A) $54,000.

B) $57,600.

C) $58,000.

D) $79,200.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of repairs to damaged property is not an acceptable measure of the loss in value of the property.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

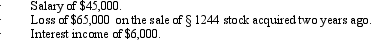

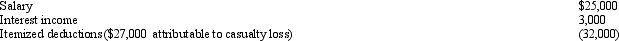

John files a return as a single taxpayer.In 2012,he had the following items:  Determine John's AGI for 2012.

Determine John's AGI for 2012.

A) ($5,000) .

B) $0.

C) $45,000.

D) $51,000.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

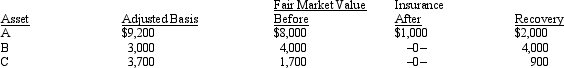

In 2012,Wally had the following insured personal casualty losses (arising from one casualty) .Wally also had $42,000 AGI for the year before considering the casualty.  Wally's casualty loss deduction is:

Wally's casualty loss deduction is:

A) $1,500.

B) $1,600.

C) $4,800.

D) $58,000.

E) None of the above.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Essay

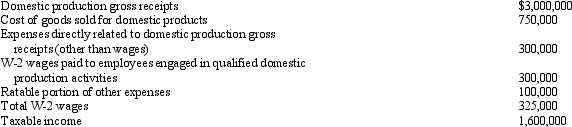

Green,Inc.,manufactures and sells widgets.During 2012,an examination of the company records showed the following items:

Determine Green's domestic production activities deduction for 2012.

Determine Green's domestic production activities deduction for 2012.

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer may carry any NOL incurred back two years.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A theft of investment property can create or increase a net operating loss for an individual.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

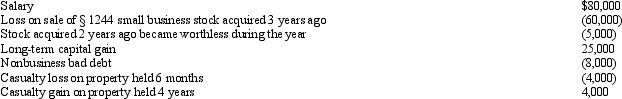

Maria,who is single,had the following items for 2012:

Determine Maria's adjusted gross income for 2012.

Determine Maria's adjusted gross income for 2012.

Correct Answer

verified

Correct Answer

verified

True/False

If qualified production activities income (QPAI)cannot be used in the calculation of the domestic production activities deduction in 2012 because of the taxable income limitation,the product of the amount not allowed multiplied by 9% can be carried over for 5 years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the computation of a net operating loss,which of the following items is not added to the negative taxable income?

A) Losses incurred in a transaction entered into for profit.

B) Personal casualty loss.

C) Personal theft loss.

D) Losses from theft of securities.

E) None of the above.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Three years ago,Sharon loaned her sister $30,000 to buy a car.A note was issued for the loan with the provision for monthly payments of principal and interest.Last year,Sharon purchased a car from the same dealer,Hank's Auto.As partial payment for the car,the dealer accepted the note from Sharon's sister.At the time Sharon purchased the car,the note had a balance of $18,000.During the current year,Sharon's sister died.Hank's Auto was notified that no further payments on the note would be received.At the time of the notification,the note had a balance due of $15,500.What is the amount of loss,with respect to the note,that Hank's Auto may claim on the current year tax return?

A) $0.

B) $3,000.

C) $15,500.

D) $18,000.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wu,who is single,has the following items for 2012:  What is Wu's NOL for 2012?

What is Wu's NOL for 2012?

A) $0.

B) $1,000.

C) $2,000.

D) $25,000.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An individual may deduct a loss on rental property even if it does not meet the definition of a casualty loss.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If an election is made to defer deduction of research expenditures,the amortization period is based on the expected life of the research project if less than 60 months.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The amount of partial worthlessness on a nonbusiness bad debt is deducted in the year partial worthlessness is determined.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 115 of 115

Related Exams