Correct Answer

verified

Correct Answer

verified

True/False

A timely issued disclaimer by an heir transfers the property to someone else without a Federal gift tax result.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

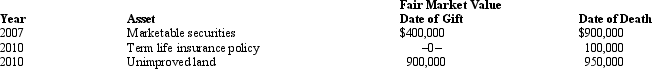

Prior to his death in 2012,Alma made the following gifts.  As a result of the 2010 transfer,Alma paid a gift tax of $70,000.As to these transactions,Alma's gross estate includes:

As a result of the 2010 transfer,Alma paid a gift tax of $70,000.As to these transactions,Alma's gross estate includes:

A) $0.

B) $70,000.

C) $100,000.

D) $170,000.

E) $1,120,000.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Paul,a U.S.citizen,will avoid the Federal estate tax if he becomes a Canadian resident and owns no property located in the U.S.at the time of his death.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Manfredo makes a donation of $50,000 to the church where he was baptized in Mexico City.The gift does not qualify as a charitable contribution for Federal income tax purposes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In most cases,the gross estate of a decedent is larger than the probate estate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

At the time of her death,Abigail held a general power of appointment over a trust created by her grandmother in 1990.Since Abigail never exercised the general power,none of the trust is included in her gross estate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The purpose of the marital deduction is to place married decedents in common law states on par with those in community property jurisdictions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Homer and Laura are husband and wife.At the time of Homer's prior death in 2012,they owned the following: land as tenants by the entirety worth $2,000,000 (purchased by Homer) and stock as equal tenants in common worth $3,000,000 (purchased by Laura) .Laura also owns an insurance policy on Homer's life (maturity value of $1,000,000) with herself as the designated beneficiary.Homer's will passes all his property to Laura.How much marital deduction is allowed Homer's estate?

A) $2,000,000.

B) $2,500,000.

C) $3,500,000.

D) $4,500,000.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

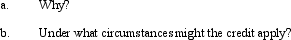

Essay

When one spouse predeceases the other,the credit for prior transfers does not apply.

Correct Answer

verified

Correct Answer

verified

True/False

Two brothers,Sam and Bob,acquire real estate as equal tenants in common.Of the purchase price of $200,000,Sam furnished $80,000 while Bob provided the balance.If Sam dies first ten years later when the real estate is worth $600,000,his estate includes $240,000 as to the property.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Reba purchases U.S.savings bonds which she lists in the name of Rod,Reba's son.The purchase of the bonds does not constitute a gift.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

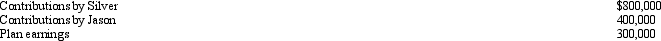

At the time of his death,Jason was a participant in Silver Corporation's qualified pension plan and group term life insurance.The balance of the survivorship feature in his pension plan is:  The term insurance has a maturity value of $100,000.All amounts are paid to Pam,Jason's daughter.One result of these transactions is:

The term insurance has a maturity value of $100,000.All amounts are paid to Pam,Jason's daughter.One result of these transactions is:

A) Pam must pay income tax on $300,000.

B) Pam must pay income tax on $1,500,000.

C) Jason's gross estate must include $1,600,000.

D) Jason's gross estate must include $1,500,000.

E) None of the above.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Sam purchases a U.S.savings bond which he registers as follows: "Sam,payable to Don upon Sam's death." A gift occurs when Sam purchases the bond.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For Federal estate tax purposes,the gross estate does not include property that will pass to a qualifying charity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A transfer in trust in which the trustee has the power to accumulate income is not a gift of a future interest if the trustee never exercises the power.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

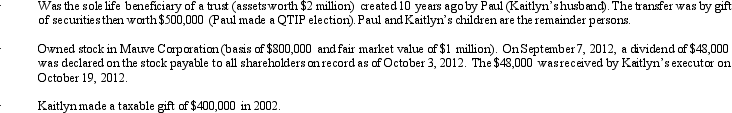

At the time of her death on October 4,2012,Kaitlyn was involved in the following transactions.  As to these transactions,Kaitlyn's gross estate includes:

As to these transactions,Kaitlyn's gross estate includes:

A) $1,048,000.

B) $1,448,000.

C) $3,000,000.

D) $3,048,000.

E) None of the above.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tom and Jean are husband and wife and live in California.In 1991,they use $400,000 of community funds to purchase an annuity from an insurance company.Under the terms of the contract,Tom is to receive $40,000 per year for life once he reaches age 65.If Jean outlives Tom,she is to receive $30,000 per year for life.Tom dies first in 2012 (and before reaching age 65) .At this time,the value of Jean's interest is $500,000.As to this contract,Tom's gross estate includes:

A) $0.

B) $200,000.

C) $250,000.

D) $500,000.

E) None of the above.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Don and Roxana are husband and wife and live in a common law state.Pursuant to the estate tax rules applicable to annuities (§ 2039) ,which of the following is not a correct statement?

A) Don has a straight-life unmatured annuity.Upon his death,none of the annuity is included in his gross estate.

B) Don's retirement plan,to which his employer contributed 50%,is in the form of an annuity with a survivorship feature covering Roxana.Upon Don's prior death,50% of the value of the survivorship feature is included in his gross estate.

C) Don has an annuity with a survivorship feature covering Roxana and to which she contributed 50% of the premiums.Upon Don's prior death,only 50% of the value of the survivorship feature is included in his gross estate.

D) Don has an annuity with a survivorship feature covering Roxana.If Roxana dies first,nothing regarding the annuity is included in her gross estate.

E) None of the above statements are false.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Distributions from retirement plans and proceeds from life insurance plans usually are not subject to probate.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 170

Related Exams