increases in the size of the tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decrease in the size of a tax is most likely to increase tax revenue in a market with

A) elastic demand and elastic supply.

B) elastic demand and inelastic supply.

C) inelastic demand and elastic supply.

D) inelastic demand and inelastic supply.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

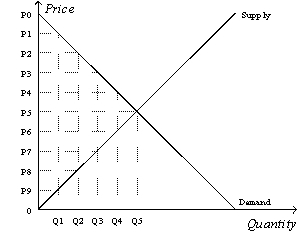

Figure 8-10  -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.With the tax,the consumer surplus is

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.With the tax,the consumer surplus is

A) (P0-P2) x Q2.

B) x (P0-P2) x Q2.

C) (P0-P5) x Q5.

D) x (P0-P5) x Q5.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct regarding the imposition of a tax on gasoline?

A) The incidence of the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

B) The incidence of the tax depends upon the price elasticities of demand and supply.

C) The amount of tax revenue raised by the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

D) The amount of tax revenue raised by the tax does not depend upon the amount of the tax per unit.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on buyers of a good,

A) government collects too little revenue to justify the tax if the equilibrium quantity of the good decreases as a result of the tax.

B) there is an increase in the quantity of the good supplied.

C) a wedge is placed between the price buyers pay and the price sellers effectively receive.

D) the effective price to buyers decreases because the demand curve shifts leftward.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If the government imposes a $3 tax in a market,the equilibrium price will rise by $3.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The supply curve for cameras is the typical upward-sloping straight line,and the demand curve for cameras is the typical downward-sloping straight line.When cameras are taxed,the area on the relevant supply-and-demand graph that represents

A) government's tax revenue is a rectangle.

B) the deadweight loss of the tax is a triangle.

C) the loss of consumer surplus caused by the tax is neither a rectangle nor a triangle.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 421

Related Exams