A) Public Law 86-272.

B) The Multistate Tax Treaty.

C) The Multistate Tax Commission (MTC) .

D) The Uniform Division of Income for Tax Purposes Act (UDITPA) .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A U.S. taxpayer may take a current FTC equal to the greater of the FTC limit or the actual foreign taxes (direct or indirect) paid or accrued.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Jokerz, a CFC of a U.S. parent, generated $80,000 Subpart F foreign base company services income in its first year of operations. The next year, Jokerz distributes $50,000 cash to the parent, from those service profits. The parent is taxed on $0 in the first year (tax deferral rules apply) and $50,000 in the second year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Section 482 is used by the Treasury to:

A) Force taxpayers to use arms-length transfer pricing on transactions between related parties.

B) Reallocate income, deductions, etc., to a related taxpayer to minimize tax liability.

C) Increase information that is reported about U.S. corporations with non-U.S. owners.

D) All of the above.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The IRS can use § 482 reallocations to assure that transactions between related parties are properly reflected in a tax return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Columbia, Inc., a U.S. corporation, receives a $150,000 cash dividend from Starke, Ltd. Columbia owns 15% of Starke. Starke's E & P is $2 million and it has paid foreign taxes of $750,000 attributable to that E & P. What is Columbia's foreign tax credit related to the Starke dividend?

A) $22,500

B) $56,250

C) $150,000

D) $750,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following foreign taxes paid by a U.S. corporation may be eligible for the foreign tax credit?

A) Real property taxes.

B) Value added taxes.

C) Sales taxes.

D) Dividend withholding taxes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

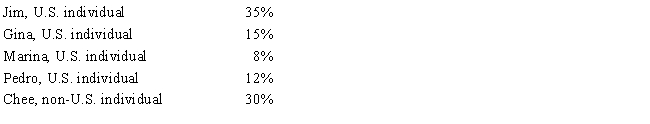

The following persons own Schlecht Corporation, a foreign corporation.

None of the shareholders are related. Subpart F income for the tax year is $300,000. No distributions are made. Which of the following statements is correct?

None of the shareholders are related. Subpart F income for the tax year is $300,000. No distributions are made. Which of the following statements is correct?

A) Schlecht is not a CFC.

B) Chee includes $90,000 in gross income.

C) Marina is not a U.S. shareholder for purposes of determining whether Schlecht is a CFC.

D) Marina includes $24,000 in gross income.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding income sourcing is not correct?

A) Concerning the foreign tax credit, most U.S. persons benefit from earning low-tax foreign-source income.

B) Foreign persons generally benefit from avoiding U.S.-source income classification.

C) U.S. persons are not concerned with source of income because all their income is subject to U.S. tax under a worldwide system.

D) Foreign persons may be subject to tax on U.S.-source income without regard to their actual presence in the United States.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 121 - 129 of 129

Related Exams