A) Provide rules by which multinational taxpayers avoid double taxation.

B) Provide for taxation exclusively by the source country.

C) Provide that the country with the highest tax rate will be allowed exclusive tax collection.

D) Provide for taxation exclusively by the country of residence.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

GreenCo, a domestic corporation, earns $25 million of taxable income from U.S. sources and $5 million of taxable income from foreign sources. What amount of taxable income does GreenCo report on its U.S. tax return?

A) $30 million.

B) $25 million.

C) $30 million less any tax paid on U.S. income.

D) $25 million less any tax paid on the foreign income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following persons typically is concerned with the U.S.-sourcing rules for gross income?

A) Foreign persons with only foreign activities.

B) U.S. persons with U.S. and foreign activities.

C) U.S. persons with only U.S. activities.

D) U.S. persons that earn only tax-exempt income.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Young, Inc., a U.S. corporation, earns foreign-source income classified in two different income baskets in the current year. It earns $100,000 in passive foreign-source income and suffers a net loss of $70,000 in the general basket. What is the numerator of the FTC limitation formula for the passive basket in the current year?

A) $0.

B) $30,000.

C) $70,000.

D) $100,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding a foreign person's U.S. tax consequences is true?

A) Foreign persons must be physically present in the United States before any U.S.-source income is subject to U.S. income or withholding tax.

B) Foreign individuals may be subject to U.S. income tax but foreign corporations are never subject to U.S. income tax.

C) Foreign persons are only subject to U.S. income or withholding tax if engaged in a U.S. trade or business.

D) Foreign persons are potentially subject to U.S. withholding tax on U.S.-source investment income.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wood, a U.S. corporation owns 30% of Hout, a foreign corporation. The remaining 70% of Hout is owned by other foreign corporations not controlled by Wood. Hout's functional currency is the euro. Wood receives a 50,000€ distribution from Hout. If the average exchange rate for the E & P to which the dividend is attributed is 1.2€: $1, the exchange rate at year end is .95€: $1, and on the date of the dividend payment the exchange rate is 1.1€: $1, what is Wood's tax result from the distribution?

A) Wood receives a dividend of $45,455 and realizes an exchange gain of $3,788 [$45,455 minus $41,667 (50,000€/1.2) ].

B) Wood receives a dividend of $52,632 (50,000€/.95) with no exchange gain or loss.

C) Wood receives a dividend of $41,667 and realizes an exchange loss of $3,788 ($41,667 minus $45,455) .

D) Wood receives a dividend of $45,455 (50,000€/1.1) with no exchange gain or loss.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the taxation of U.S. real property gains recognized by foreign persons not engaged in a U.S. trade or business is false? Gains from the disposition of U.S. real property are:

A) Taxed to foreign persons notwithstanding the general exemption of capital gains from U.S. taxation.

B) Taxed to foreign persons without regard to whether such foreign persons are engaged in a U.S. trade or business.

C) Taxed in the U.S. because such gains are treated as if they are effectively connected to a U.S. trade or business.

D) Not taxed to foreign persons because real property gains are specifically exempt from U.S. taxation.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Gain or loss on the exchange of foreign currency is considered separately from the underlying transaction (e.g., the purchase or sale of goods).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flapp Corporation, a domestic corporation, conducts all of its transactions in the U.S. dollar. It sells inventory for $1 million to a Canadian company when the exchange rate is $1US: $1.2Can. The Canadian company pays for the inventory when the exchange rate is $1US: $1.25Can. What is Flapp's exchange gain or loss on this sale?

A) Flapp does not have a foreign currency exchange gain or loss, since it conducts all of its transactions in the U.S. dollar.

B) Flapp's account receivable for the sale is $1 million (when the exchange rate is $1US: $1.2Can.) and it collects on the receivable when the exchange rate is $1US: $1.25Can. Flapp has an exchange gain of $50,000.

C) Flapp's account receivable for the sale is $1 million (when the exchange rate is $1US: $1.2Can.) . It collects on the receivable at $1US: $1.25Can. Flapp has an exchange loss of $5,000.

D) Flapp's foreign currency exchange loss is $50,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding income sourcing is not correct?

A) U.S. persons benefit from earning low-tax foreign-source income.

B) Foreign persons generally benefit from avoiding U.S.-source income classification.

C) U.S. persons are not concerned with source of income because all their income is subject to U.S. tax under a worldwide system.

D) Foreign persons may be subject to tax on U.S.-source income without regard to their actual presence in the United States.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a foreign corporation's U.S. effectively connected earnings for the taxable year are $900,000 and its net equity has increased by $40,000, its dividend equivalent amount is $940,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding income sourcing is correct?

A) Everything else equal, larger foreign-source income increases the foreign tax credit limitation for U.S. persons.

B) Everything else equal, larger foreign-source income decreases the foreign tax credit limitation for U.S. persons.

C) Everything else equal, changing foreign-source income has no impact on the foreign tax credit limitation for U.S. persons.

D) Everything else equal, larger U.S.-source income increases the foreign tax credit limitation for U.S. persons.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In all cases, the "residence of seller" rule is used in determining the sourcing of income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

AirCo, a domestic corporation, purchases inventory for resale from unrelated distributors within the United States and resells this inventory to customers outside the United States with title passing outside the United States. What is the source of AirCo's inventory sales income?

A) 50% U.S. source and 50% foreign source.

B) 100% U.S. source.

C) 100% foreign source.

D) 50% foreign source and 50% sourced based on location of manufacturing assets.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

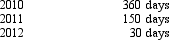

Shannon, a foreign person with a green card, spends the following days in the United States.  Shannon's residency status for 2012 is:

Shannon's residency status for 2012 is:

A) U.S. resident because she has a green card.

B) U.S. resident since she was a U.S. resident for the past immediately preceding two years.

C) Not a U.S. resident because Shannon was not in the United states for at least 31 days during 2012.

D) Not a U.S. resident since, using the three-year test, Shannon is not present in the United states for at least 183 days.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dividends received from a domestic corporation are totally U.S. source:

A) If the corporation earns at least 80% of its gross income over the immediately preceding three tax years from the active conduct of a U.S. trade or business.

B) Unless the corporation earns at least 80% of its gross income over the immediately preceding three tax years from the active conduct of a foreign trade or business.

C) If the corporation earns at least 25% of its gross income over the immediately preceding three tax years from the active conduct of a U.S. trade or business.

D) Unless the corporation earns at least 25% of its gross income over the immediately preceding three tax years from the active conduct of a foreign trade or business.

E) In all of the above cases.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A domestic corporation is one whose assets are primarily (> 50%) located in the U.S.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Waltz, Inc., a U.S. taxpayer, pays foreign taxes of $50,000 on foreign-source general basket income of $90,000. Waltz's worldwide taxable income is $450,000, on which it owes U.S. taxes of $157,500 before FTC. Waltz's FTC is $50,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Disposition of stock of a domestic corporation that is a real property holding corporation is subject to tax under FIRPTA.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olaf, a citizen of Norway with no trade or business activities in the United States, sells at a gain 200 shares of MicroShift, Inc., a U.S. company. The sale takes place through Olaf's broker in Oslo. How is this gain treated for U.S. tax purposes?

A) It is foreign-source income subject to U.S. taxation.

B) It is foreign-source income not subject to U.S. taxation.

C) It is U.S.-source income subject to U.S. taxation.

D) It is U.S.-source income exempt from U.S. taxation.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 159

Related Exams