A) both the real exchange rate and the quantity of dollars exchanged in the market for foreign-currency exchange would fall.

B) both the real exchange rate and the quantity of dollars exchanged in the market for foreign-currency would rise.

C) the real exchange rate would rise and the quantity of dollars exchanged in the market for foreign-currency would fall.

D) the real exchange rate would fall and the quantity of dollars exchanged in the market for foreign-currency would rise.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the 1980s, the U.S. government budget deficit rose. At the same time the U.S. trade deficit grew larger, the real exchange rate of the dollar appreciated, and U.S. net capital outflow decreased. Which of these events is contrary to what the open-economy macroeconomic model predicts concerning the effects of an increase in the budget deficit?

A) The U.S. trade deficit grew.

B) The real exchange rate of the dollar appreciated.

C) U.S. net capital outflow fell.

D) None of the above is contrary to the predictions of the model.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm produces manufacturing equipment, some of which it exports. Which of the following effects of capital flight in the country it produces in would likely reduce the quantity of equipment it sells?

A) both what happens to the interest rate and what happens to the exchange rate

B) what happens to the interest rate but not what happens to the exchange rate

C) what happens to the exchange rate but not what happens to the interest rate

D) neither what happens to the interest rate nor what happens to the interest rate.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From 2001 to 2004 the U.S. budget went from surplus to deficit. According to the open economy macroeconomic model, this change should have

A) increased U.S. interest rates and increased the real exchange rate of the dollar.

B) increased U.S. interest rates and decreased the real exchange rate of the dollar.

C) decreased U.S. interest rates and increased the real exchange rate of the dollar.

D) decreased U.S. interest rates and decreased the real exchange rate of the dollar.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, an increase in the U.S. real interest rate induces

A) Americans to buy more foreign assets, which increases U.S. net capital outflow.

B) Americans to buy more foreign assets, which reduces U.S. net capital outflow.

C) foreigners to buy more U.S. assets, which reduces U.S. net capital outflow.

D) foreigners to buy more U.S. assets, which increases U.S. net capital outflow.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recently the Greek government had large deficits and people became worried about Greece's ability to continue to make payments on its debt. Which of the these events raise a country's interest rates?

A) an increase in the budget deficit, and increased concerns about the ability of the government to pay back its debt

B) an increase in the budget deficit, but not increased concerns about the ability of the government to pay back its debt

C) increased concerns about the ability of the government to pay back its debt, but not an increase in the budget deficit

D) neither an increase in the budget deficit, nor increased concerns about the ability of the government to pay back its debt

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the open-economy macroeconomic model, other things the same, when a U.S. resident imports a foreign good, the demand for dollars in the foreign-currency exchange market decreases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an open economy, the demand for loanable funds comes from

A) only those who want to borrow funds to buy domestic capital goods.

B) only those who want to borrow funds to buy foreign assets.

C) those who want to borrow funds to buy either domestic capital goods or foreign assets.

D) neither those who want to borrow funds to buy domestic capital goods nor those who want to borrow funds to buy foreign assets.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, an increase in the U.S. interest rate

A) raises net capital outflow which decreases the quantity of loanable funds demanded.

B) raises net capital outflow which increases the quantity of loanable funds demanded.

C) lowers net capital outflow which decreases the quantity of loanable funds demanded.

D) lowers net capital outflow which increases the quantity of loanable funds demanded.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decrease in the budget deficit causes domestic interest rates

A) and investment to rise.

B) to rise and investment to fall.

C) to fall and investment to rise.

D) and investment to fall.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the open-economy macroeconomic model, the real exchange rate does not affect net capital outflow.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in the demand for dollars in the market for foreign-currency exchange in the open-economy macroeconomic model?

A) A German bank desires to purchase U.S. Treasury securities

B) A firm in Canada wants to buy rice from a U.S. company.

C) An U.S. citizen wants to buy a bond issued by a Swedish corporation.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, other things the same, which of the following both make the exchange rate fall?

A) U.S. investment demand falls and foreign demand for U.S. goods falls

B) U.S. investment demand falls and foreign demand for U.S. goods rises

C) U.S. investment demand rises and foreign demand for U.S. goods falls

D) U.S. investment demand rises and foreign demand for U.S. goods rises

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many U.S. business leaders argue that the current state of U.S. net exports is the result of

A) U.S. export subsidies.

B) free trade policies of foreign governments.

C) unproductive U.S. workers.

D) unfair foreign competition.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would do the most to reduce a trade deficit?

A) increase domestic saving

B) increase domestic political stability and respect of property rights

C) other countries reduce their trade restrictions

D) raise tariffs

F) A) and B)

Correct Answer

verified

Correct Answer

verified

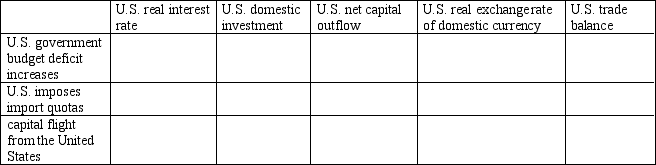

Essay

Fill in the table below with the direction of the variables that change in response to the events in the first column.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a country's budget deficit decreases, then the exchange rate

A) rises, which raises net exports.

B) rises, which reduces net exports.

C) falls, which raises net exports.

D) falls, which reduces net exports.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which case(s) does(do) a country's supply of loanable funds shift right?

A) both an increase in the budget deficit and capital flight

B) an increase in the budget deficit, but not capital flight

C) capital flight, but not an increase in the budget deficit

D) neither an increase in the budget deficit nor capital flight

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The imposition of an import quota shifts

A) the supply of currency right, so the exchange rate falls.

B) the supply of currency left, so the exchange rate rises.

C) the demand for currency right, so the exchange rate rises.

D) the demand for currency left, so the exchange rate falls.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following make(s) demand for U.S. dollars in the market for foreign-currency exchange higher than otherwise?

A) a Russian firm wanting to buy equipment from a U.S. manufacturer and a U.S. manufacturer wanting to buy zinc from Canada

B) a Russian firm wanting to buy equipment from a U.S. manufacturer but not a U.S. manufacturer wanting to buy zinc from Canada

C) a U.S. manufacturer wanting to buy zinc from Canada but not a Russian firm wanting to buy equipment from a U.S. manufacturer

D) neither a Russian firm wanting to buy equipment from a U.S. manufacturer nor a U.S. manufacturer wanting to buy zinc from Canada

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 375

Related Exams