A) $415,000 if the interest rate is 5%

B) $419,000 if the interest rate is 4%

C) K-Nine would buy the equipment in both cases.

D) K-Nine would not buy the equipment in either case.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you will receive $500 at some point in the future. If the annual interest rate is 7.5 percent, then the present value of the $500 is

A) $411.26 if the $500 is to be received in 5 years and $338.95 if the $500 is to be received in 10 years.

B) $348.28 if the $500 is to be received in 5 years and $242.60 if the $500 is to be received in 10 years.

C) $291.11 if the $500 is to be received in 5 years and $272.89 if the $500 is to be received in 10 years.

D) $291.11 if the $500 is to be received in 5 years and $236.49 if the $500 is to be received in 10 years.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rita puts $10,000 into each of two different assets. The first asset pays 10 percent interest and the second pays 5 percent. According to the rule of 70, what is the approximate difference in the value of the two assets after 14 years?

A) $12,000

B) $14,000

C) $15,500

D) $20,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, as the stocks of a greater number of corporations are held in a portfolio,

A) risk increases at an increasing rate.

B) risk increases at a decreasing rate.

C) risk decreases at an increasing rate.

D) risk decreases at a decreasing rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank might make mortgages to people in different regions of the country. By doing so

A) the bank reduces the risk it faces from falling house prices in its region and falling prices in all regions.

B) the bank reduces the risk it faces of falling house prices in its region but not from falling prices in all regions.

C) the bank reduces the risk it faces of falling house prices in all regions, but not the risk it faces from falling house prices in its regions.

D) the bank reduces neither the risk it faces from falling house prices in its region nor falling prices in all regions.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

John says that the future value of $250 saved for one year at 6 percent interest is less than the future value of $250 saved for two years at 3 percent interest. George says that the present value of a $250 payment to be received in one year when the interest rate is 6 percent is less than the value of a $250 payment to be received in two years when the interest rate is 3 percent.

A) John and George are both correct.

B) John and George are both incorrect.

C) Only John is correct.

D) Only George is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You deposit X dollars into a 3-year certificate of deposit that pays 4.75 percent annual interest. At the end of the 3 years you have $4,310.16. What number of dollars, X, did you deposit?

A) $3,680.00

B) $3,712.77

C) $3,750.00

D) $3,772.57

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Managed funds typically have a higher return than indexed funds. This tends to refute the efficient market hypothesis.

B) Managed funds typically have a higher return than indexed funds. This tends to support the efficient market hypothesis.

C) Index funds typically have a higher rate of return than managed funds. This tends to refute the efficient market hypothesis.

D) Index funds typically have a higher rate of return than managed funds. This tends to support the efficient market hypothesis.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

People who are risk averse dislike bad outcomes more than they like comparable good outcomes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From the standpoint of the economy as a whole, the role of

A) the interest rate is to make sure that the price of bonds increases over time.

B) diversification is to eliminate market risk.

C) insurance is to reduce the risks inherent in life.

D) insurance is to spread risks around more efficiently.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

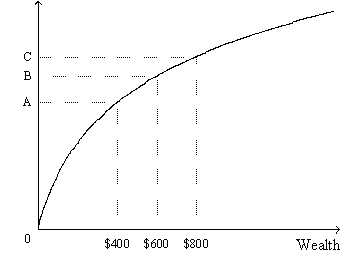

Figure 9-1. The figure shows a utility function.

-Refer to Figure 9-1. The utility function that is shown exhibits the property of diminishing

-Refer to Figure 9-1. The utility function that is shown exhibits the property of diminishing

A) wealth.

B) utility.

C) marginal wealth.

D) marginal utility.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Risk aversion helps to explain various things we observe in the economy, including

A) adherence to the old adage, "Don't put all your eggs in one basket."

B) insurance.

C) the risk-return trade-off.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sari puts $100 into an account with an interest rate of 10 percent. According to the rule of 70, about how much does she have at the end of 21 years?

A) $210

B) $300

C) $800

D) $1,010

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If unexpected news raised people's expectations of a corporation's future dividends and price, then before the price changes this corporation's stock would be

A) overvalued, so its price would rise.

B) overvalued, so its price would fall.

C) undervalued, so its price would rise.

D) undervalued, so its price would fall.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your accountant tells you that if you can continue to earn the current interest rate on your balance of $800 for the next two years you will have $898.88 in your account. If your accountant is correct what is the current interest rate?

A) 6 percent

B) 7 percent

C) 8 percent

D) 9 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

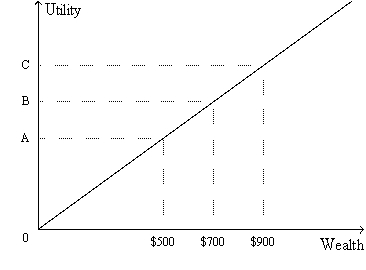

Figure 9-3. The figure shows a utility function for Rob.

-Refer to Figure 9-3. From the appearance of Rob's utility function, we know that

-Refer to Figure 9-3. From the appearance of Rob's utility function, we know that

A) if Rob owns a house, then he definitely would buy fire insurance provided the cost of the insurance were reasonable.

B) Rob would voluntarily exchange a portfolio of stocks with a high average return and a high level of risk for a portfolio with a low average return and a low level of risk.

C) Rob is risk averse.

D) Rob is not risk averse.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From the standpoint of the economy as a whole, the role of insurance is

A) to entice risk-loving people to become risk averse.

B) to promote the phenomenon of adverse selection.

C) not to eliminate the risks inherent in life, but to spread them around more efficiently.

D) not to spread risks, but to eliminate them for individual policy holders.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A risk-averse person has

A) a utility function whose slope gets flatter as wealth rises. This means they have increasing marginal utility of wealth.

B) a utility function whose slope gets flatter as wealth rises. This means they have diminishing marginal utility of wealth.

C) a utility function whose slope gets steeper as wealth rises. This means they have increasing marginal utility of wealth.

D) a utility function whose slope gets steeper as wealth rises. This means they have diminishing utility of wealth.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Risk-averse persons will take no risks.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Risk-averse people will not hold stock.

B) Diversification cannot reduce firm-specific risk.

C) The larger the percentage of stock in a portfolio, the greater the risk, but the greater the average return.

D) Stock prices are determined by fundamental analysis rather than by supply and demand.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 341 - 360 of 419

Related Exams