B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

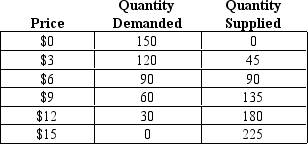

Table 6-5  -Refer to Table 6-5. Suppose the government imposes a price ceiling of $3 on this market. What will be the size of the shortage in this market?

-Refer to Table 6-5. Suppose the government imposes a price ceiling of $3 on this market. What will be the size of the shortage in this market?

A) 0 units

B) 30 units

C) 45 units

D) 75 units

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

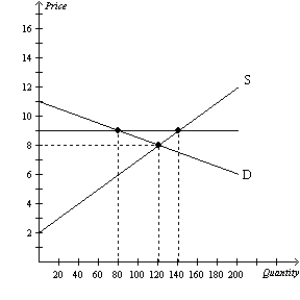

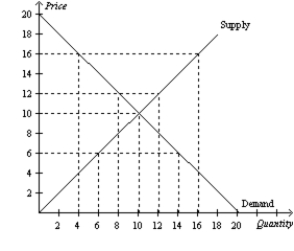

Figure 6-5  -Refer to Figure 6-5. If government imposes a price floor at $9, then the price floor causes

-Refer to Figure 6-5. If government imposes a price floor at $9, then the price floor causes

A) quantity demanded to decrease by 40 units.

B) quantity supplied to increase by 20 units.

C) a surplus of 60 units.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a nonbinding price ceiling is imposed on a market, then the

A) quantity sold in the market will decrease.

B) quantity sold in the market will stay the same.

C) price in the market will increase.

D) price in the market will decrease.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Economists argue that rent control is a highly efficient way to help the poor raise their standard of living.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax imposed on the sellers of a good will

A) raise both the price buyers pay and the effective price sellers receive.

B) raise the price buyers pay and lower the effective price sellers receive.

C) lower the price buyers pay and raise the effective price sellers receive.

D) lower both the price buyers pay and the effective price sellers receive.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under rent control, tenants can expect

A) lower rent and higher quality housing.

B) lower rent and lower quality housing.

C) higher rent and a shortage of rental housing.

D) higher rent and a surplus of rental housing.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most likely explanation for the imposition of a price floor on the market for corn?

A) Policymakers have studied the effects of the price floor carefully, and they recognize that the price floor is advantageous for society as a whole.

B) Buyers and sellers of corn have agreed that the price floor is good for both of them and have therefore pressured policy makers into imposing the price floor.

C) Buyers of corn, recognizing that the price floor is good for them, have pressured policymakers into imposing the price floor.

D) Sellers of corn, recognizing that the price floor is good for them, have pressured policymakers into imposing the price floor.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax imposed on the buyers of a good will

A) raise both the price buyers pay and the effective price sellers receive.

B) raise the price buyers pay and lower the effective price sellers receive.

C) lower the price buyers pay and raise the effective price sellers receive.

D) lower both the price buyers pay and the effective price sellers receive.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A minimum wage that is set below a market's equilibrium wage will

A) result in an excess demand for labor, that is, unemployment.

B) result in an excess demand for labor, that is, a shortage of workers.

C) result in an excess supply of labor, that is, unemployment.

D) have no impact on employment.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A binding price ceiling causes quantity demanded to be less than quantity supplied.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on a market with elastic demand and elastic supply will shrink the market more than a tax on a market with inelastic demand and inelastic supply will shrink the market.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In an unregulated labor market, the wage adjusts to balance labor supply and labor demand.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

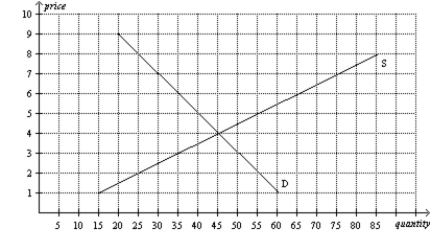

Figure 6-8  -Refer to Figure 6-8. When a certain price control is imposed on this market, the resulting quantity of the good that is actually bought and sold is such that buyers are willing and able to pay a maximum of P1 dollars per unit for that quantity and sellers are willing and able to accept a minimum of P2 dollars per unit for that quantity. If P1 - P2 = $3, then the price control is

-Refer to Figure 6-8. When a certain price control is imposed on this market, the resulting quantity of the good that is actually bought and sold is such that buyers are willing and able to pay a maximum of P1 dollars per unit for that quantity and sellers are willing and able to accept a minimum of P2 dollars per unit for that quantity. If P1 - P2 = $3, then the price control is

A) a price ceiling of $2.00.

B) a price ceiling of $5.00.

C) a price floor of $5.00.

D) either a price ceiling of $2.00 or a price floor of $5.00.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

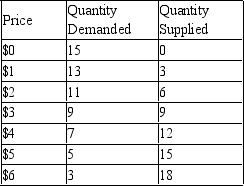

Table 6-3

The following table contains the demand schedule and supply schedule for a market for a particular good. Suppose sellers of the good successfully lobby Congress to impose a price floor $2 above the equilibrium price in this market.  -Refer to Table 6-3. Following the imposition of a price floor $2 above the equilibrium price, irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor. The resulting market price is

-Refer to Table 6-3. Following the imposition of a price floor $2 above the equilibrium price, irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor. The resulting market price is

A) $2.

B) $3.

C) $4.

D) $5.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a binding price floor is imposed on the market for eBooks, then

A) the demand for eBooks will decrease.

B) the supply of eBooks will increase.

C) a surplus of eBooks will develop.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An outcome that can result from either a price ceiling or a price floor is

A) an enhancement of efficiency.

B) undesirable rationing mechanisms.

C) a surplus.

D) a shortage.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-4  -Refer to Figure 6-4. A government-imposed price floor of $12 in this market results in

-Refer to Figure 6-4. A government-imposed price floor of $12 in this market results in

A) a surplus of 2 units.

B) a surplus of 4 units.

C) 12 units sold.

D) 10 units sold.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When OPEC raised the price of crude oil in the 1970s, it caused the

A) demand for gasoline to increase.

B) demand for gasoline to decrease.

C) supply of gasoline to increase.

D) supply of gasoline to decrease.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in a particular market, the supply curve is highly elastic and the demand curve is highly inelastic. If a tax is imposed in this market, then the

A) buyers will bear a greater burden of the tax than the sellers.

B) sellers will bear a greater burden of the tax than the buyers.

C) buyers and sellers are likely to share the burden of the tax equally.

D) buyers and sellers will not share the burden equally, but it is impossible to determine who will bear the greater burden of the tax without more information.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 645

Related Exams