B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) A risk averse person might be willing to hold stocks.

B) Other things the same, a portfolio with the stocks of a large number of companies has less risk.

C) Other things the same, the larger a portion of savings a person invests in stocks, the greater his expected return.

D) Diversification can eliminate market risk but not firm-specific risk.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The value of a stock depends on the ability of the company to generate dividends and the expected price of the stock when the stockholder sells her shares.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anna deposited $10,000 into an account three years ago. The first year she earned 12 percent interest, the second year she earned 8 percent interest, and the third year she earned 4 percent interest. How much money does she have in her account today?

A) $12,579.84

B) $12,596.80

C) $12,597.12

D) None of the above are correct to the nearest cent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given that Tamar is a risk-averse person, she might accept a bet with a 50 percent chance of losing $100 today if she had a 50 percent

A) chance of winning $120 in two years and the interest rate was 11%.

B) chance of winning $114 in two years and the interest rate was 7%.

C) chance of winning $110 in two years and the interest rate was 3%.

D) None of the above are correct; a risk averse person would not accept any of the above bets.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

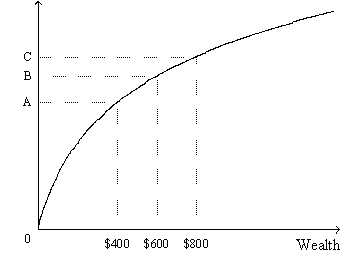

Figure 9-1. The figure shows a utility function.

-Refer to Figure 9-1. What is measured along the vertical axis?

-Refer to Figure 9-1. What is measured along the vertical axis?

A) risk aversion

B) marginal utility

C) utility

D) the number of units of a good that can be purchased

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions best illustrates adverse selection?

A) A person purposely chooses bonds of corporations with high default risk because of the high returns.

B) A person dislikes losing $400 more than he likes winning $400.

C) After obtaining automobile insurance a person drives less carefully than before.

D) A person intending to take up dangerous hobbies applies for life insurance.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $183.60 two years from today equal to about $173.06 today?

A) 2 percent

B) 3 percent

C) 4 percent

D) 5 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diversifying

A) increases the standard deviation of the value of a portfolio indicating its risk has increased.

B) increases the standard deviation of the value of a portfolio indicating its risk has decreased.

C) decreases the standard deviation of the value of a portfolio indicating its risk has increased.

D) decreases the standard deviation of the value of a portfolio indicating its risk has decreased.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rule of 70 can be stated as follows: A variable with a growth rate of X percent per year

A) doubles every 70/X years.

B) doubles every 70(1 - 1/X) years.

C) doubles every 70/X2 years.

D) doubles every 70/(1 - X) years.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

ZZL Corporation has the opportunity to undertake an investment project that will cost $20,000 today. If the interest rate is 20 percent and if the project will yield the company $30,000 in 3 years, then ZZL will undertake the project.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following terms is used to describe a situation in which the price of an asset rises above what appears to be its fundamental value?

A) "random walk"

B) "random bubble"

C) "speculative bubble"

D) "speculative hedge"

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which famous person referred to compounding as "the greatest mathematical discovery of all time?"

A) Abraham Lincoln

B) Thomas Edison

C) Benjamin Franklin

D) Albert Einstein

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The problem of moral hazard arises because

A) life is full of all sorts of risks.

B) after people buy insurance, they have less incentive to be careful about their risky behavior.

C) a high-risk person is more likely to apply for insurance than is a low-risk person.

D) insurance companies go to great effort to avoid paying claims to their policy holders.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

According to the rule of 70, if you earn an interest rate of 3.5 percent, your savings will double about every 20 years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alice says that the present value of $700 to be received one year from today if the interest rate is 6 percent is less than the present value of $700 to be received two years from today if the interest rate is 3 percent. Beth says that $700 saved for one year at 6 percent interest has a smaller future value than $700 saved for two years at 3 percent interest.

A) Both Alice and Beth are correct.

B) Both Alice and Beth are incorrect.

C) Only Alice is correct.

D) Only Beth is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you put $500 into a bank account today. Interest is paid annually and the annual interest rate is 5.5 percent. The future value of the $500 is

A) $637.50 after 5 years and $822.09 after 10 years.

B) $637.50 after 5 years and $775.00 after 10 years.

C) $653.48 after 5 years and $854.07 after 10 years.

D) $688.36 after 5 years and $915.56 after 10 years.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following make(s) insurance premiums higher than otherwise?

A) adverse selection and moral hazard

B) adverse selection, but not moral hazard

C) moral hazard, but not adverse selection

D) neither adverse selection nor moral hazard

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A high-ranking corporate official of a well-known company is unexpectedly sentenced to prison for criminal activity in trading stocks. This should

A) raise the price and raise the present value of the corporation's stock.

B) raise the price and lower the present value of the corporation's stock.

C) lower the price and raise the present value of the corporation's stock.

D) lower the price and lower the present value of the corporation's stock.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value of a future payment to be received in three years is $1,000. If the interest rate is 5%, what is the amount that will be paid in three years?

A) $1,150.00

B) $1,157.63

C) $1,215.51

D) $1,250.00

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 419

Related Exams