A) control taxes.

B) command levies.

C) Pigovian taxes.

D) Marshallian taxes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

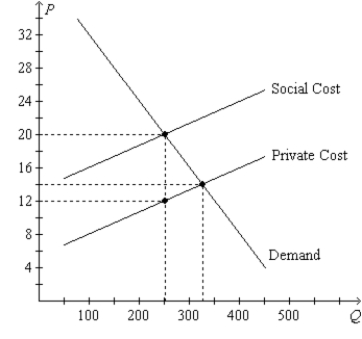

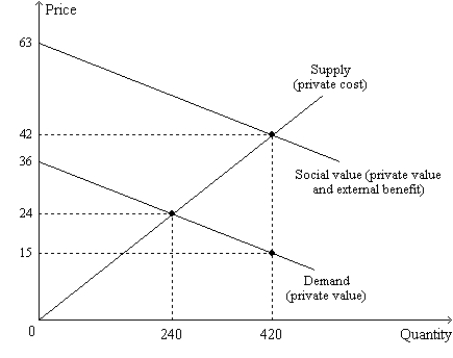

Figure 10-13. On the graph, Q represents the quantity of plastics and P represents the price of plastics.  Multiple Choice - Section 02: Public Policies toward Externalities

-Refer to Figure 10-13. If the government imposed a corrective tax that successfully moved the market from the market equilibrium to the social optimum, then tax revenue for the government would amount to

Multiple Choice - Section 02: Public Policies toward Externalities

-Refer to Figure 10-13. If the government imposed a corrective tax that successfully moved the market from the market equilibrium to the social optimum, then tax revenue for the government would amount to

A) $1,250.

B) $1,600.

C) $2,000.

D) $2,500.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If we know that the supply curve for good x fails to reflect the total cost to society of producing that good, then we know that

A) the market for good x is characterized by an externality, but we cannot determine whether the externality is positive or negative from this fact alone.

B) the market for good x is characterized by a positive externality.

C) the market for good x is characterized by a negative externality.

D) the demand curve for good x fails to reflect the value to society of that good.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a positive externality?

A) A college student buys a new car when she graduates.

B) The mayor of a small town plants flowers in the city park.

C) Local high school teachers have pizza delivered every Friday for lunch.

D) An avid fisherman buys new fishing gear for his next fishing trip.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary and Cathy are roommates. Mary assigns a $30 value to smoking cigarettes. Cathy values smoke-free air at $15. Which of the following scenarios is a successful example of the Coase theorem?

A) Cathy offers Mary $20 not to smoke. Mary accepts and does not smoke.

B) Mary pays Cathy $16 so that Mary can smoke.

C) Mary pays Cathy $14 so that Mary can smoke.

D) Cathy offers Mary $15 not to smoke. Mary accepts and does not smoke.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 10-1 The demand curve for gasoline slopes downward and the supply curve for gasoline slopes upward. The production of the 1,000th gallon of gasoline entails the following: • a private cost of $3.10; • a social cost of $3.55; • a value to consumers of $3.70. -Refer to Scenario 10-1. Let QMARKET represent the equilibrium quantity of gasoline, and let QOPTIMUM represent the socially optimal quantity of gasoline. Which of the following inequalities is correct?

A) 1,000 < QOPTIMUM < QMARKET

B) QOPTIMUM < 1,000 < QMARKET

C) QMARKET < 1,000 < QOPTIMUM

D) QOPTIMUM < QMARKET < 1,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Research into new technologies provides a

A) negative externality, and too few resources are devoted to research as a result.

B) negative externality, and too many resources are devoted to research as a result.

C) positive externality, and too few resources are devoted to research as a result.

D) positive externality, and too many resources are devoted to research as a result.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

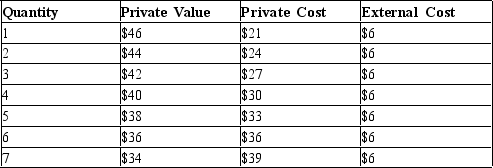

Table 10-4

-Refer to Table 10-4. The market equilibrium quantity of output is

-Refer to Table 10-4. The market equilibrium quantity of output is

A) 3 units.

B) 4 units.

C) 5 units.

D) 6 units.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A market for pollution permits can efficiently allocate the right to pollute by using the forces of supply and demand.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that cookie producers create a positive externality equal to $2 per dozen. What is the relationship between the equilibrium quantity and the socially optimal quantity of cookies to be produced?

A) They are equal.

B) The equilibrium quantity is greater than the socially optimal quantity.

C) The equilibrium quantity is less than the socially optimal quantity.

D) There is not enough information to answer the question.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

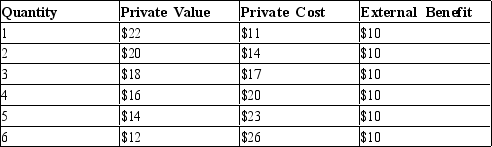

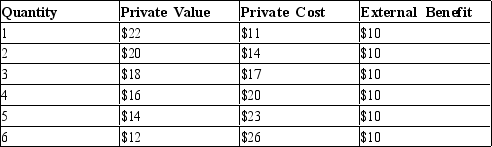

Table 10-3

-Refer to Table 10-3. The market equilibrium quantity of output is

-Refer to Table 10-3. The market equilibrium quantity of output is

A) 3 units.

B) 4 units.

C) 5 units.

D) 6 units.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 10-3

-Refer to Table 10-3. The table represents a market in which

-Refer to Table 10-3. The table represents a market in which

A) there is no externality.

B) there is a positive externality.

C) there is a negative externality.

D) The answer cannot be determined from inspection of the table.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When externalities are present, reaching an efficient outcome is especially difficult when the number of interested parties is large.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) Tradable pollution permits have an advantage over corrective taxes if the government is uncertain as to the optimal size of the tax necessary to reduce pollution to a specific level.

B) Both corrective taxes and tradable pollution permits provide market-based incentives for firms to reduce pollution.

C) Corrective taxes set the maximum quantity of pollution, whereas tradable pollution permits fix the price of pollution.

D) Both corrective taxes and tradable pollution permits reduce the cost of environmental protection and thus should increase the public's demand for a clean environment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 10-11  -Refer to Figure 10-11. On the

-Refer to Figure 10-11. On the

A) 390th unit of output, private value exceeds private cost.

B) 390th unit of output, private value exceeds external value.

C) 450th unit of output, private value exceeds social value.

D) 450th unit of output, private cost exceeds social value.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an effective method of reducing negative externalities?

A) relying on voluntary compliance

B) taxing the output of industries that pollute

C) creating legal environmental standards

D) increasing public spending on cleanup and reduction of pollution

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a policy succeeds in giving buyers and sellers in a market an incentive to take into account the external effects of their actions, the policy is said to

A) equalize private value and private cost.

B) equalize private cost and external cost.

C) externalize the actions of the buyers and sellers.

D) internalize the externality.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following problems can not be alleviated by a gasoline tax?

A) traffic congestion

B) traffic accidents

C) the undersupply of goods that produce positive externalities

D) air pollution

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Private contracts between parties with mutual interests

A) will reduce the well-being of society.

B) will lead to market outcomes in which the public interest is sacrificed for personal gain.

C) can solve some inefficiencies associated with positive externalities.

D) will create negative externalities.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax on cigarettes is an example of

A) a consumption tax.

B) a corrective tax.

C) an income tax.

D) a command-and-control policy.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 522

Related Exams