Correct Answer

verified

Correct Answer

verified

Short Answer

When a _________________________ is in effect, out-of-state sales that are not subject to tax in the destination state are pulled back into the sales factor numerator of the origination state.

Correct Answer

verified

Correct Answer

verified

Short Answer

The ____________________ tax levied by a state usually is based on the book value of a corporation's "net worth."

Correct Answer

verified

Correct Answer

verified

Multiple Choice

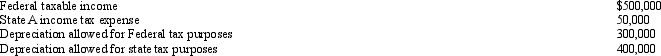

Perez Corporation is subject to tax only in State a Perez generated the following income and deductions.  Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Perez's A taxable income is:

Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Perez's A taxable income is:

A) $400,000.

B) $450,000.

C) $600,000.

D) $650,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An LLC apportions and allocates its annual taxable income in the same manner used by any other business operating in the state.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Under common terminology, a unitary group files a ____________________ state income tax return.

Correct Answer

verified

Correct Answer

verified

True/False

The typical local property tax falls on both an investor's real estate and her stock portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under P.L. 86-272, which of the following transactions by itself would create nexus with a state?

A) Inspection by a sales employee of the customer's inventory for specific product lines.

B) Using an independent contractor who acts as a manufacturer's representative for the taxpayer through a sales office in the state.

C) Executing a sales campaign, using an advertising agency acting as an independent contractor for the taxpayer.

D) Maintenance of inventory in the state by an independent contractor under a consignment plan.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An assembly worker earns a $30,000 salary and receives a fringe benefit package worth $15,000. The payroll factor assigns $30,000 for this employee.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Double weighting the sales factor effectively increases the tax burden on taxpayers based in the state, such as corporations with in-state headquarters.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Typical indicators of nexus include the presence of employees based in the state, and the ownership or lease of realty there.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A state or local tax on a corporation's income might be called a franchise tax or a business privilege tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the taxpayer has exposure to a capital stock tax:

A) The pricing of inventory sales should reflect no more than inflation increases.

B) Subsidiary operations should be funded through direct capital contributions.

C) Expansions should be funded with retained earnings.

D) Dividends should be paid regularly to a parent based in a low-tax state.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

State and local politicians tend to apply new and increased taxes to taxpayers who are visitors to the jurisdiction and cannot vote to reelect the lawmaker.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Typically exempt from the sales/use tax base is the purchase by a symphony orchestra of printed music for its players.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A typical state taxable income addition modification is the Federal net operating loss (NOL) deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The property factor includes business assets that the taxpayer owns, but also those merely used under a lease agreement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A capital stock tax usually is structured as an excise tax imposed on a corporation's "net worth," using financial statement data to compute the tax.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

An ad valorem property tax is based on the asset's current ____________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Britta Corporation's entire operations are located in State A. Eighty percent ($800,000) of Britta's sales are made in A and the remaining sales ($200,000) are made in State B. B has not adopted a corporate income tax. If A has adopted a throwback rule, the numerator of Britta's A sales factor is:

A) $0.

B) $200,000.

C) $800,000.

D) $1,000,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 160

Related Exams