Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 52

True/False

If the amount of the insurance recovery for a theft of business property is greater than the asset's fair market value but less than it's adjusted basis,a loss is recognized.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 53

True/False

In determining whether a debt is a business or nonbusiness bad debt,the debtor's use of the borrowed funds is important.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 54

Multiple Choice

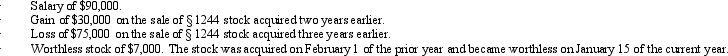

Bruce,who is single,had the following items for the current year:  Determine Bruce's AGI for the current year.

Determine Bruce's AGI for the current year.

A) $37,000.

B) $38,000.

C) $42,000.

D) $47,000.

E) None of the above.

F) B) and C)

G) None of the above

G) None of the above

Correct Answer

verified

Correct Answer

verified

Question 55

Essay

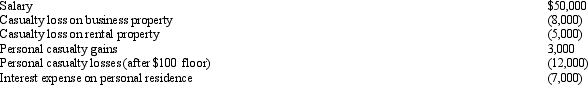

Neal,single and age 37,has the following items for 2010:

Determine Neal's taxable income for 2010.

Determine Neal's taxable income for 2010.

Correct Answer

verified

Correct Answer

verified

Question 56

Essay

Identify the factors that should be considered in determining whether a transaction is a business bad debt or a nonbusiness bad debt.

Correct Answer

verified

Factors to be considered in de...View Answer

Show Answer

Correct Answer

verified

Factors to be considered in de...

View Answer

Question 57

True/False

Expenses in connection with the acquisition of land are not research and experimental expenditures.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 58

True/False

A casualty loss deduction is not allowed for losses resulting from a decline in value rather than an actual loss of property.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 59

True/False

A nonbusiness bad debt is a debt unrelated to the taxpayer's trade or business either when it was created or when it became worthless.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 60

True/False

Last year,taxpayer had a $10,000 business loan that was written off.Last year,taxpayer also had an NOL which taxpayer carried back two years and used in its entirety.If taxpayer collects the entire $10,000 during the current year,$10,000 needs to be included in gross income.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 90 of 90

Related Exams