B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2013, ABC Corporation had total earnings of $200 million and 40 million shares of the corporation's stock were outstanding. If the price-earnings ratio for ABC is 20, then what is the price of a share of its stock?

A) $5

B) b. $10

C) c. $80

D) $100

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

In a closed economy private saving is $500 billion and the government budget deficit is $100 billion. What is investment?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following could explain a decrease in the equilibrium interest rate and an increase in the equilibrium quantity of loanable funds?

A) The demand for loanable funds shifted rightward.

B) The demand for loanable funds shifted leftward.

C) The supply of loanable funds shifted rightward.

D) The supply of loanable funds shifted leftward.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events could explain a decrease in interest rates together with an increase in investment?

A) The government went from surplus to deficit.

B) The government instituted an investment tax credit.

C) The government reduced the tax rate on savings.

D) None of the above is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included as investment in the GDP accounts?

A) the government buys goods from another country

B) someone buys stock in an American company

C) a firm increases its capital stock

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm's priceearnings ratio is relatively low, then it might be an indication that

A) the demand for the stock is relatively high.

B) the supply of the stock is relatively low.

C) people expect the firm's earnings to rise.

D) people expect the firm's earnings to fall.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Some bonds have terms as short as a few months.

B) Because they are so risky, junk bonds pay a low rate of interest.

C) Corporations buy bonds to raise funds.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

A higher interest rate makes less attractive. Therefore the quantity of loanable funds demanded decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

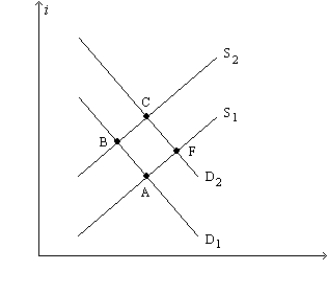

Figure 26-3. The figure shows two demand-for-loanable-funds curves and two supply-of-loanable-funds curves.  -Refer to Figure 26-3. Which of the following movements shows the effects of the government going from a budget surplus to a budget deficit?

-Refer to Figure 26-3. Which of the following movements shows the effects of the government going from a budget surplus to a budget deficit?

A) a movement from Point A to Point B

B) a movement from Point B to Point A

C) a movement from Point A to Point F

D) a movement from Point B to Point C

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A government budget deficit affects the supply of loanable funds, rather than the demand for loanable funds, because

A) in our model of the loanable funds market, we define "loanable funds" as the flow of resources available to fund private investment.

B) in our model of the loanable funds market, we define "loanable funds" as the flow of resources available from private saving.

C) markets for government debt are fundamentally different from markets for private debt.

D) of our assumption that the economy is closed.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is a surplus of loanable funds, then

A) the quantity demanded is greater than the quantity supplied and the interest rate will rise.

B) the quantity demanded is greater than the quantity supplied and the interest rate will fall.

C) the quantity supplied is greater than the quantity demanded and the interest rate will rise.

D) the quantity supplied is greater than the quantity demanded and the interest rate will fall.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following bonds has the highest interest rate?

A) a high credit risk and a short term.

B) a low credit risk and a short term.

C) a long term and a high credit risk.

D) a long term and a low credit risk.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

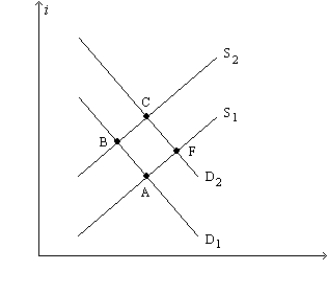

Figure 26-3. The figure shows two demand-for-loanable-funds curves and two supply-of-loanable-funds curves.  -Refer to Figure 26-3. Which of the following movements would be consistent with the government budget going from deficit to surplus and the simultaneous enactment of an investment tax credit?

-Refer to Figure 26-3. Which of the following movements would be consistent with the government budget going from deficit to surplus and the simultaneous enactment of an investment tax credit?

A) a movement from Point A to Point C

B) a movement from Point B to Point A

C) a movement from Point B to Point F

D) a movement from Point C to Point B

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Index funds

A) buy all the stocks in a given stock index.

B) promise to beat the market by a certain percentage known as an index.

C) provide a return that is adjusted for changes in the consumer price index.

D) buy industries within a particular category of the North American Industry Classification System.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, the effects of an increase in transfer payments on the government's budget deficit will lead to

A) greater investment.

B) a higher interest rate.

C) higher public saving.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Lenders sell bonds and borrowers buy them.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Joan uses some of her income to buy mutual fund shares. A macroeconomist refers to Joan's purchase as investment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Who accepts all of the risk associated with a mutual fund's portfolio of stocks and/or bonds?

A) the fund's managers

B) the fund's shareholders

C) the federal government

D) the corporations that originally issued the stocks and/or bonds held by the fund

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a closed economy, if Y and T remained the same, but G rose and C fell but by less than the rise in G, what would happen to private and national saving?

A) private and national saving would rise

B) private and national saving would fall

C) private saving would rise and national saving would fall

D) private saving would fall and national saving would rise

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 481 - 500 of 567

Related Exams