A) the stock price of a company should reflect the company's expected profitability.

B) the basic tools of finance reflect valid ideas.

C) stock prices reflect rational estimates of a company's true worth.

D) there is any relationship between stock market fluctuations and fluctuations in the economy more broadly.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the future value of $800 one year from today if the interest rate is 7 percent?

A) $747.66

B) $756.00

C) $856.00

D) None of the above are correct to the nearest cent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fundamental analysis shows that stock in Lodgefire Restaurants has a present value below its price.

A) This stock is overvalued; you should consider adding it to your portfolio.

B) This stock is overvalued; you shouldn't consider adding it to your portfolio.

C) This stock is undervalued; you should consider adding it to your portfolio.

D) This stock is undervalued; you shouldn't consider adding it to your portfolio.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Available evidence indicates that stock prices, even if not exactly a random walk, are very close to a random walk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, when the interest rate rises, the present value of future revenues from investment projects

A) rises, so investment spending rises.

B) falls, so investment spending rises.

C) rises, so investment spending falls.

D) falls, so investment spending falls.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the future value of $500 one year from today if the interest rate is 6 percent?

A) $515

B) $520

C) $530

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The value of a stock is based on the

A) present values of the dividend stream and final price. As a result, the value of a stock rises when interest rates rise.

B) present values of the dividend stream and final price. As a result, the value of a stock falls when interest rates rise.

C) future values of the dividend stream and final price. As a result, the value of a stock rises when interest rates rises.

D) future values of the dividend stream and final price. As a result, the value of a stock falls when interest rates rise.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A judge requires Harry to make a payment to Sally. The judge says that Harry can pay her either $10,000 today or $12,000 two years from today. Of the following interest rates, which is the highest one at which Harry would be better off paying the money today?

A) 4 percent

B) 6 percent

C) 9 percent

D) 11 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial system

A) involves bank accounts, mortgages, stock prices, and many other items.

B) involves decisions and actions undertaken by people at a point in time that affect their lives in the future.

C) coordinates the economy's saving and investment.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate is 4.5 percent, what is the present value of a payment of $500 to be made one year from today?

A) $457.14

B) $468.02

C) $478.47

D) None of the above are correct to the nearest cent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After the 1982 recession, the U.S. and world economies entered into a long period

A) of high unemployment rates.

B) high inflation rates.

C) that has become known as the "Great Moderation."

D) that has become known as the "Great Recession."

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has three different investment options. Option A will give the firm $10 million at the end of one year, $10 million at the end of two years, and $10 million at the end of three years. Option B will give the firm $15 million at the end of one year, $10 million at the end of two years, and $5 million at the end of three years. Option C will give the firm $30 million at the end of one year, and nothing thereafter. Which of these options has the highest present value?

A) Option A

B) Option B

C) Option C

D) The answer depends on the rate of interest, which is not specified here.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate is 7.5 percent, then what is the present value of $4,000 to be received in 6 years?

A) $2,420.68

B) $2,591.85

C) $2,996.33

D) $3,040.63

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the interest rate is 4 percent. Which of the following has the greatest present value?

A) $100 today plus $190 one year from today

B) $150 today plus $140 one year from today

C) $200 today plus $90 one year from today

D) $250 today plus $40 one year from today

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

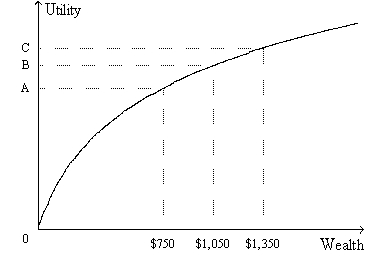

Figure 9-2. The figure shows a utility function for Mary Ann.

-Refer to Figure 9-2. Suppose Mary Ann begins with $1,050 in wealth. Starting from there,

-Refer to Figure 9-2. Suppose Mary Ann begins with $1,050 in wealth. Starting from there,

A) she would be willing to accept a coin-flip bet that would result in her winning $300 if the result was "heads" or losing $300 if the result was "tails."

B) the pain of losing $300 of her wealth would equal the pleasure of adding $300 to her wealth.

C) the pain of losing $300 of her wealth would exceed the pleasure of adding $300 to her wealth.

D) the pleasure of adding $300 to her wealth would exceed the pain of losing $300 of her wealth.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Roger determines that if Aim Corporation has high revenues, then Zest Corporation will have low revenues, and that if Aim Corporation has low revenues, Zest Corporation will have high revenues. He buys stock in both corporations.

A) He has reduced firm-specific risk but not market risk.

B) He has reduced market risk, but not firm-specific risk.

C) He had reduce both firm-specific risk and market risk.

D) He has reduced neither firm-specific risk nor market risk.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

April, who currently owns stock in four companies, has decided to expand her portfolio by purchasing stock in virtually every company that sells stock. In doing so, April will

A) increase the risk of her portfolio.

B) decrease some, but not all, of the risk of her portfolio.

C) decrease all of the risk of her portfolio.

D) leave the risk of her portfolio unchanged from its present level.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The field of finance primarily studies

A) how society manages its scarce resources.

B) the implications of time and risk for allocating resources over time.

C) firms' decisions concerning how much to produce and what price to charge.

D) how society can reduce market risk.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If you are faced with the choice of receiving $500 today or $800 6 years from today, you will be indifferent between the two possibilities if the interest rate is 8.148 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have been promised a payment of $400 in the future. In which of the following cases is the present value of this payment the lowest?

A) You receive the payment 4 years from now and the interest rate is 4 percent.

B) You receive the payment 4 years from now and the interest rate is 5 percent.

C) You receive the payment 5 years from now and the interest rate is 4 percent.

D) You receive the payment 5 years from now and the interest rate is 5 percent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 419

Related Exams